Pendle Print #82

400,000,000,000% APY with Boros

Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Pools

cUSD (29 Jan 2026)

dnHYPE (27 Nov 2025)

mAPOLLO (20 Nov 2025)

mHYPE (20 November 2025)

YU (4 Dec 2025)

satUSD+ (18 Dec 2025)

Important Highlights ✨

Another ATH milestone - $11B TVL 🚀

HIGHER.

Boros off to a good start in the 1st month:

Pencosystem

Deposit, borrow and loop with Pendle assets to earn ARB:

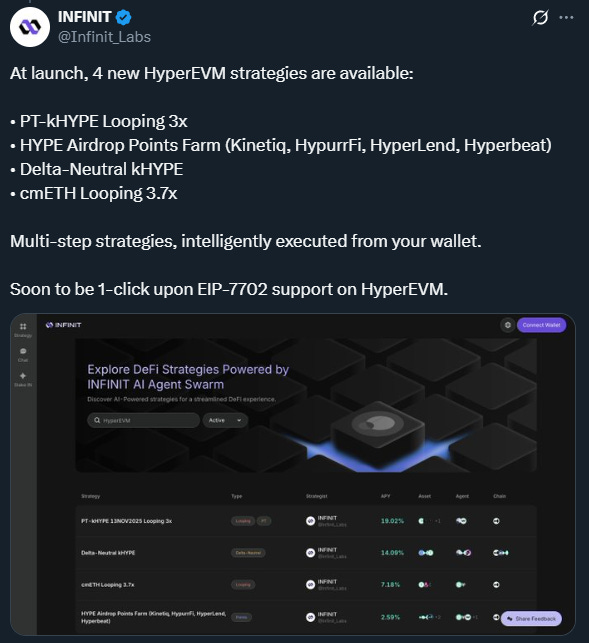

PT-kHYPE looping unlocked on INFINIT:

Speaking of PT-kHYPE looping…

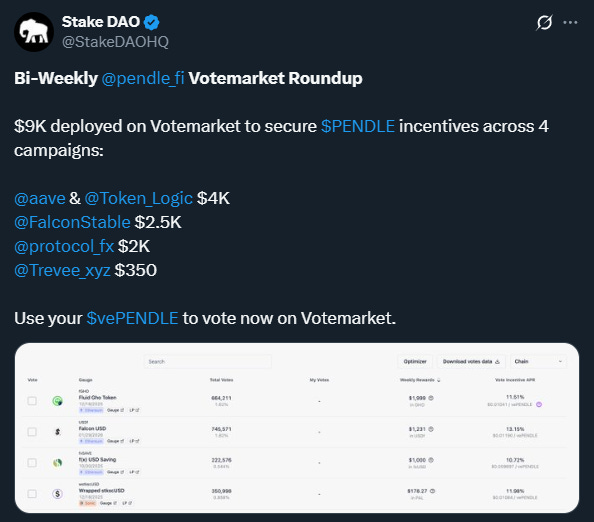

Here’s how you can earn even more with your vePENDLE just from voting:

And more PT supports on money markets, including Euler:

And also Morpho!

Intern Insights

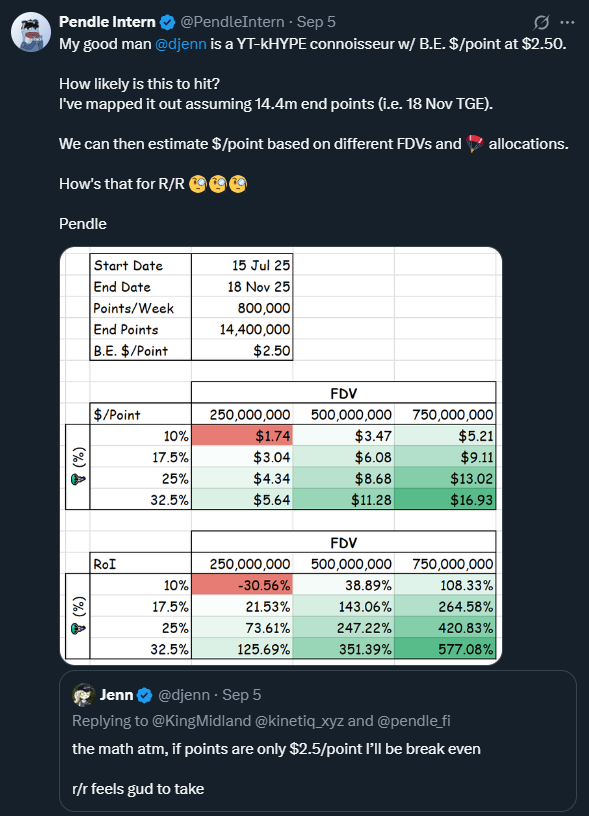

A detailed breakdown of R/R for YT-kHYPE:

If you’re buying spot ENA you’re losing out. Here’s why 👇

Could this be the new, best play? YT-stcUSD could be good enough off yield alone, WITHOUT even accounting for 5x points:

And this ladies and gents is why discounted assets on Pendle (i.e. PT) could be so powerful:

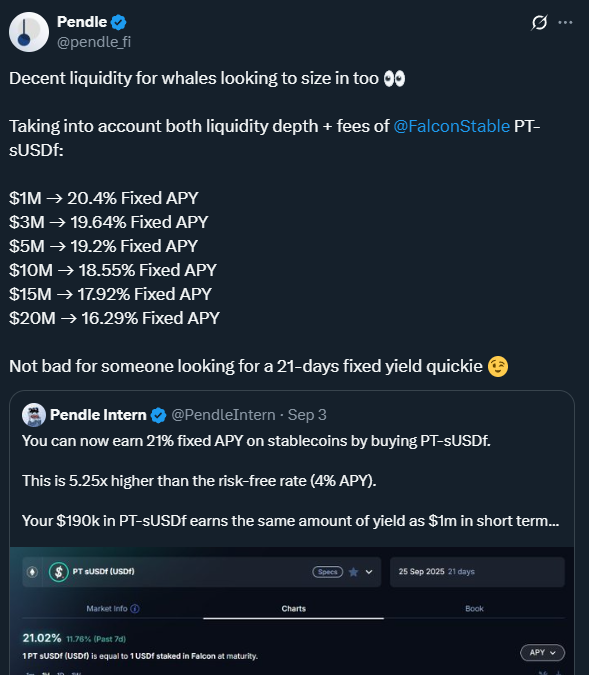

If you’re on the lookout for something thicc to slide in to deposit your liquidity… 💦

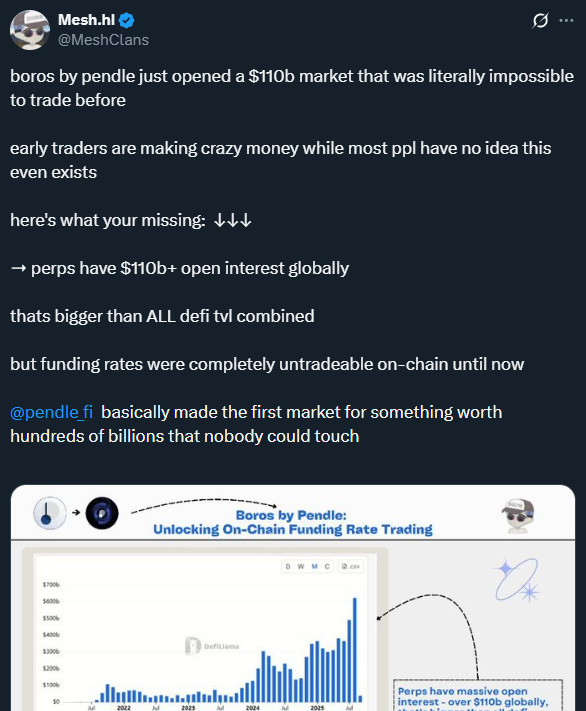

Boros

Your chance to showoff your trading prowess is finally here:

New crystal ball function on Boros:

The famous Gabavineb is at it again, and this time he graces us with another jaw-dropping, gazillion APY play:

Another post from another Pendle team member, and this time it’s our dear Head of Growth showing you how easy Boros could be:

5 seconds is all you need on Boros:

Just the tip for Boros:

Mr.Mughal continues to dazzle with his ongoing Boros trades:

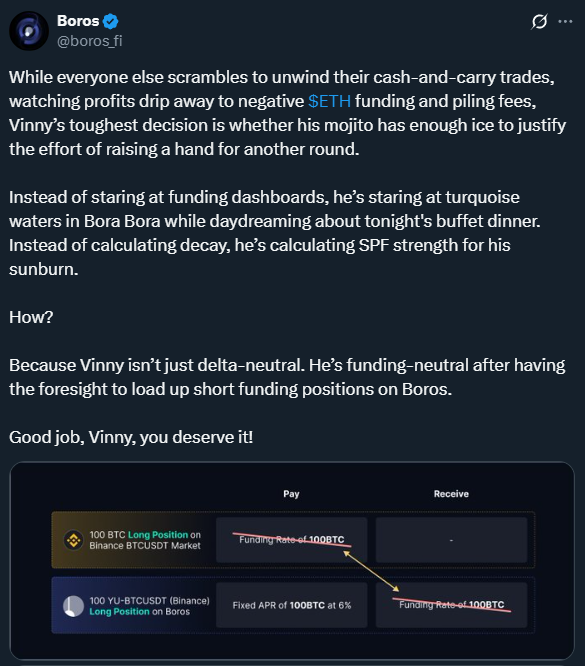

It was a bloody week with funding flipping negative but ‘twas but a scratch for those who hedged with Boros.

Actually nay, there was no scratch at all:

X Highlights

“Pendle continues to execute with precision on its roadmap, scaling both product innovation and ecosystem expansion. With strong fundamentals, accelerating adoption, and multiple growth levers ahead, we believe Pendle is exceptionally well positioned to remain one of the most compelling opportunities in DeFi.”

Awww GLC, you shouldn’t have:

Many are still sleeping on Pendle LP.

Maintaining points exposure AND additional yield though (even when there’s NO yield to be earned in the first place) is muackz

A clean, breakdown of Keep YT Mode:

How Pendle unlocks more value for DeFi:

And last but certainly not least… is this what they call a “googolplex”?

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle