Pendle Print #59

Berachain x Pendle

Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Pools

Pendle arrives on Berachain! 🐻

Infrared Finance iBGT & iBERA 26-JUN

Ethena sUSDe & USDe 25-SEP

Ether.fi eBTC 25-SEP

sUSDe 31-JUL [ETH]

Reminder:

For those who have yet to rollover funds from the 27-MAR maturity (>$190M), refer to our pool rollover guide:

Trades of the Week 🔥

0x293 redeemed 18.6M from matured PT-USDe-27MAR, and swapped into PT-eUSDe-29MAY

0x520 swapped 9.9M USDe for 10.15M PT-eUSDe-29MAY

0x520 swapped 4.9M USDe for 5M PT-sUSDe-29MAY

0x349 added 8.9M USR in liquidity into USR-29MAY

0x197 swapped 3.51M PT-USDe-27MAR to 3.57M PT-eUSDe-29MAY

Intern Insights

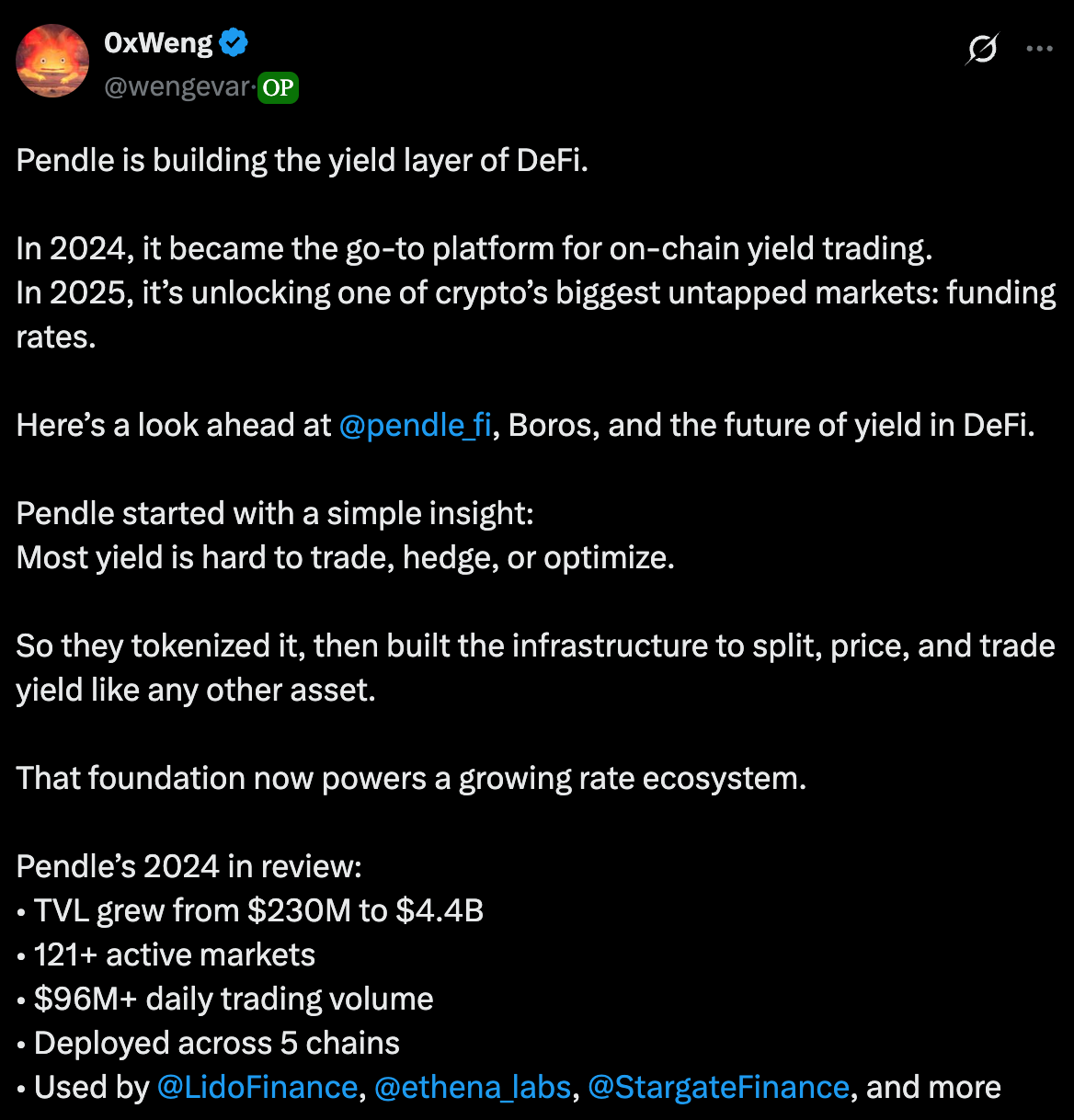

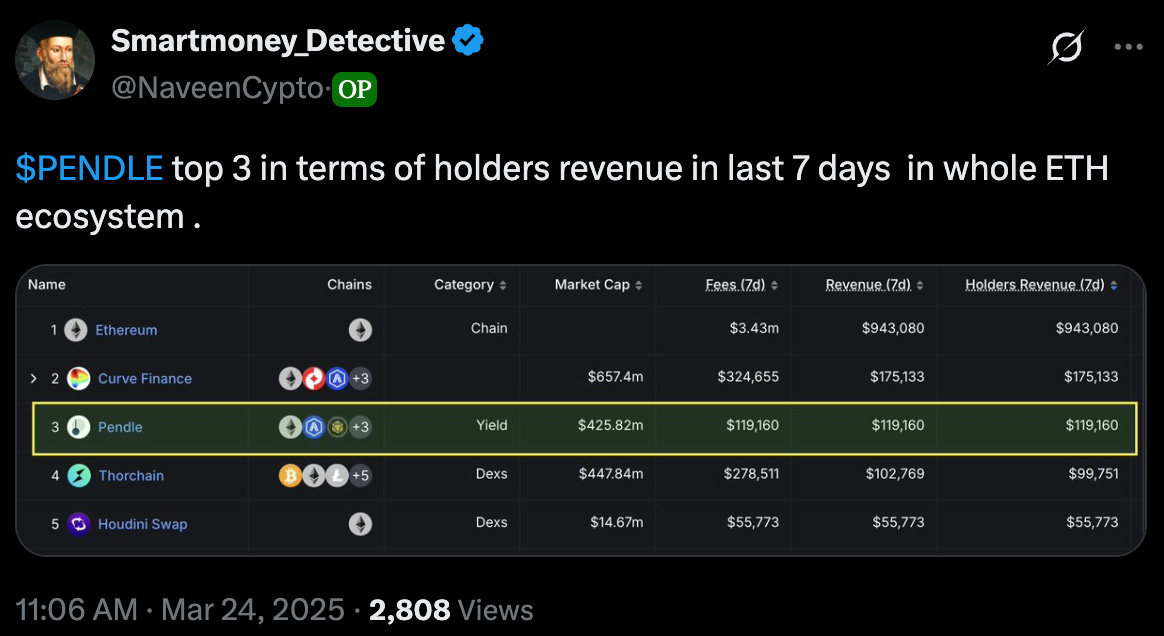

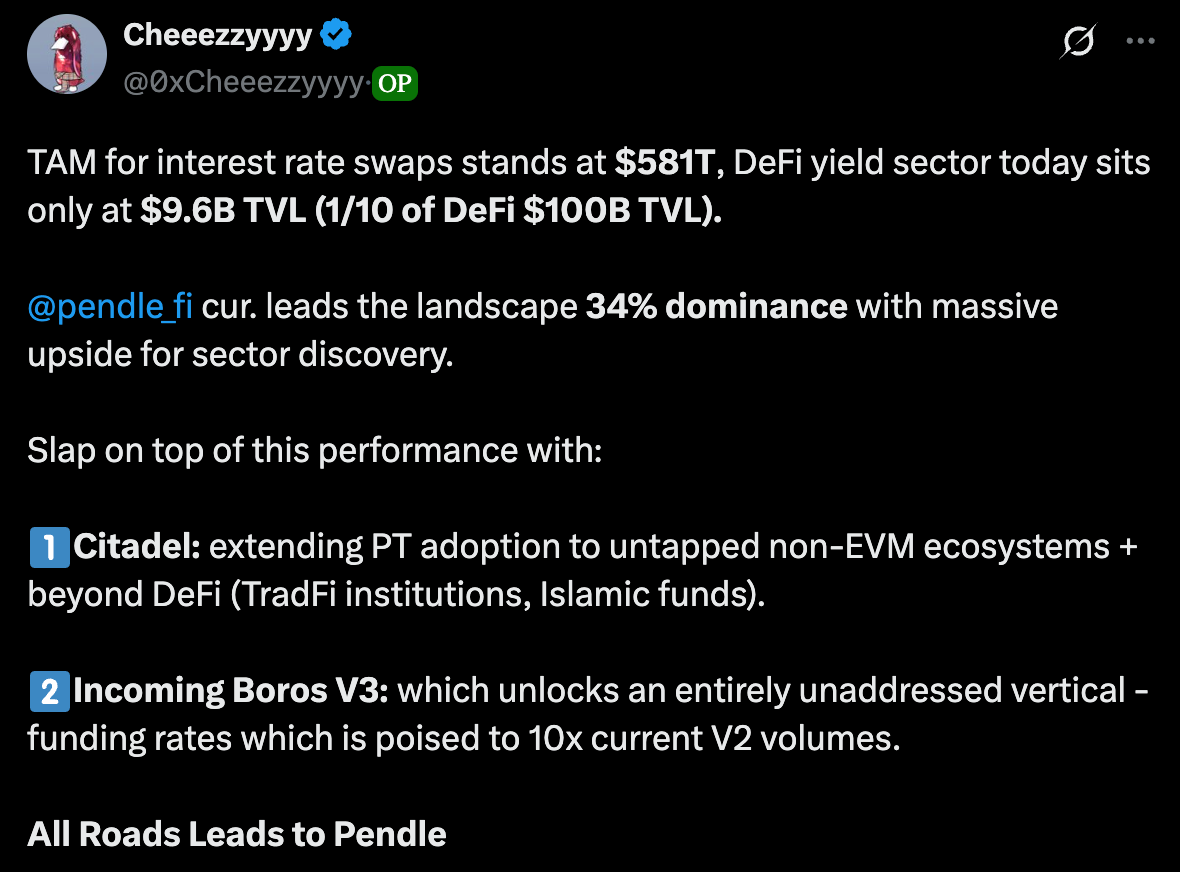

X Highlights

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle