Pendle Print #84

I believe in $PENDLE

Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Pools

gmETH (29 Jan 2026)

Ethena sENA (27 Nov 2025)

Resolv wstUSR (29 Jan 2026)

Sigma.Money sigmaSP (18 Dec 2025)

SmarDex wstUSDN (18 Dec 2025)

Syrup syrupUSDC (29 Jan 2026)

Yield yoETH (26 Mar 2026)

Yield yoUSD (26 Mar 2026)

HyperBeat beHYPE (19 Mar 2026)

Important Highlights ✨

Boros v1.0 goes live! Including a new referral program that lets you earn a share of protocol fees:

Just in case any of you finds kindness in your beautiful heart to pity our poor, impoverished Intern - https://boros.pendle.finance/join/BIGDK

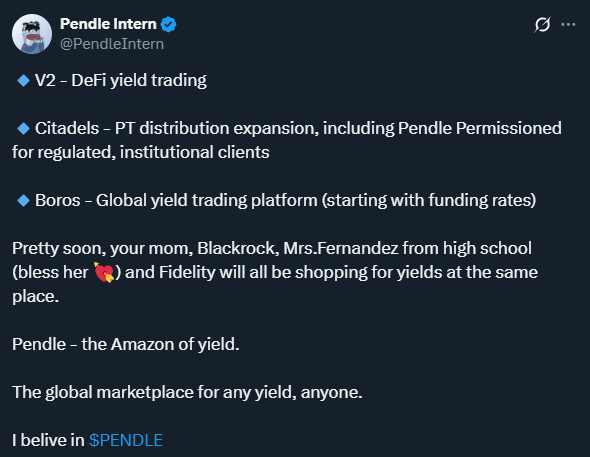

But I digress. As encouraging as its early traction already is, Boros (and Pendle as a whole) can be so, so much more:

I believe in $PENDLE.

Pencosystem

Don’t miss it! Limited-time, special Falcon Miles boost for those looking to ramp up your $FALCON alloc:

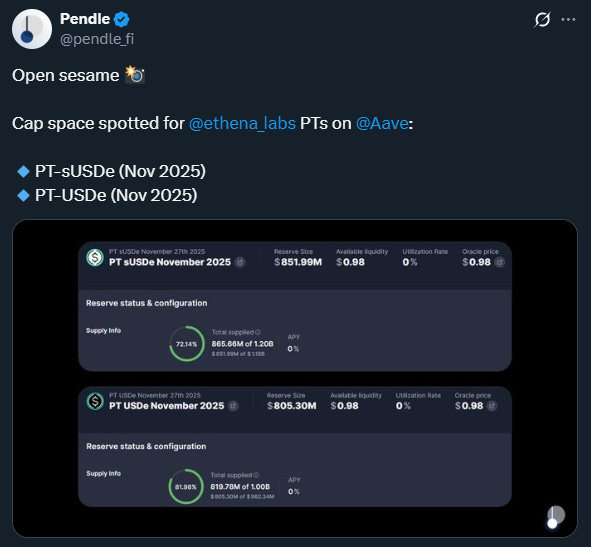

Caps lifted for Nov 2025 Ethena PT markets on Aave, right in time for those looking to migrate from your Sep 2025 positions later this week 👀

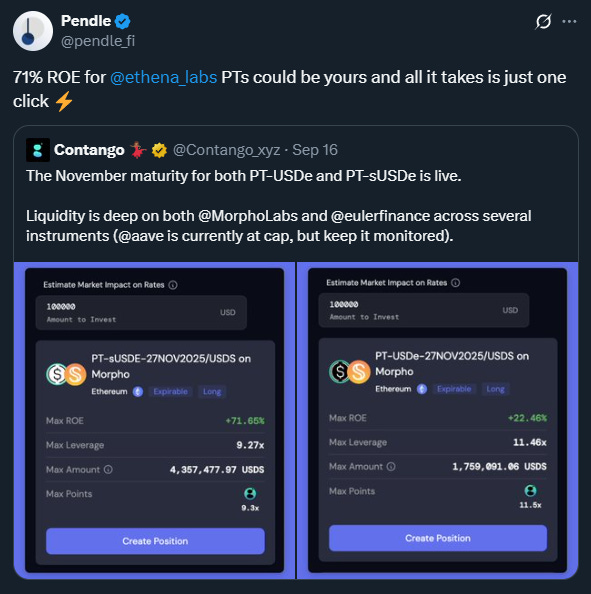

For the lazy apes, here are the same PTs on Contango too:

New Pendle LP collateral on K3 Capital’s Pendlelend:

EarnPark yields - now powered by Pendle PTs:

Pendle on Plasma - the ultimate stablecoin yield gateway for institutions:

Some new assets on Silo:

You can now swap any tokens for any PT/YT on HyperEVM with GlueX:

PT/YT fees rebate for Solv:

Intern Insights

3 days later and it’s still 45% Fixed APY 👀

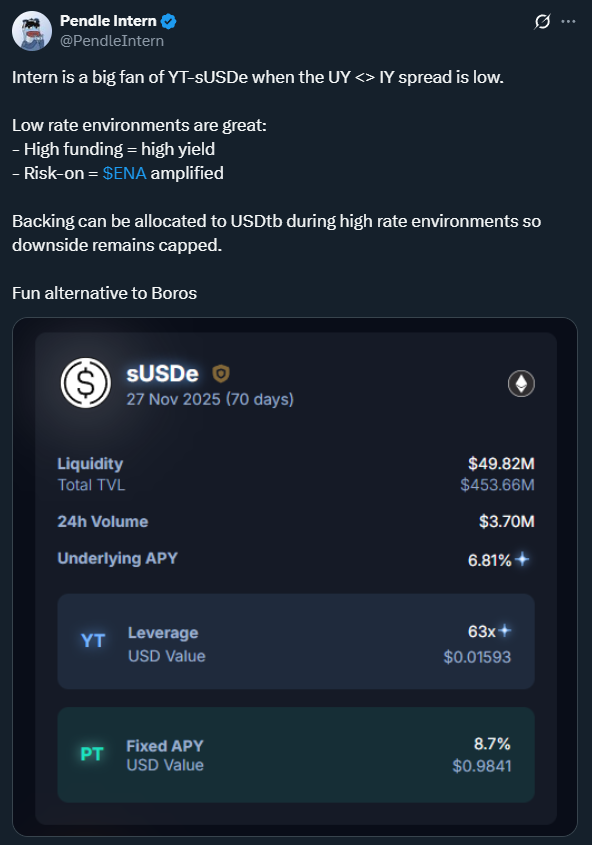

2 plays in a high-funding environment - Long YU on Boros and….

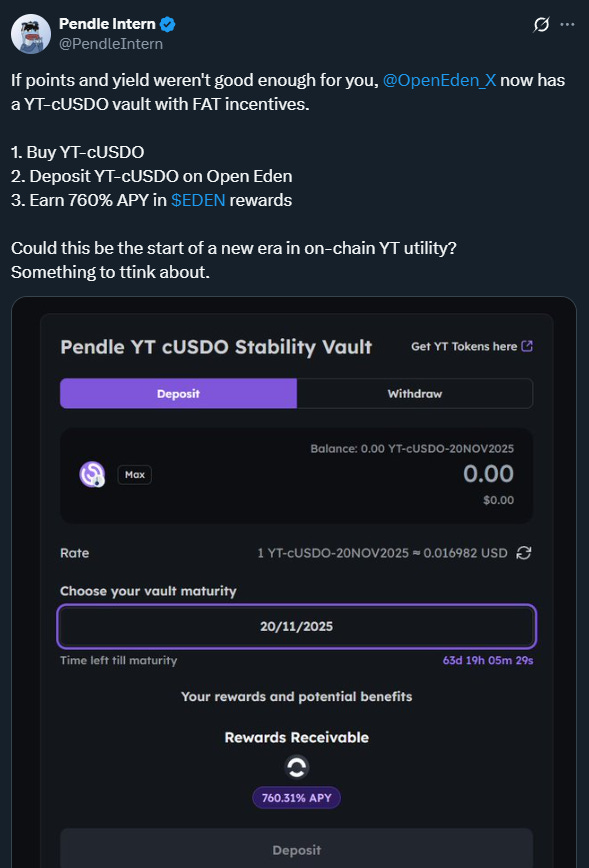

760% APY for Open Eden’s YT-cUSDO vault 🤤

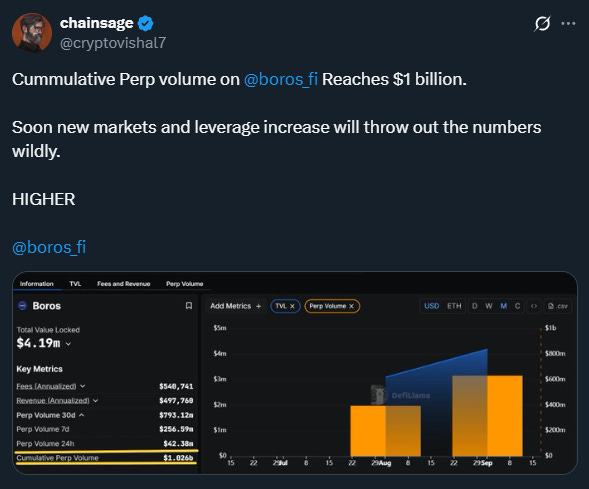

Boros

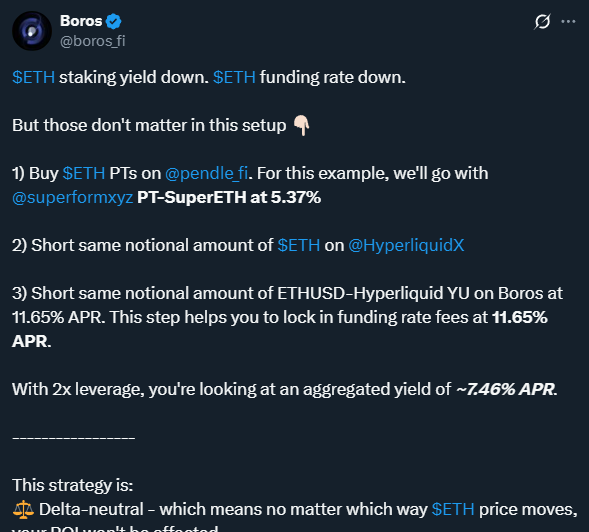

Sleep easy with this delta-neutral, funding-neutral strategy:

A bit too late now that the FOMC meeting has already passed but hey, you could still keep this in your backpocket for the next one:

If you had shorted ETHUSD-Hyperliquid anywhere above 10.95% APR in the last few days, you’d have been feasting very, very well on settlements.

Only 0.03% of the total addressable market by the way:

X Highlights

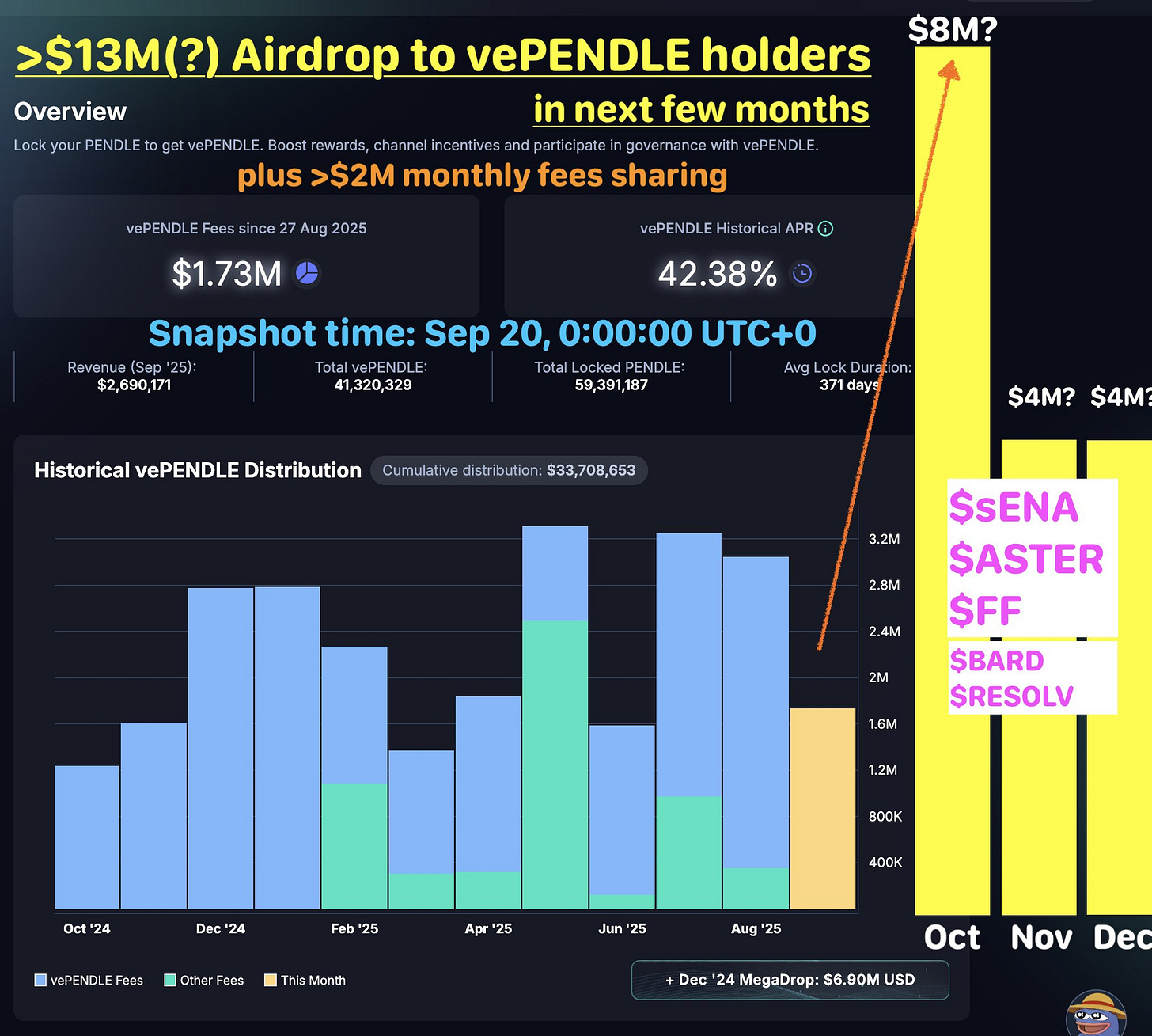

Another month of big wins for vePENDLE:

Make sure you check all of these before trading on Pendle 👀

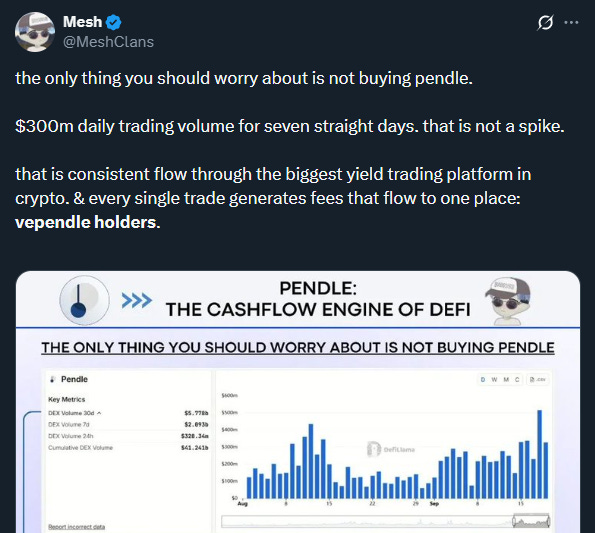

The one thing you should worry about:

Pendiddling Pendle:

A detailed report by Tiger Research on how Pendle and Boros are revolutionizing DeFi derivatives:

Over $13B have trusted Pendle. Have you?

After 5 days of horseback riding to central Mongolia…

And last but certainly least…promise to think of Pendle every so often when you’ve made it, okay?

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle