Pendle Print #101

Yield ahoyyyy!

Pendle is the ultimate yield market in DeFi – fixed yields, leveraged yield + points trading, and funding rate swaps (via Boros).

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

Important Highlights ✨

sPENDLE buybacks have officially commenced! And hey, keep an eye out for that first yield distribution on 13 Feb 😉

PTs on Compound soon 🤝

And also over yonder in BNB Chain thanks to a little cross-chain magic. Deposit, borrow, and loop on ListaDAO:

Record volume in record time. Boros is fattening up nice and easy 😋

Reminder to rollover/claim your matured positions!

New Pools

stUSDS (25 Jun 2026)

ENA (30 Apr 2026)

avUSD (14 May 2026)

Pencosystem

All the markets sporting juicy external incentives (and PENDLE co-incentives):

W Cap for making YTs “100% profitable” 👀

Pendle contracts, custom UI.

In the words of their founder:

“I think this is also the first time that somebody wants Pendle so hard that instead of shipping with a competitor, they (us) deploy a community pool and then ship an entire UI around it”

Don’t be like Intern and miss this 30% APY opportunity ⭐

New PT-srUSDe market on Aave:

Boros

Gold and Silver funding rates, the hottest assets on planet Earth, are now tradeable on Boros:

Another exchange gets added to Boros:

How one man (or woman) turned $11k to $117k on Boros with just ONE strategy:

“Don’t trade cryptos, trade rates”

An amazing Boros ELI5:

Intern Insights

When you win, you win BIG on Boros:

For God’s sake, please don’t do naked longs for XAG and screwed upside down by funding:

3 digit APY is still well and alive:

30% APY is online now thanks to PT-srUSDe on Aave:

X Highlights

Phteven handpicked the Top 5 stables on Pendle:

Why AIM will be huge for Pendle (and $PENDLE):

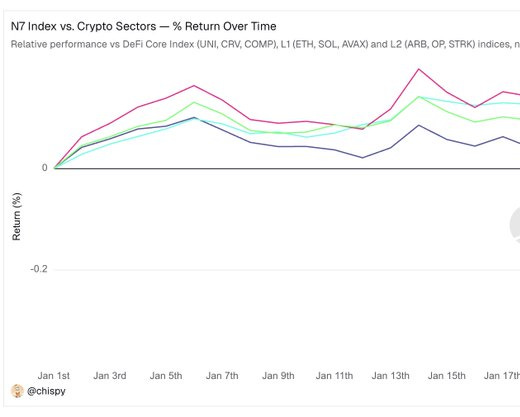

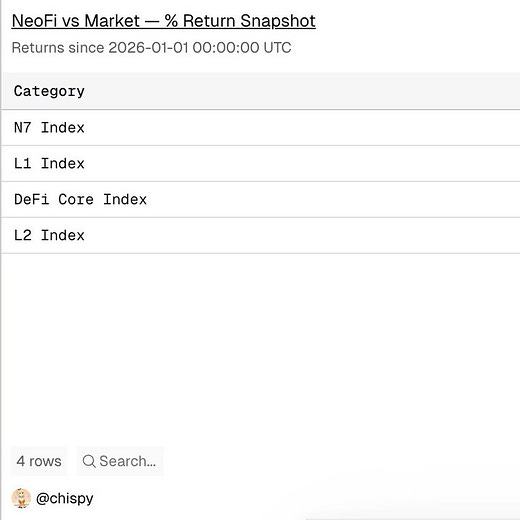

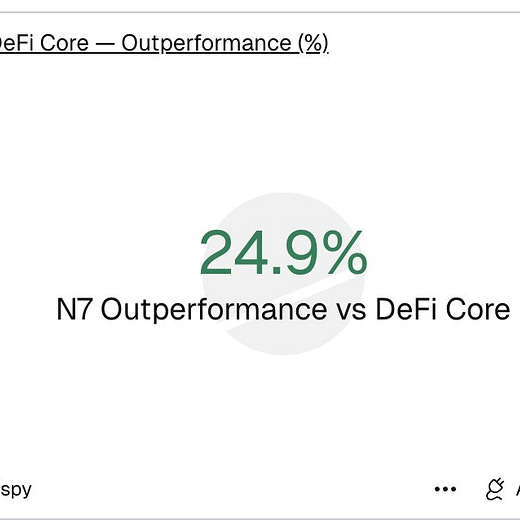

The neobank narrative:

Job’s not done, we’re not done:

Some sPENDLE updates from the #1 Pendie (get well soon, Linn!):

And last but certainly not least…if you know any anyone who loves asking “why” and proceeds to answer their own question, please let them know that we would love to have a chat with them:

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle