Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Pools

reUSD (18 Dec 2025)

reUSDe (18 Dec 2025)

On the hunt for even higher yields for your stables? How about some reinsurance exposure then, anon?

With the latest Re pools on Pendle, Pendies can underwrite reinsurance contracts in exchange for more yield but just make sure you understand the risks involved - in the event of insurance payouts due to extraordinary events, there is a potential for negative yields.

stkaUSDC (30 Oct 2025)

stkaUSDT (30 Oct 2025)

Speaking of insurance, here’s another pool series by Aave!

stkaUSDC and stkaUSDT are basically USDC/USDT staked in Aave's Umbrella Safety Module, which lets you earn additional rewards on top of the usual aToken supply yield.

In return for earning a higher yield, your stake may be slashed to cover the deficit in the event of a shortfall.

eATH (11 Sep 2025)

deUSD (11 Dec 2025)

sUSP (28 Aug 2025)

Important Highlights 👀

⚠️ Some of you may be eligible for SPK Airdrop

Do not miss out on this free money opportunity!

Check your eligibility here.

Trades of the Week 🔥

0xda9 added $20M of liquidity (ZPI) to uniBTC 18DEC2025

0x2af added $12.4M of liquidity (ZPI) to uniBTC 18DEC2025

0x56e added $4M of liquidity (ZPI) to sUSDE 25SEP2025

0xf03 added $5M of liquidity (ZPI) to LBTC 18DEC2025

0x8cc added another $2.5M of liquidity (up to $11.9M now) to wsrUSD 31JUL2025

Pencosystem

Pendle LP as collateral on the mainnet is finally here, thanks to our friends over at Silo, with plenty more integrations on the way!

Always happy to see Pendle being trusted as one of the key vault strategies 🤝

More Ethena yield-bearing stablecoins on the way 👀

If you’re on the sideline for PT-cUSDO looping, there’s good news:

PENDLE trading campaign:

Intern Insights

The power of LP as collateral:

Same thing but with more BOLD with a side of extra PENDLE:

Slight correction - it’s only 82.81% Long Yield APY at time of writing (assuming the Underlying APY averages 10% ) 🙏

YT-iUSD and what it means for airdrop hunters:

X Highlights

The foundation of DeFi yield infrastructure:

A peek into Pendle’s future in Grandma’s crystal ball:

How Pendle will help push the RWA frontier:

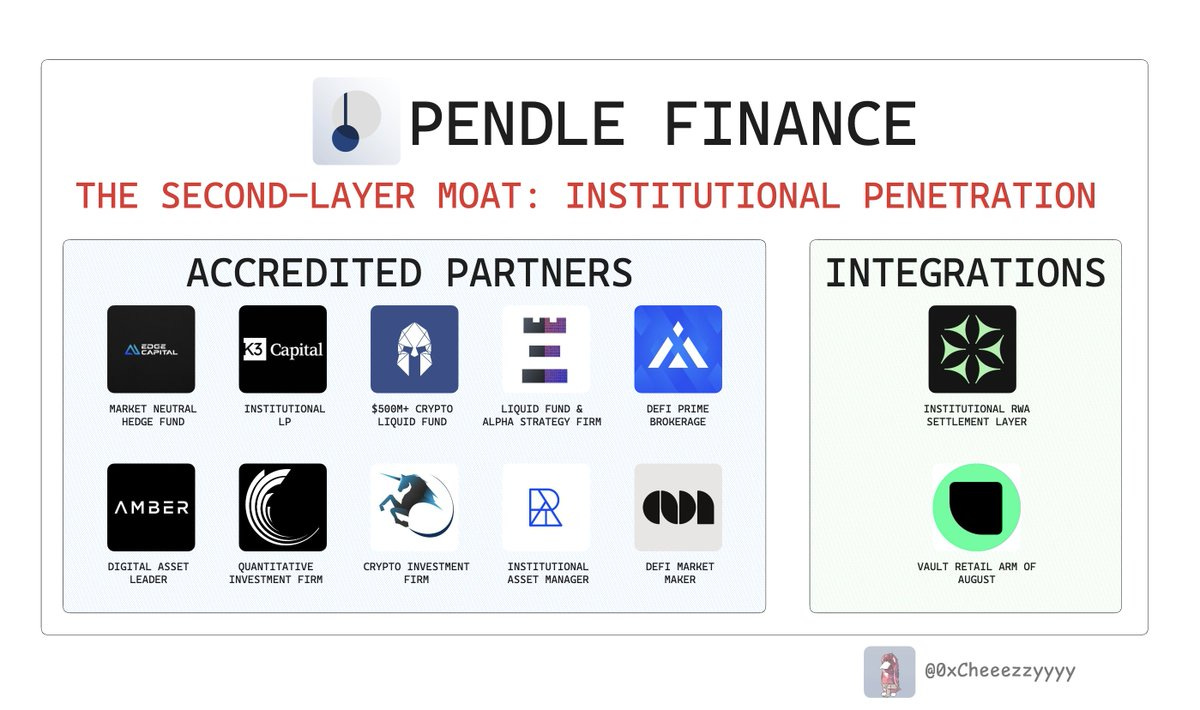

Deep institutional penetration for Pendle:

Are you still sleeping on these yields, anon?

And last but certainly not least… what else do you want to see on the Boros menu?

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle