Pendle Print #100

Now Everyone Can Earn

Pendle is the ultimate yield market in DeFi – fixed yields, leveraged yield + points trading, and funding rate swaps (via Boros).

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

Important Highlights ✨

Pendle’s incentive model has been upgraded!

The new Algorithmic Incentive Model (AIM) will cut emission by 30%, switching from vote-based (where the LEAST 10 profitable pools ate up >50% of the emission 🤯) to a merit-based system - where incentives are automatically routed by TVL and volume/fees.

Check out our article for more info:

As part of the upgrade, we also rolled out a co-incentives module, which lets protocols “bribe” for PENDLE rewards.

Same “bribe” efficiency, but with Pendle cutting emissions by as much as SEVENTY PERCENT (70%):

A summary of all that’s happened last week for those who missed it, including vePENDLE snapshot (for sPENDLE Loyalty Bonus) and more:

Last Wednesday, we also held a special sPENDLE AMA on our Discord, an hour long session where TN and Dan shared all the juicy alphas.

Lucky for us, Intern has kindly distilled all the key points into a nice 5-min read:

New Pools

yzUSD (30 Jul 2026)

syzUSD (30 Apr 2026)

fusnstETH (30 Apr 2026)

sBOLD (25 Jun 2026)

SuperUSDC (30 Apr 2026)

USDf (18 Jun 2026)

sUSDf (18 Jun 2026)

sUSN (30 Jun 2026)

wstUSR (25 Jun 2026)

RLP (9 Apr 2026)

Pencosystem

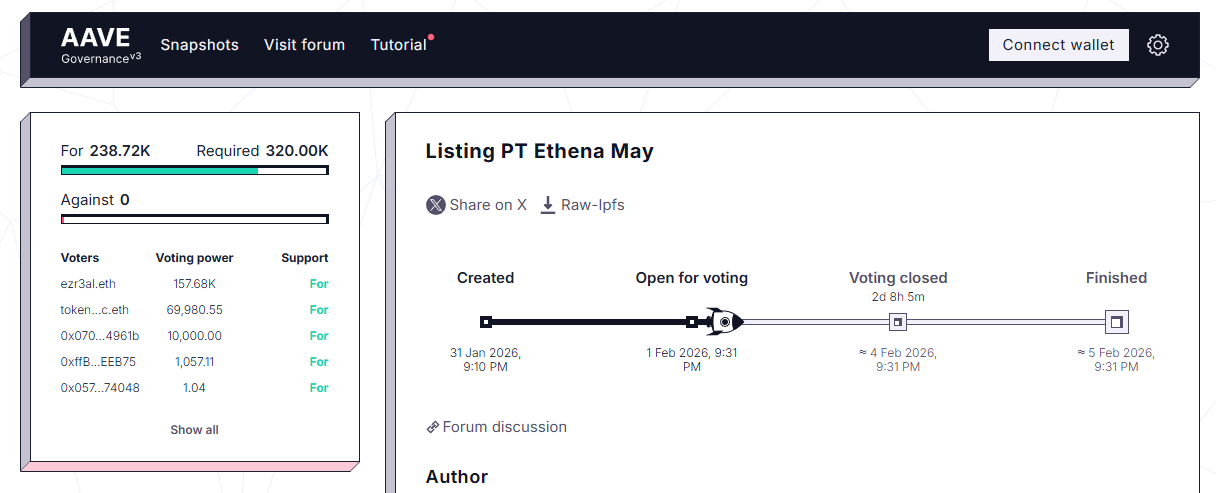

Coming soon - May PT markets on Aave!

Speaking of co-incentives, take a gander at these extra rewards for 2 Midas YTs:

For those who prefer the sanctuary of fixed yield, the PT-mHYPER market is also live on Morpho:

More Morpho markets (but for Cap):

Not forgetting also the DOUBLE POINTS campaign for these YTs:

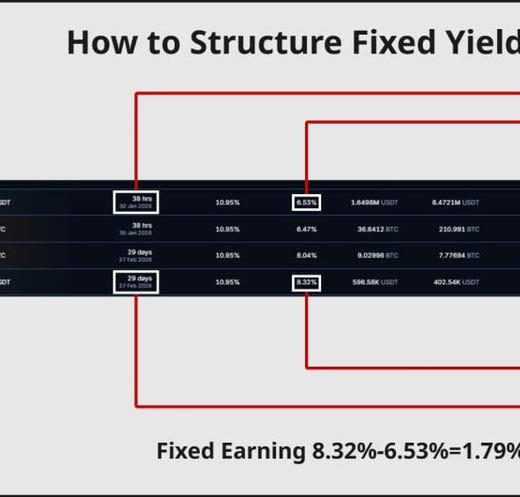

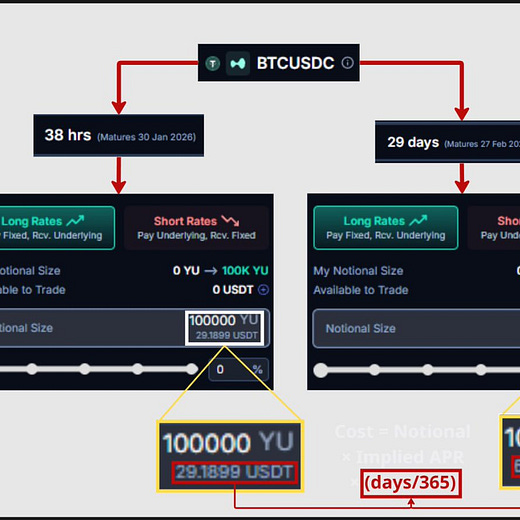

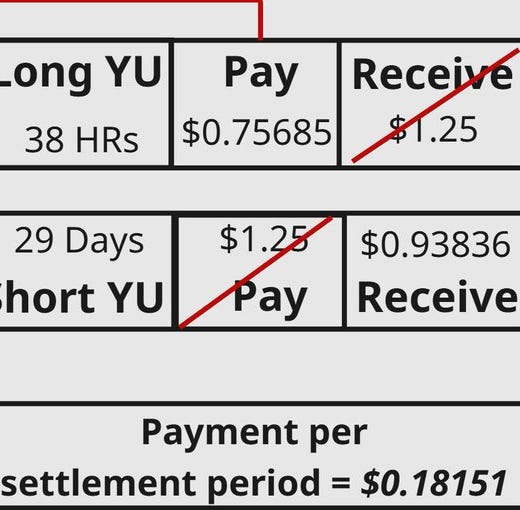

3% spread here means a 27% APY opportunity for us:

5x YT points boost for one of our hottest new players - savUSD:

Boros

New HYPE markets now support HYPE collateral. Next up…. XAU and XAG? 🤔

Our new handy TG bot lets you track your wallets with updates on settlements (wins/losses), limit order fills, liquidations and more!

But just how useful can this be?

+48% P&L useful:

Another new ATH in Open Interest for Boros:

And some a decent fee situation:

Plus some juicy yields up for grab too:

Intern Insights

We had the option to be content with mediocrity but where we’re going, being “alright” isn’t going to cut it, hence the change:

reUSDe has somehow flown under the radar as the cheapest dollar in the world:

Free points up for grab?!

X Highlights

Pendle is more than just a yield market. It’s a global yield infrastructure.

Pendle x Arbitrum 🤝

Can’t get enough of sPENDLE? Neither can we:

And last but certainly not least…guilty as charged, your honour 🖐🏻🤚🏻

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle