Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Pools

stkGHO (30 Oct 2025)

More Aave Umbrella markets! This time it’s Aave’s very own stablecoin - stkGHO.

Same deal as before - stake for more GHO but do note that your stake may be slashed to cover the deficit in the event of a shortfall.

You can learn more about “negative yields” in our Intern’s latest ELI5 thread here:

upUSDC (2 Oct 2025)

Important Highlights 👀

H1 2025 Recap for Pendle!

Interestingly, Pendle is now >87% stablecoins, just in time for many tailwinds in H2 2025:

GENIUS act which will see big names like Amazon, Walmart and Revolut launching their own stablecoins

Upcoming rate cuts by the Fed, which could lead to more DeFi yield demand as investors seek out higher APYs, and possibly more PT demand to just to lock in the rates before they go south

Also some other exciting stuff on the horizon including Boros, Citadels, LP as Collateral and more!

What’s next for Pendle by Nansen

WHAT DO THEY KNOW?!

Uncover the secrets why Smart Money is circling PENDLE 🤫👇

Trades of the Week 🔥

0x556 bought $10.2M worth of PT-sUSDE 31JUL2025

0x63f provided $5.3M of liquidity to sUSDE 25SEP2025

0x53a provided $5M of liquidity (ZPI) to uniBTC 18DEC2025

0x22b provided $4.2M of liquidity (ZPI) to sUSDE 25SEP2025

0x387 provided $6.7M of liquidity (ZPI) to sUSDa 18DEC2025

Pencosystem

K3 Capital's USDT lending vault on Morpho is now live, allowing you to put your precious $USDT to work in servicing the liquidity demand from Pendle LP and PT collateral.

And yes, Pendle LP as collateral will be available on Morpho soon 😉

Auto-rollover for your Ethena PTs on Aave:

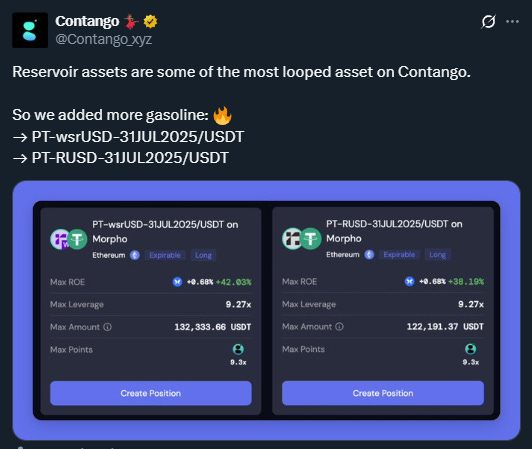

Can’t get enough of Reservoir? Contango’s got you covered:

Intern Insights

Pendle PTs = Investment grade “bonds” + CCC yields?

The YT-yUSD thesis:

Breaking down Aave’s Umbrella staked assets on Pendle:

vePENDLE eating good…literally:

X Highlights

The hottest buzzword on CT lately - Aegis.

How Pendle is helping to push the frontier for DeFi’s oldest vertical:

PT-AMAZON has a nice ring to it…

Take flight with Falcon PTs:

TVL up despite maturity 🫡

For the love of Domi, could someone please answer this man?!

And last but certainly not least… every life ends in Zero - just like YTs.

What truly matters is the journey: the points you earned, the memories you made, and the friends you found along the way.

Good night, Mr. Joot.

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle