Pendle Print #83

Earn like Kawhi with Pendle

Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Pools

USDe (11 Dec 2025) on Base

USDe (11 Dec 2025) on Arbitrum

sUSDf (29 Jan 2026)

USDS-SPK (18 Dec 2025)

tUSDe (18 Dec 2025)

tETH (18 Dec 2025)

tBTC (18 Dec 2025)

Harmonix haHYPE (20 Nov 2025)

Theo Network thBILL (27 Nov 2025)

Gauntlet gtUSDa (17 Dec 2025)

Alamanak alUSD (23 Oct 2025)

Important Highlights ✨

BOOM 🔥 Cross-chain PTs are now live!

Earlier this year, we shared our vision of bringing PTs into non-EVM ecosystems, TradFi institutions, and even Islamic finance. This is our first toward making expanding PT distribution to make all those a reality.

TN friggin’ Lee on @Ethereum!

Just as Treasuries anchor TradFi, fixed yield on Ethereum led by Pendle is shaping up to be the DeFi’s equivalent.

And this, will be our best chance of wooing institutional capital.

Another week, another B 🫡

One of Pendle’s greatest strengths is our ability to be a “narrative chameleon”.

2 years ago, it was LST.

Last year, it was LRT, and then BTCfi.

And now it’s Ethena + stablecoins.

No matter what it is, as long as there is yield, there is Pendle.

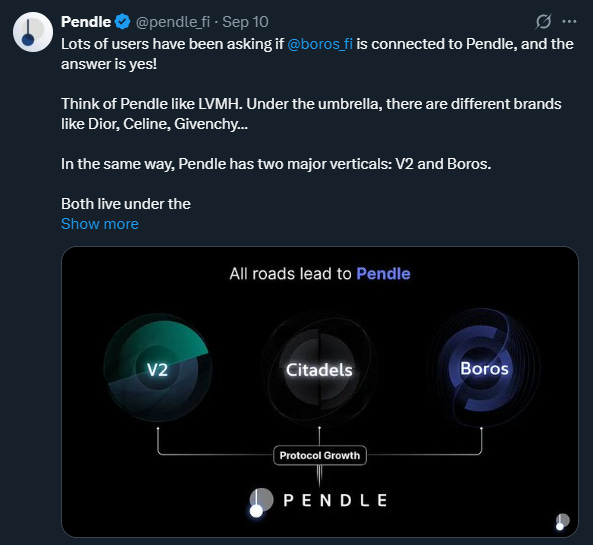

Oh and just in case you’re one of the people wondering…Yes! Boros is part of Pendle. Just as how V2 and Citadels are!

Pencosystem

The Pendle agent is finally here!

With Pulse, you now have a PT portfolio optimizer, helping you to reallocate 24/7 to the best markets, managing maturity cycles, and continuously compounding yield.

PT-USDe (Nov 2025) market went live on Aave earlier this week and was completely filled within minutes.

Itching for a spot? Be on the lookout for more cap increase soon!

Artemis dashboard for Pendle:

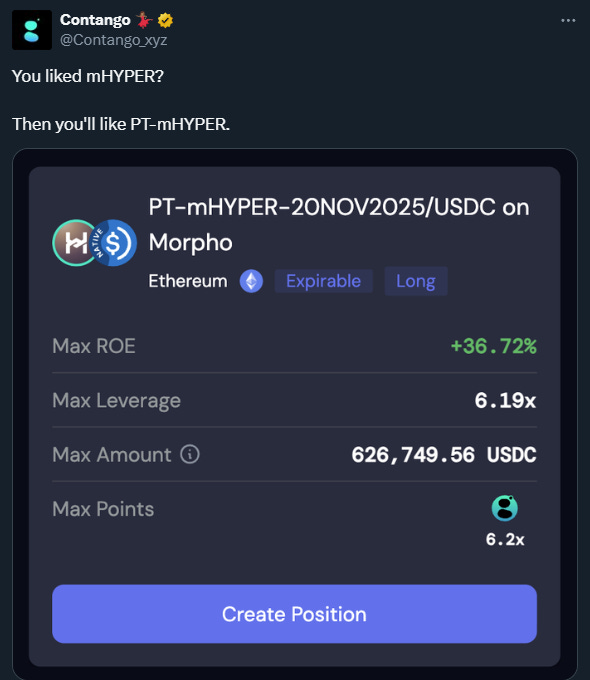

Leveraged PT yield for mHYPER with just one click - courtesy of Contango:

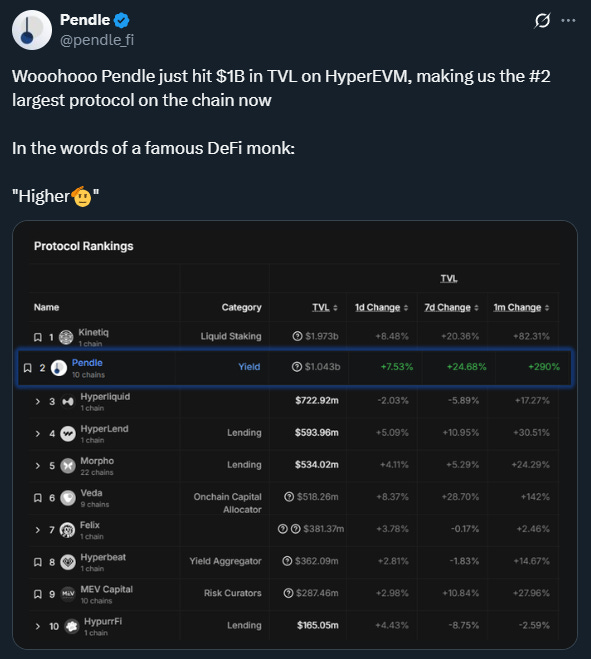

Pendle is now the #2 largest protocol on HyperEVM with $1.27B TVL.

Intern Insights

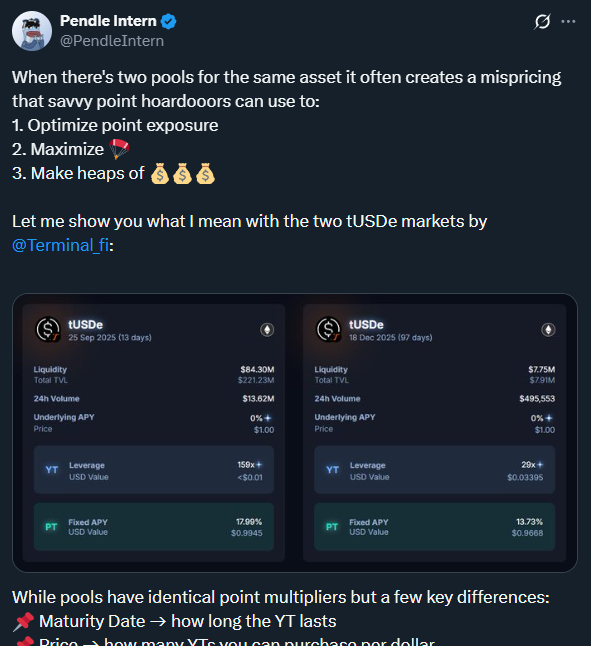

What’s the most optimal point play for Terminal? Intern answers this in detail 👇

HYPE may be $55 now but the point still stands:

sUSDf Implied APY just went absolutely cuckoo on the back of their TGE announcement.

How cuckoo? 33% Fixed APY cuckoo 🤪

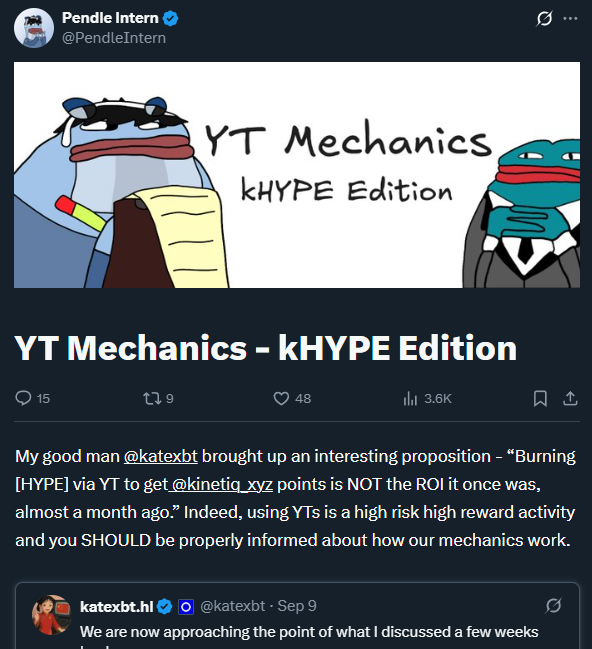

Pendle YT ELI5 feat. Kinetiq kHYPE 💚

Boros

Wooots Hyperliquid markets are now live on Boros!

Right in time when funding is going bonkers:

The current run can largely be attributed to the PPI news last week:

And with ETF flows flipping positive once more, and market assigning an ~82% chance of a Fed rate cut, ETH is looking good for the medium term… but for how long 👇

Thank you Llama for adding Boros to your list:

Quick summary on Boros 1 month after launch:

X Highlights

Why you should consider front running the crowd and rolling over your Pendle positions earlier:

Pendle x Pulse:

“It has consistently adapted to serve as the 独一无二 platform for sector-value discovery across leading narratives + innovative yield primitives (from restaking → BTC-Fi → yield-bearing stablecoins & more). This creates a unmatched value distribution that is irreplaceable…”

Is PENDLE the “best opportunity hiding in plain sight”?

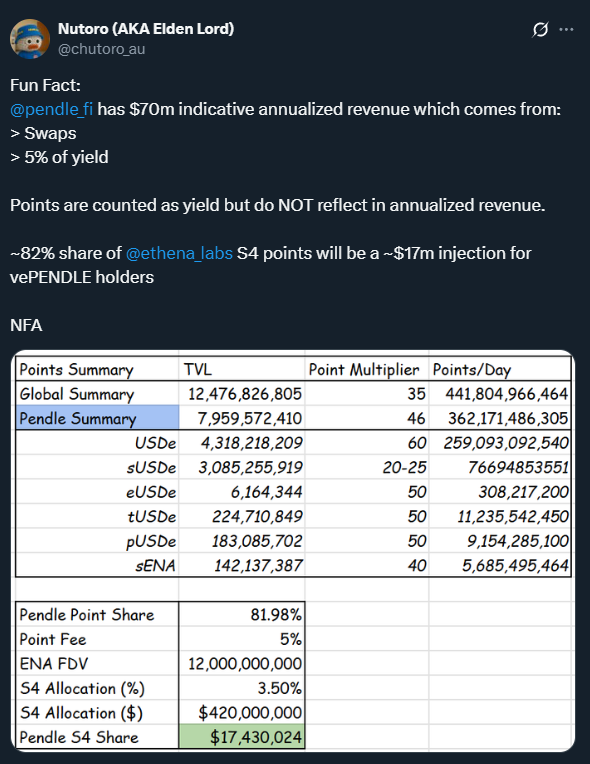

And last but certainly not least… Pendle’s BD magic unveiled 🪄

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle