Pendle Print #55

Strategic Yield Reserve

Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Pools

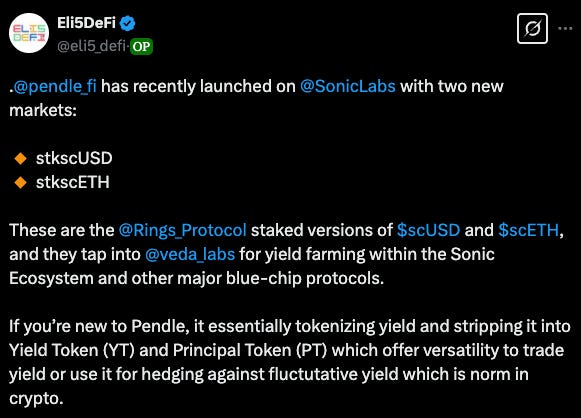

Pendle is officially on Sonic!

Our very first pools will be from Rings Protocol:

stkscUSD (29-MAY) → 2x Rings | 12x Sonic | 3x Veda Points

stkscETH (29-MAY) → 1.5x Rings | 8x Sonic | 3x Veda Points

A quick TLDR on how these markets work:

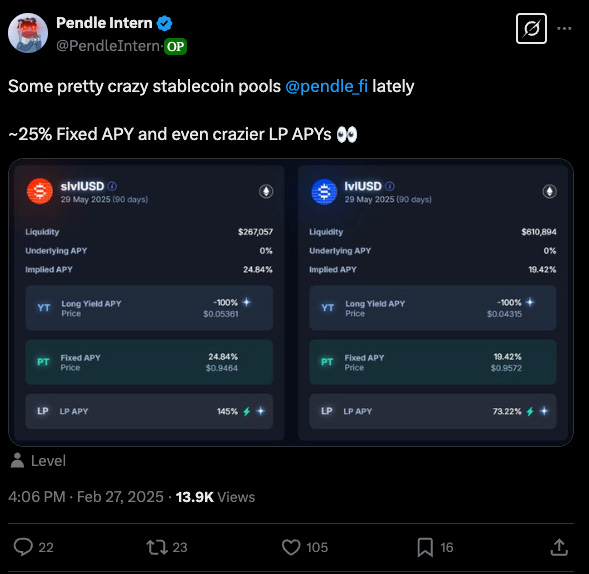

LevelUSD has arrived!

lvlUSD (29-MAY) → 40x Level XP + Symbiotic Points

slvlUSD (29-MAY) → Yield + 20x Level XP

In short, lvlUSD is the native, non-yield bearing stablecoin.

slvlUSD is the staked, yield-bearing version.

Resolv’s USR (29-MAY) on ETH mainnet

Like its cousin on Base, this USR pool will also be getting a 45x multplier for Resolv Points - for every YT and $1 worth of LP.

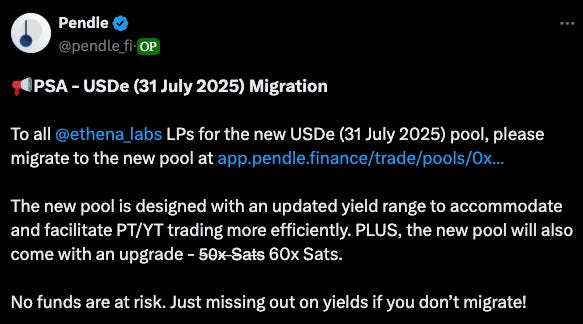

PSA to LPs – USDe (31 July 2025) Migration

There is new (optimized) USDe 31-JUL pool that existing LPs of the previous pool will have to migrate to. The new pool has been configured with a more optimal range to facilitate trading, plus it comes with a higher bonus of 60x Sats.

Action required for LPs only; no action needed for existing YT/PT as these are already tradable in the new pool.

Trades of the Week 🔥

0xac3 added $3.3M worth of liquidity into sUSDe 27MAR2025

0xf93 added $3M worth of liquidity into eUSDe 29MAY2025

0x409 bought $2M worth of PT-USDe-27MAR2025

0xaf4 bought 10 LBTC of PT-LBTC-27MAR2025

0x07e bought 6.3 liquidBeraBTC worth of PT-liquidBeraBTC-10APR2025

Intern Insights

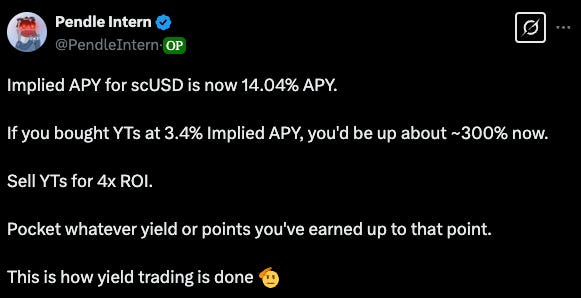

Some Pendle plays for stablecoin szn:

It literally pays to be early in new pool launches (feat. stkscUSD 29-MAY)

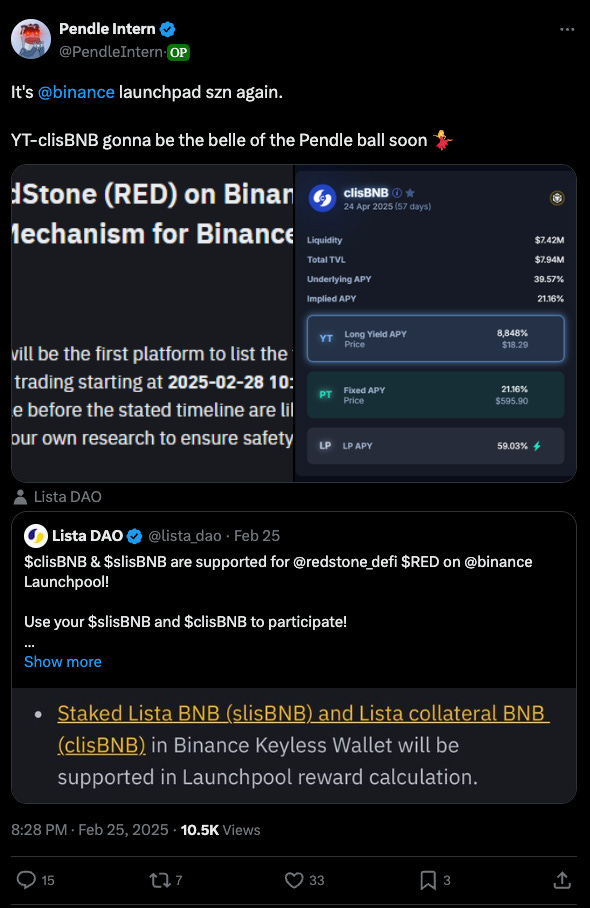

clisBNB is picking up. Remember, YT-clisBNB (also the SY portion of Pendle LP) will earn:

Launchpool APY - claimable in BNB

BNB Staking APY - claimable in slisBNB

Twitter Highlights

Double digit APYs on Sonic pools…

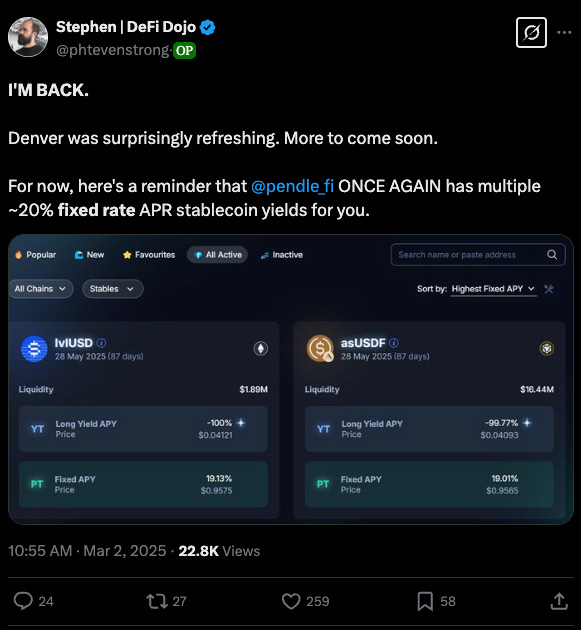

… and stablecoin/USD-denominated pools.

$PENDLE is available on Sonic, bridge available via the Sonic Gateway.

@_whalebird shared our 2025 roadmap on an X Spaces session. For a full recap, read the Pendle 2025: Zenith roadmap here

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle