Pendle Print #85

From Billions to Trillions

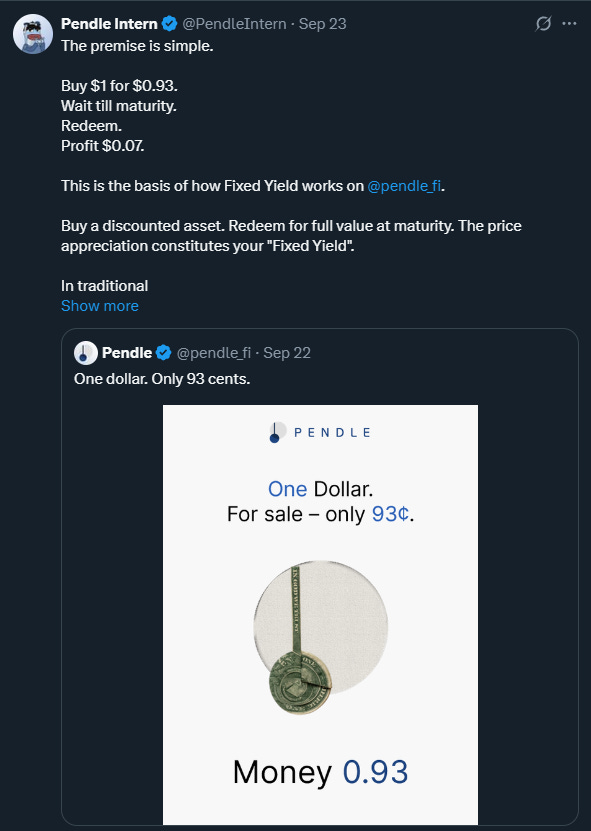

Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Pools

USDe (27 Nov 2025) on HyperEVM

dnPUMP (20 Nov 2025)

wstUSDN (18 Dec 2025)

Important Highlights ✨

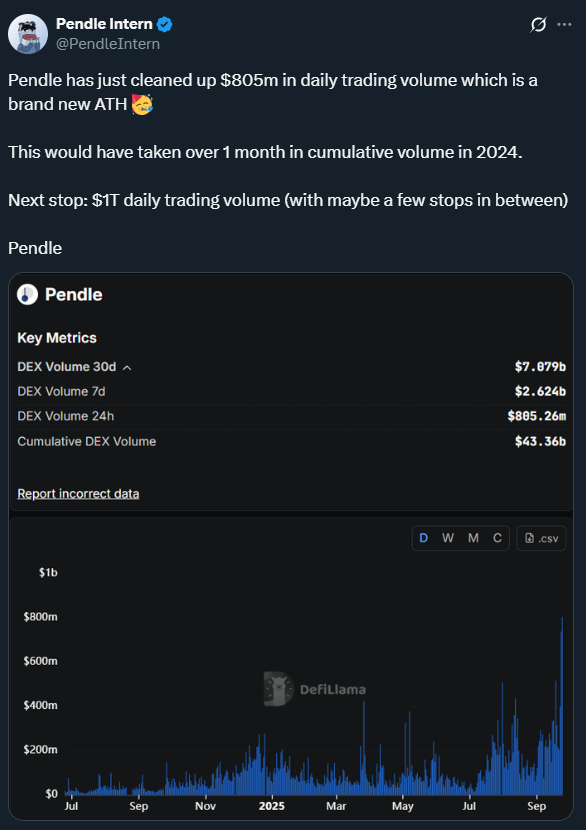

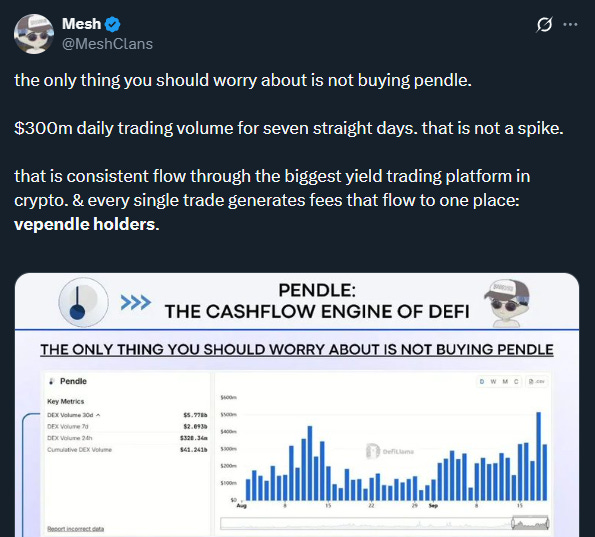

New ATH daily trading volume - $1.14B on 24 Sep 2025 🫡

Pendle on Plasma. From billions to trillions soon🫡

ICYMI here’s a gentle reminder to rollover/redeem your matured positions!

Billions have chosen to trust Pendle. Have you?

Pencosystem

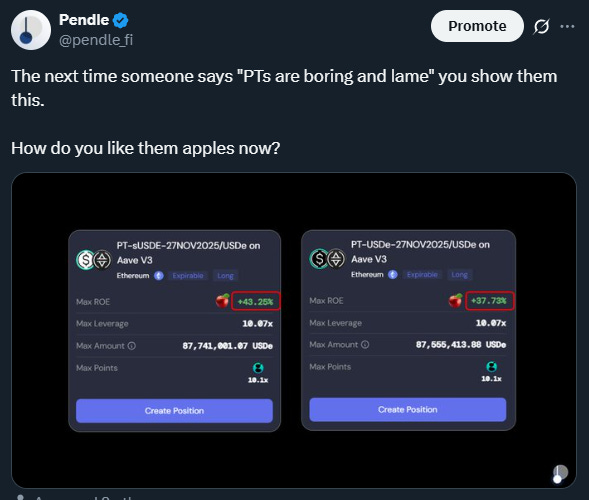

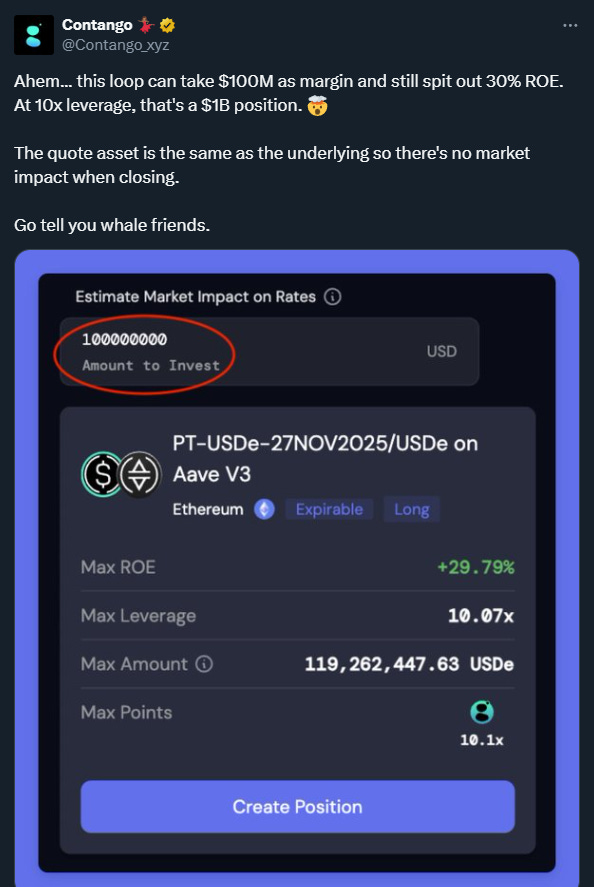

>40% ROE with stables - courtesy of Pendaavethena

Cross-chain PT looping now unlocked on Euler (Avalanche) 🫡

Plus mHYPER + mAPOLLO too:

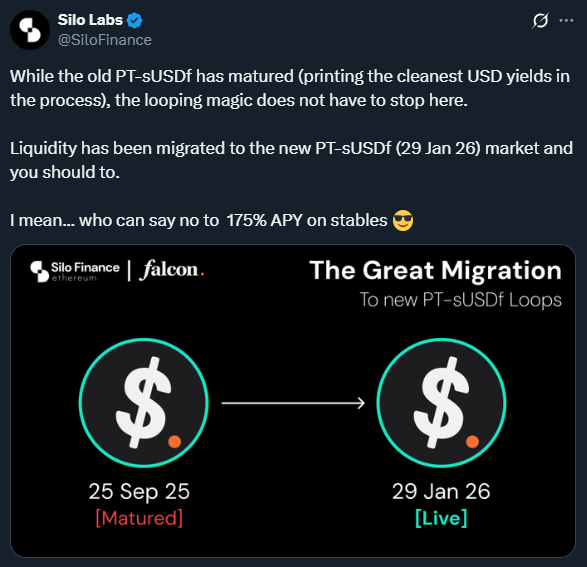

Good news for those looking to continue stacking those ridiculous PT-sUSDf yields - you still can:

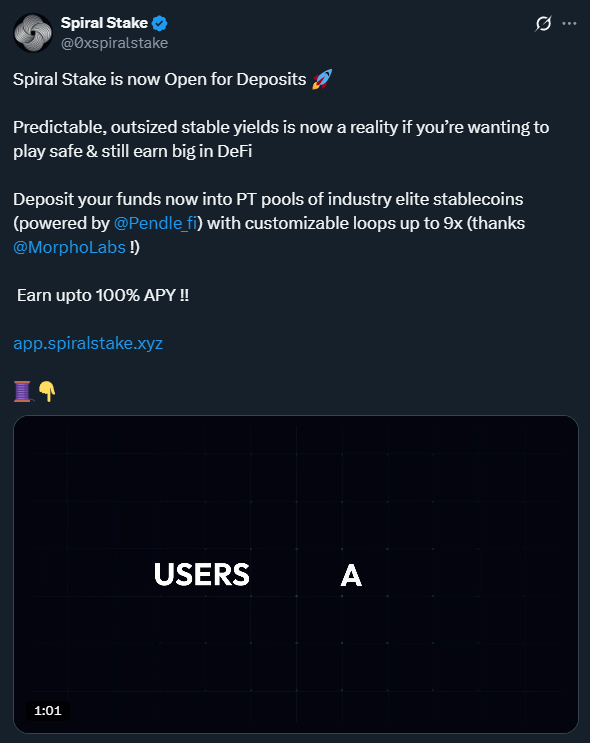

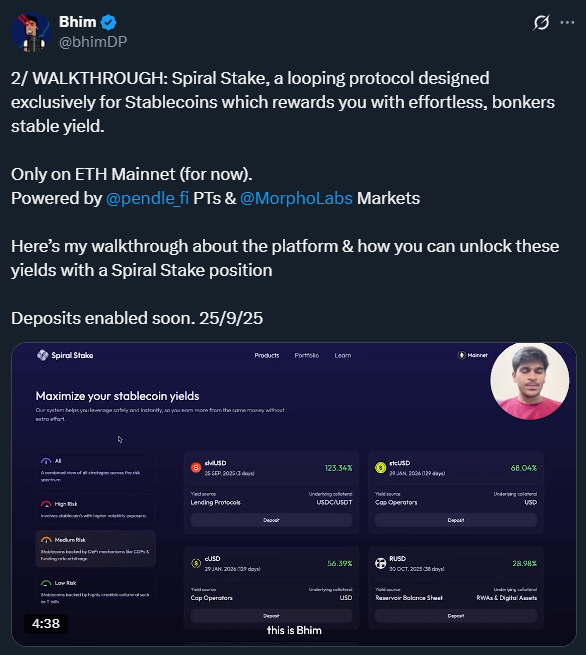

Loop Spiral your PT yields on SpiralStake:

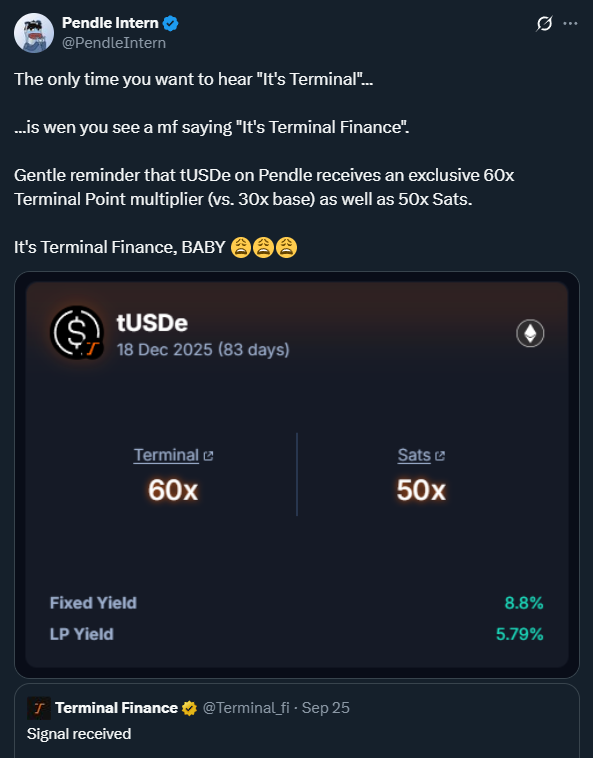

Double the native Points multiplier.

More Sats than native USDe.

What’s not to like here?

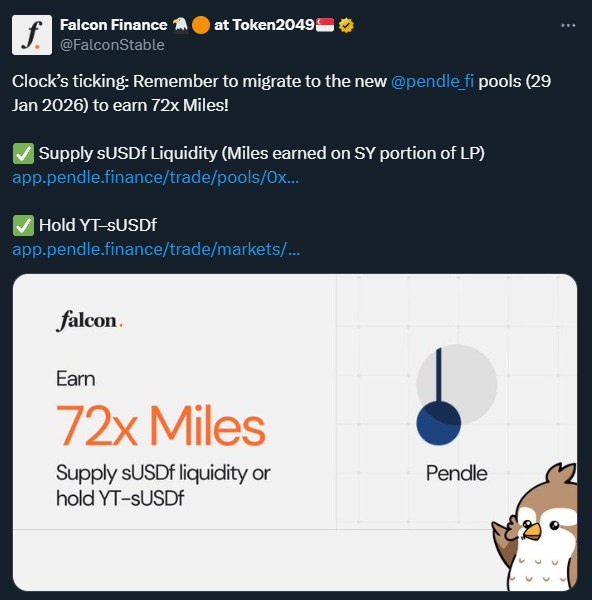

Oh and reminder that sUSDf on Pendle is now giving out a special, limited-time 72x Falcon MIles:

And then make the PTs soar with Gearbox:

Multiply Pendle fixed yield with mStable - coming soon!

Intern Insights

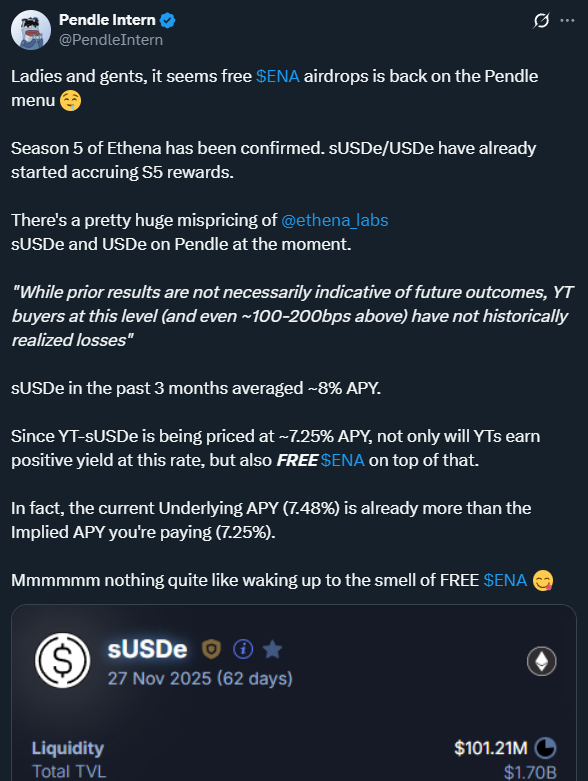

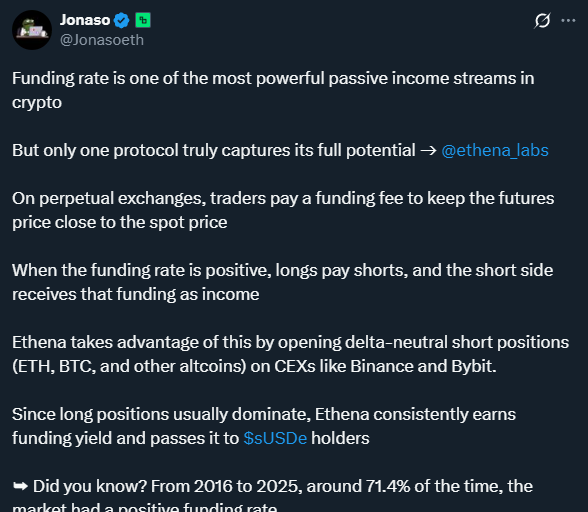

After all this time, it seems like Ethena YT could still be one of the most, if not the most, underrated plays:

And for the Fixed Yieldooors - the best yields might not even be on Ethereum 👀

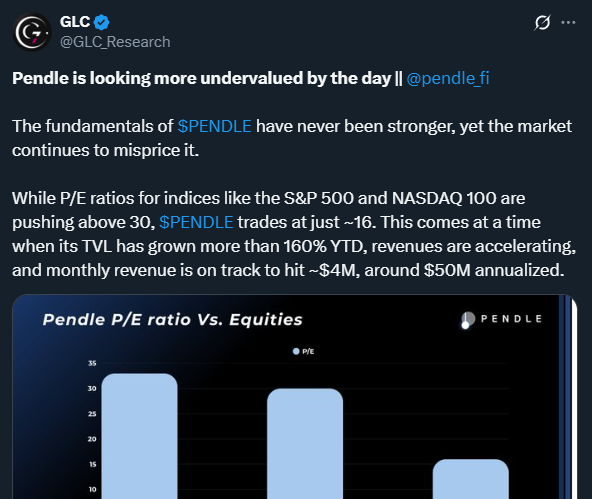

All the value, V2 and Boros and all the future what-nots, will always, always flow back to PENDLE.

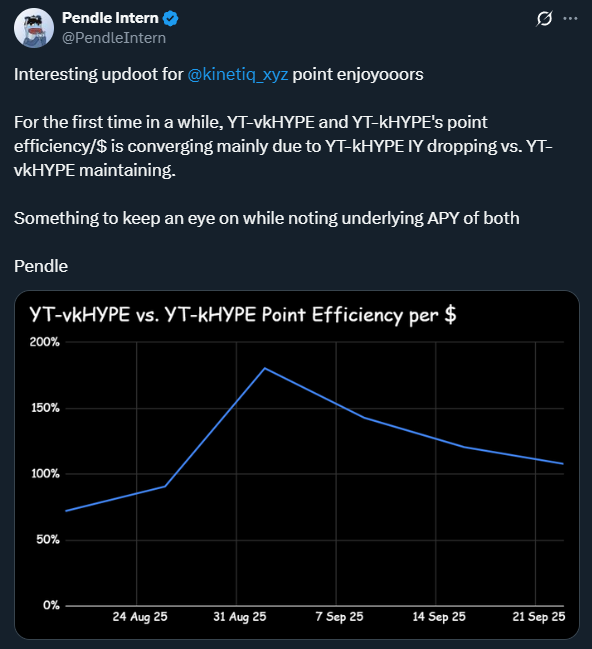

An interesting sidenote for Kinetiq fans:

Boros

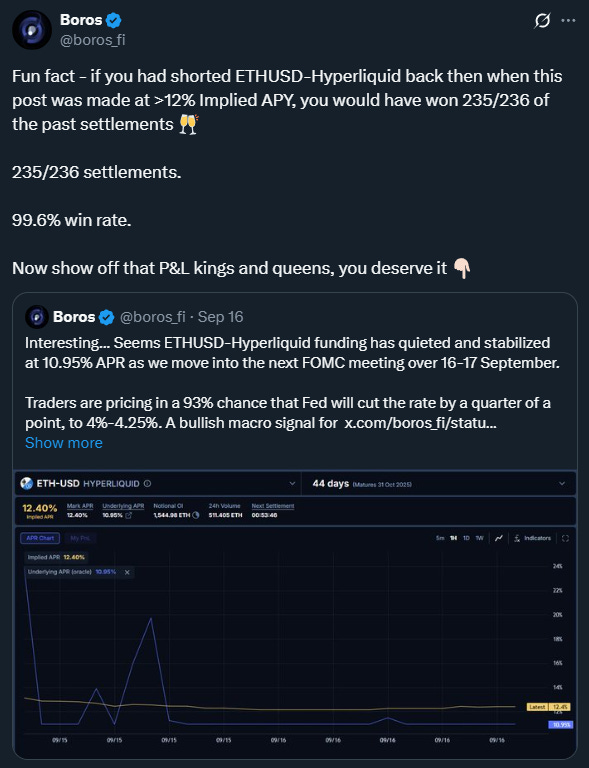

Back to back ATHs!

$225M daily trading volume for Boros ✅

Hot tip - something to look out for in the upcoming maturities 👀

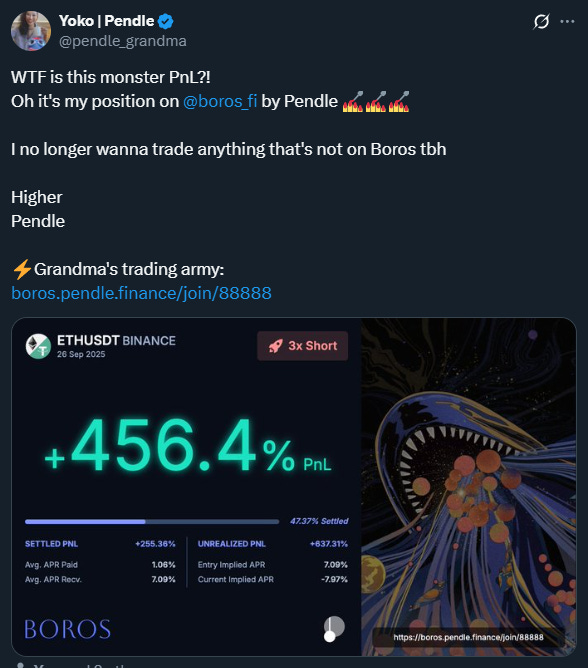

And for those who need a reason to get started:

Also the common theme for these winners seem to be “short YU” 🤔

Price oracles, powered by Chaos Labs, are now live for Boros:

X Highlights

“Across the entire onchain asset management industry, three protocols (Morpho, Pendle, Maple) account for 31% of all AUM”

Pendle pioneered and revolutionized tokenization of funding rate fees:

How Spiral Stake? Wot Spiral Stake? 👇🏻

The PENDLE thesis:

Theses*

And last but certainly not least… who wants to see our dear beloved leader half naked*?

*Not guaranteed

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle