Pendle Print #86

First millions, then trillion.

Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Pools

sUSDe 15JAN2026 [Plasma]

USDE 15JAN2026 [Plasma]

USDai 19MAR2026 [Plasma]

sUSDai 19MAR2026 [Plasma]

syrupUSDT 29JAN2026 [Plasma]

hakHYPE 20NOV2025

yoEUR 26MAR2026

upUSDC 2APR2026

iBGT 24DEC2025

asdPENDLE (26MAR2026)

Important Highlights ✨

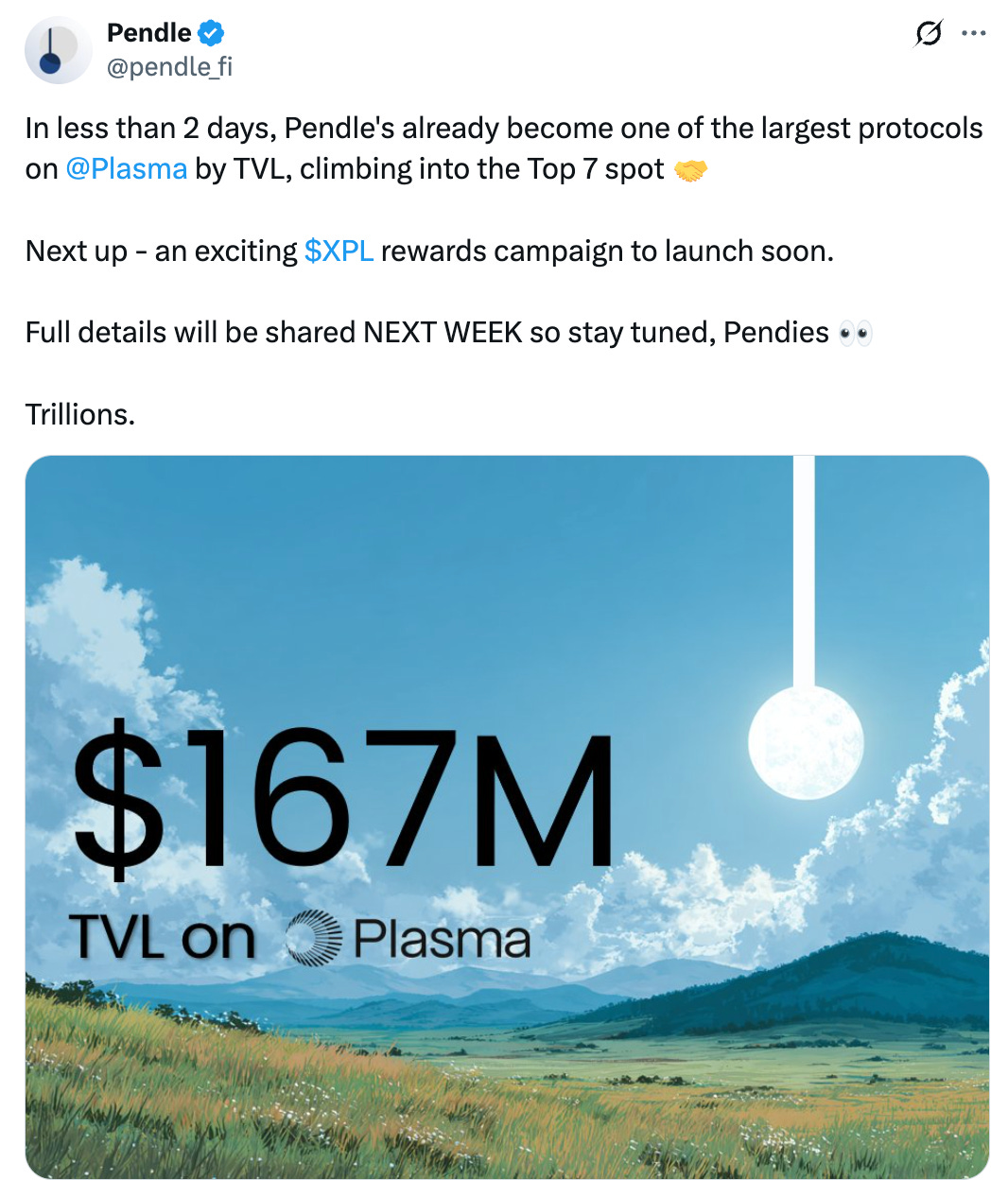

Pendle on Plasma is off to a flying start, hitting $318M at time of writing - all this in less than 4 days.

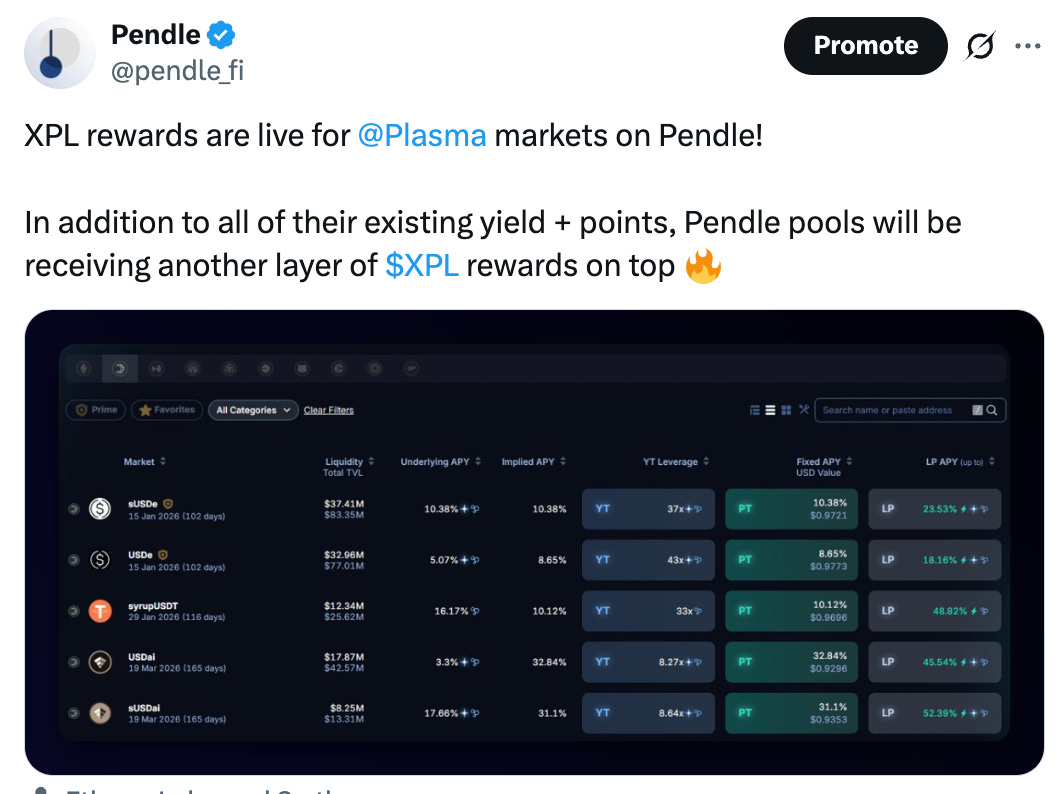

Not to mention there’s also an expansive XPL campaign on the way too, which will make trading on Pendle much, much more interesting 😉

Remember that this is just ONE of many more to come.

All to be revealed later this week!

Oh and there’s also this too 👇🏻

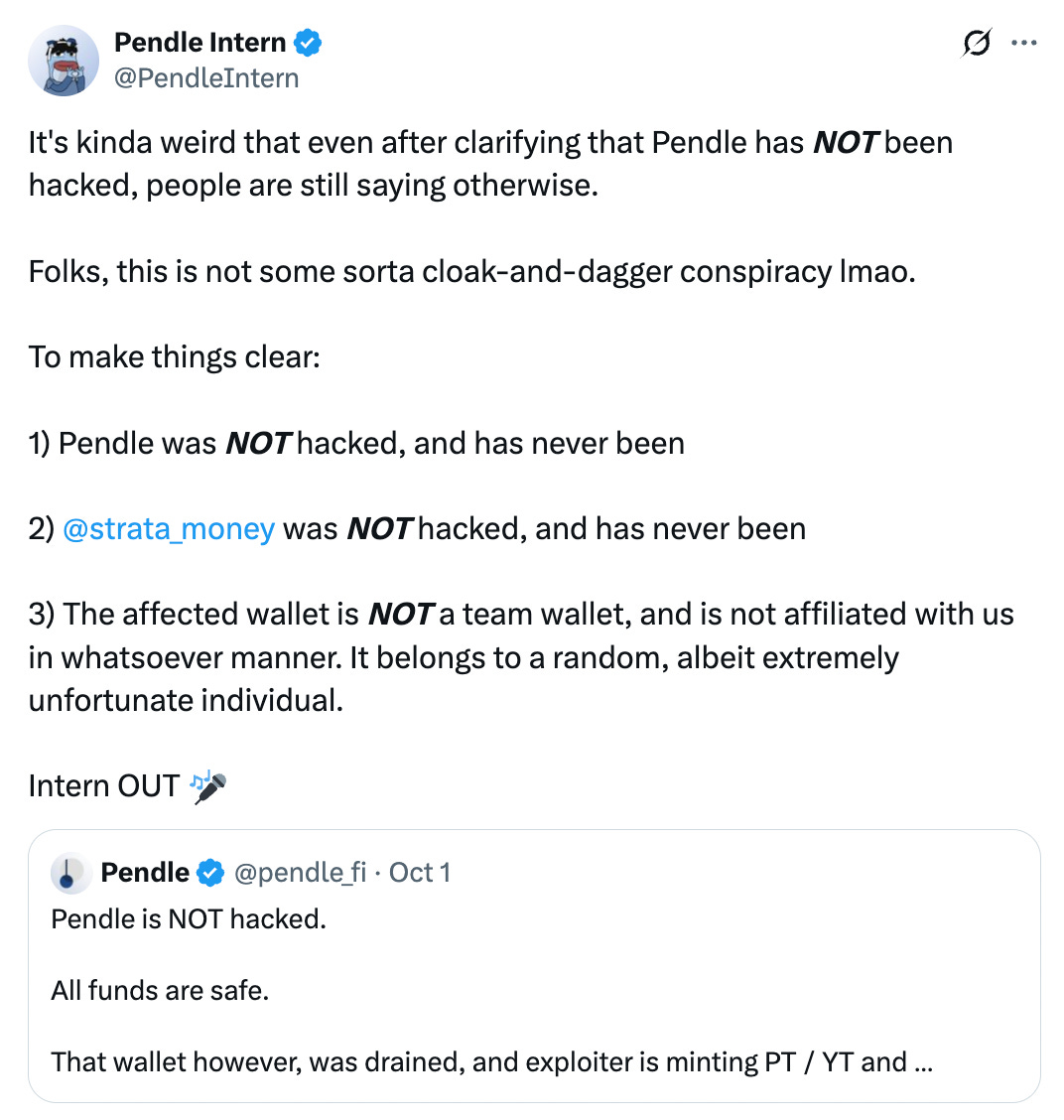

And just to be clear once and for all…

Pendle WAS NOT hacked. It has never been.

Pencosystem

Could tUSDe very well be the highest yielding Ethena asset now?

In just a couple of days, the Plasma Pencosystem is already up and running - and with decent traction too, courtesy of Gearbox:

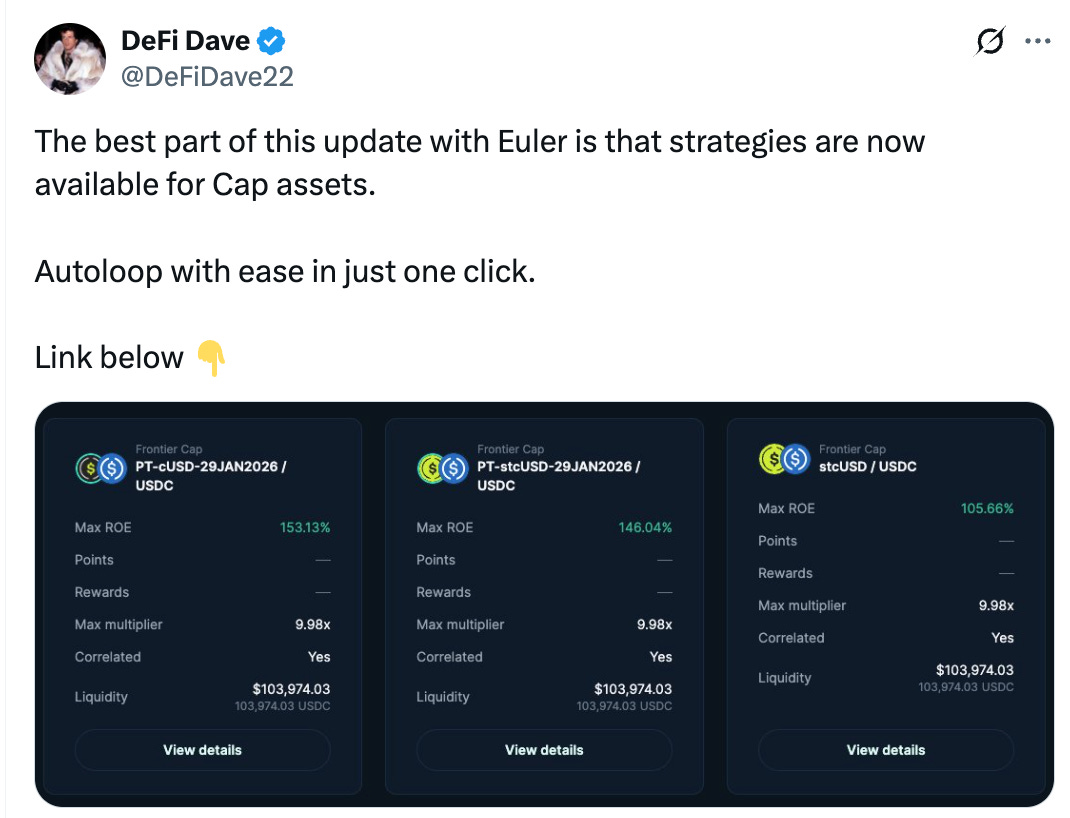

And Euler too, along with plenty other new integrations:

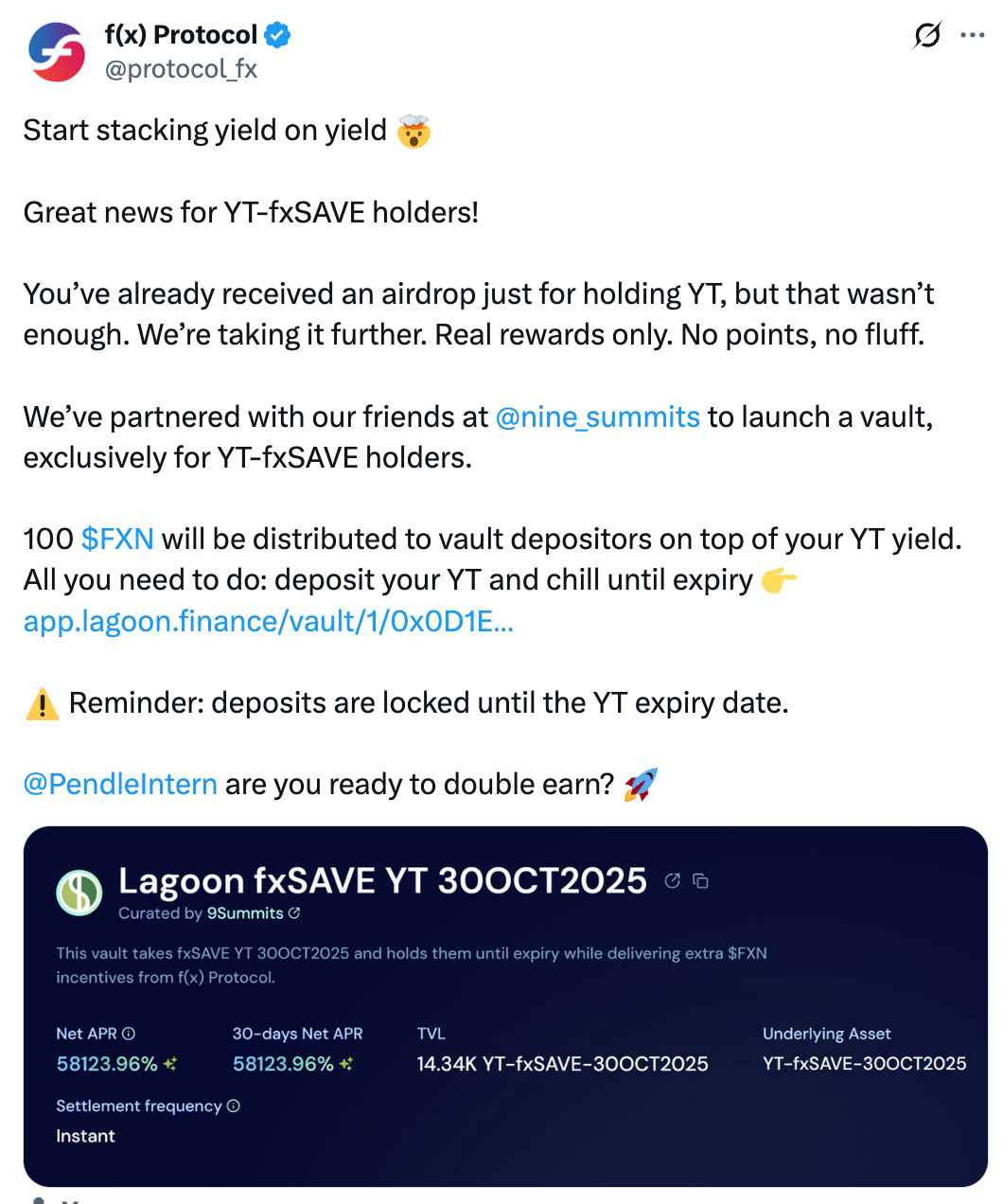

YT has taken a back seat to PT in Pencosystem support, but perhaps things are about to change?

Just imagine yield-on-yield with YT leveraged exposure on top mmm…

E-mode for PT-USDe (30 Oct 2025) on Venus:

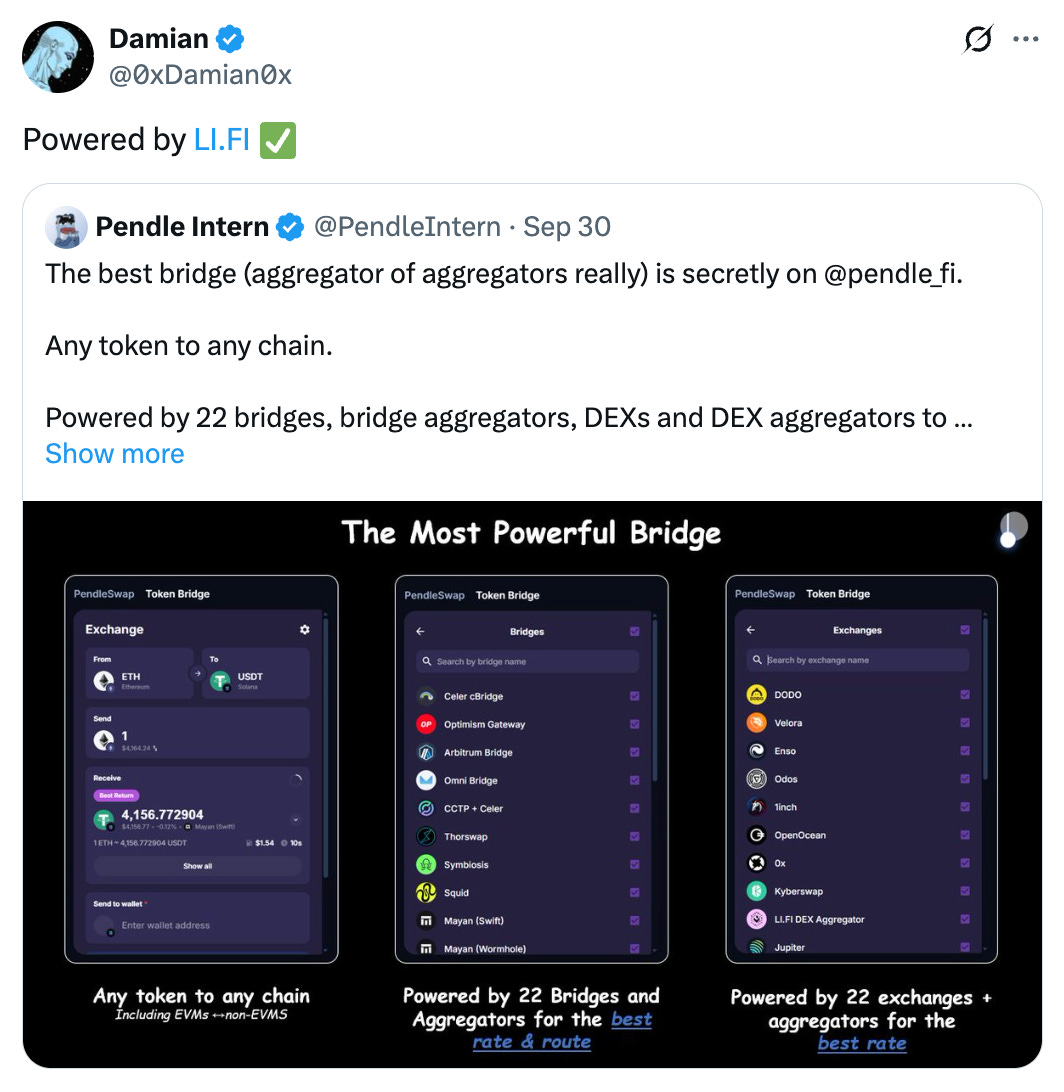

If you didn’t already know, the best bridge aggregator-of-aggregator is secretly on Pendle:

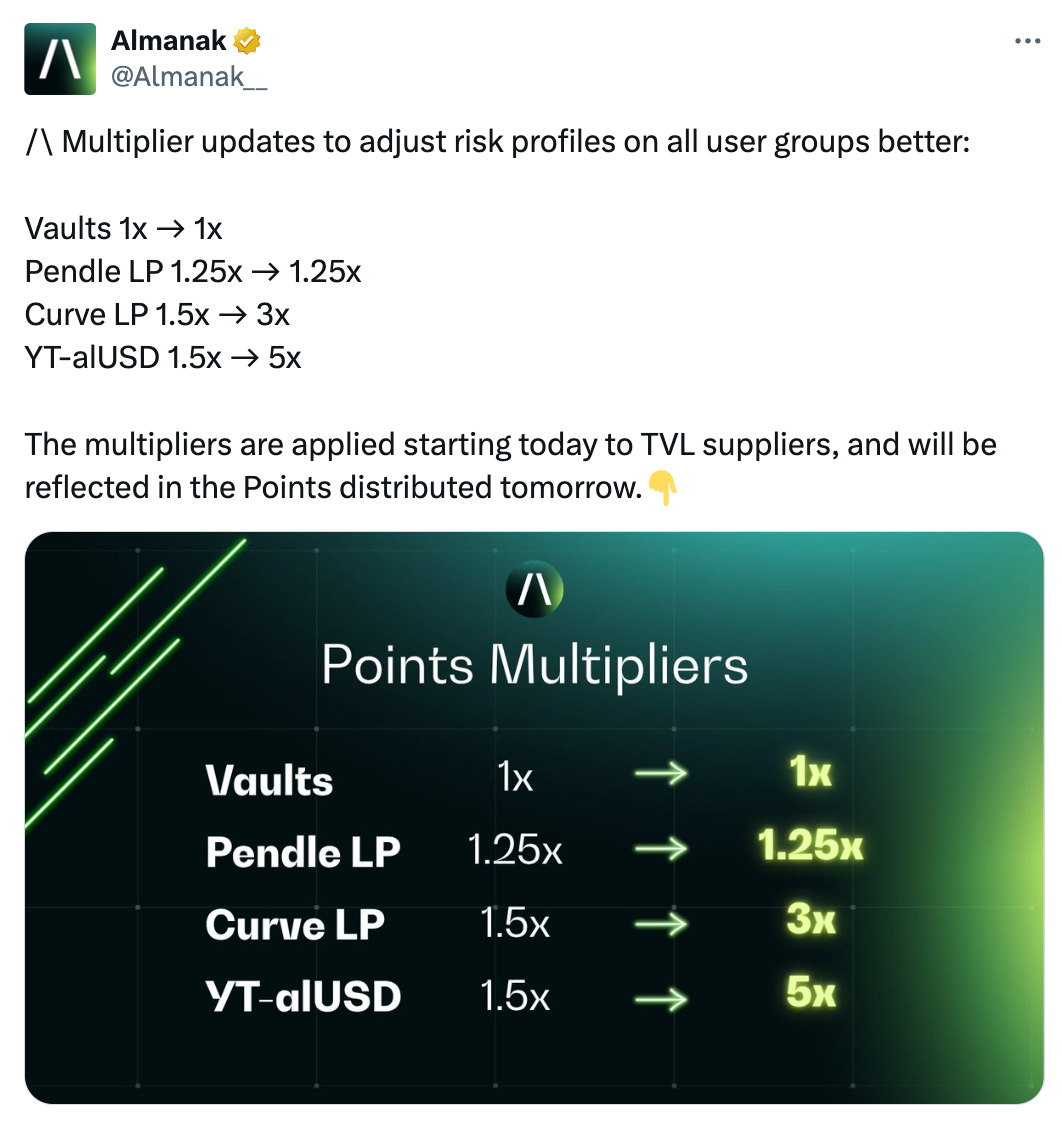

Major MAJOR boost for YT-alUSD:

Intern Insights

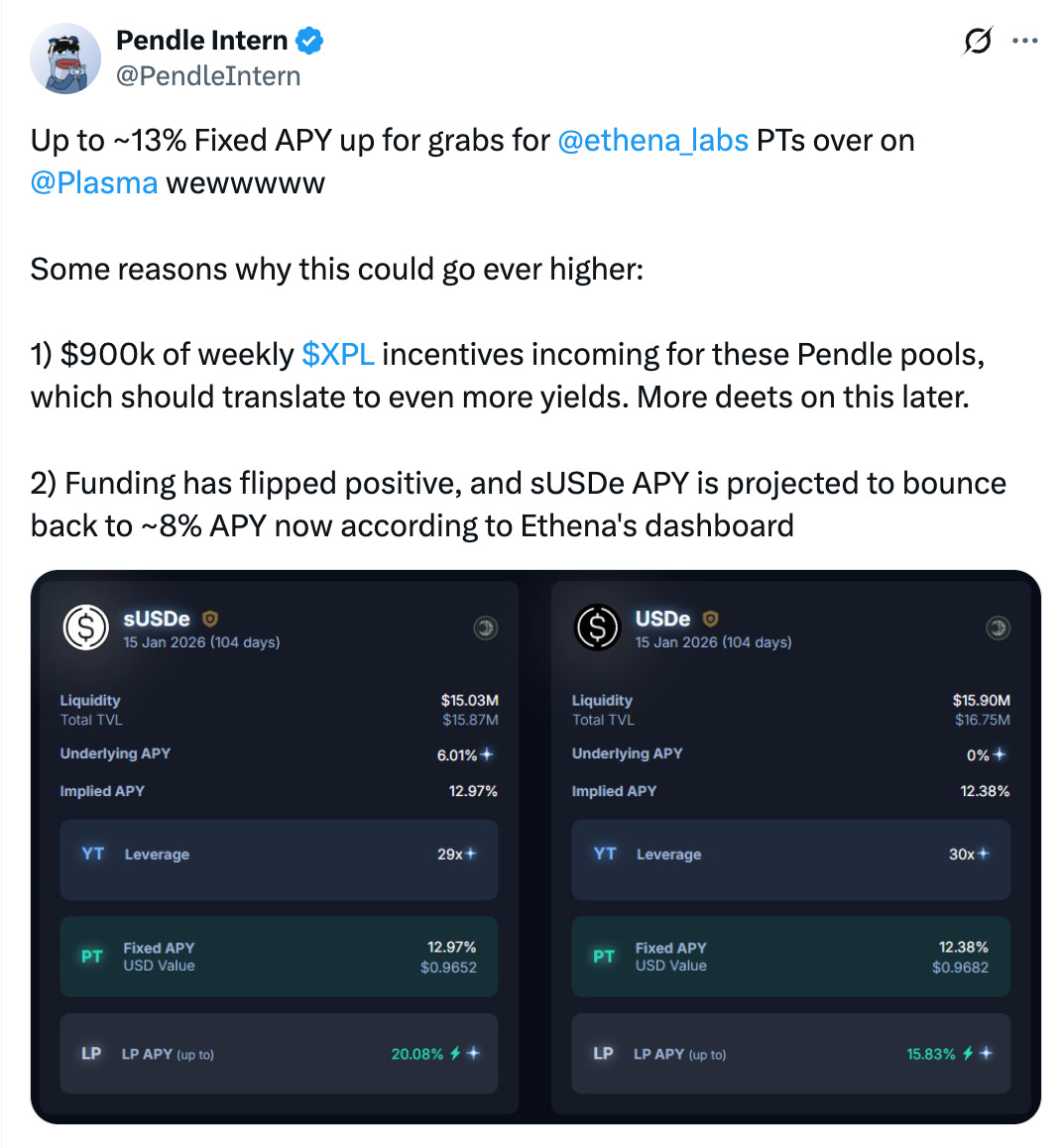

Here’s why USDe and sUSDe YTs are massively undervalued on Plasma:

“No one ever goes broke from taking profit”

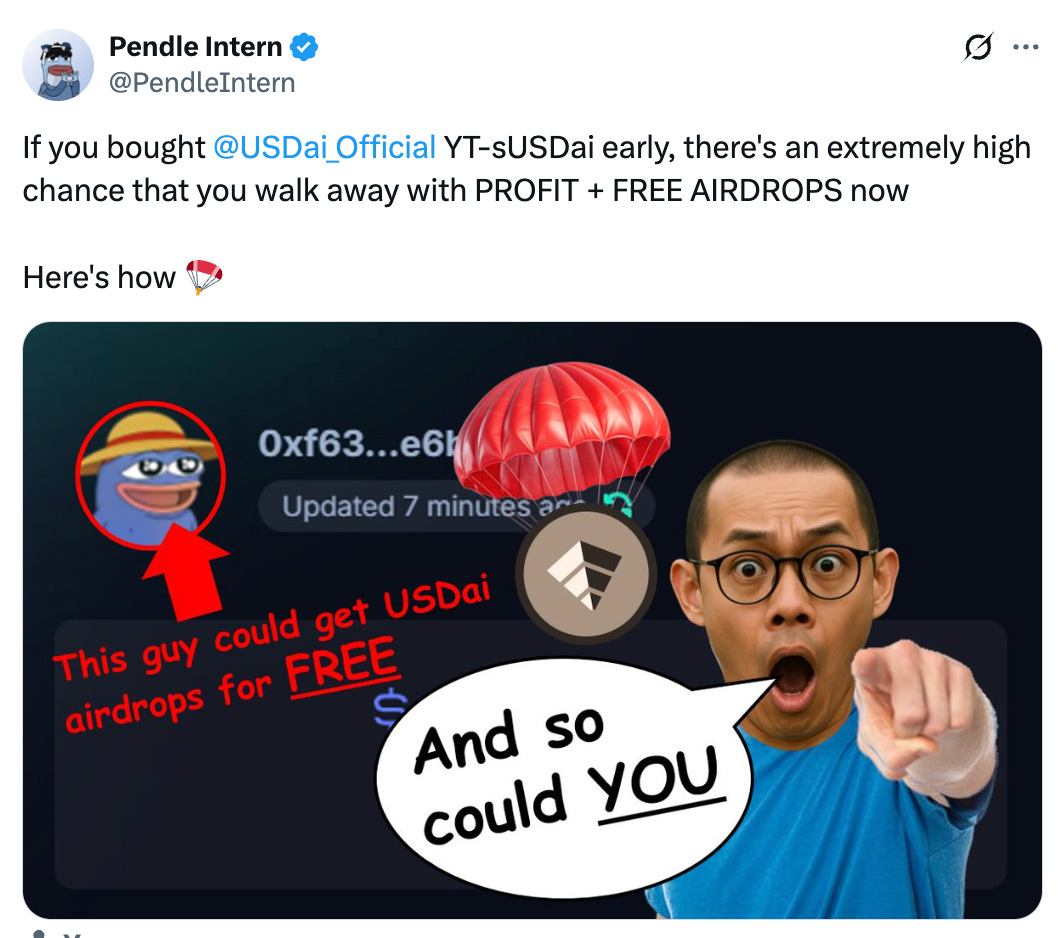

Now imagine with FREE airdrops on top:

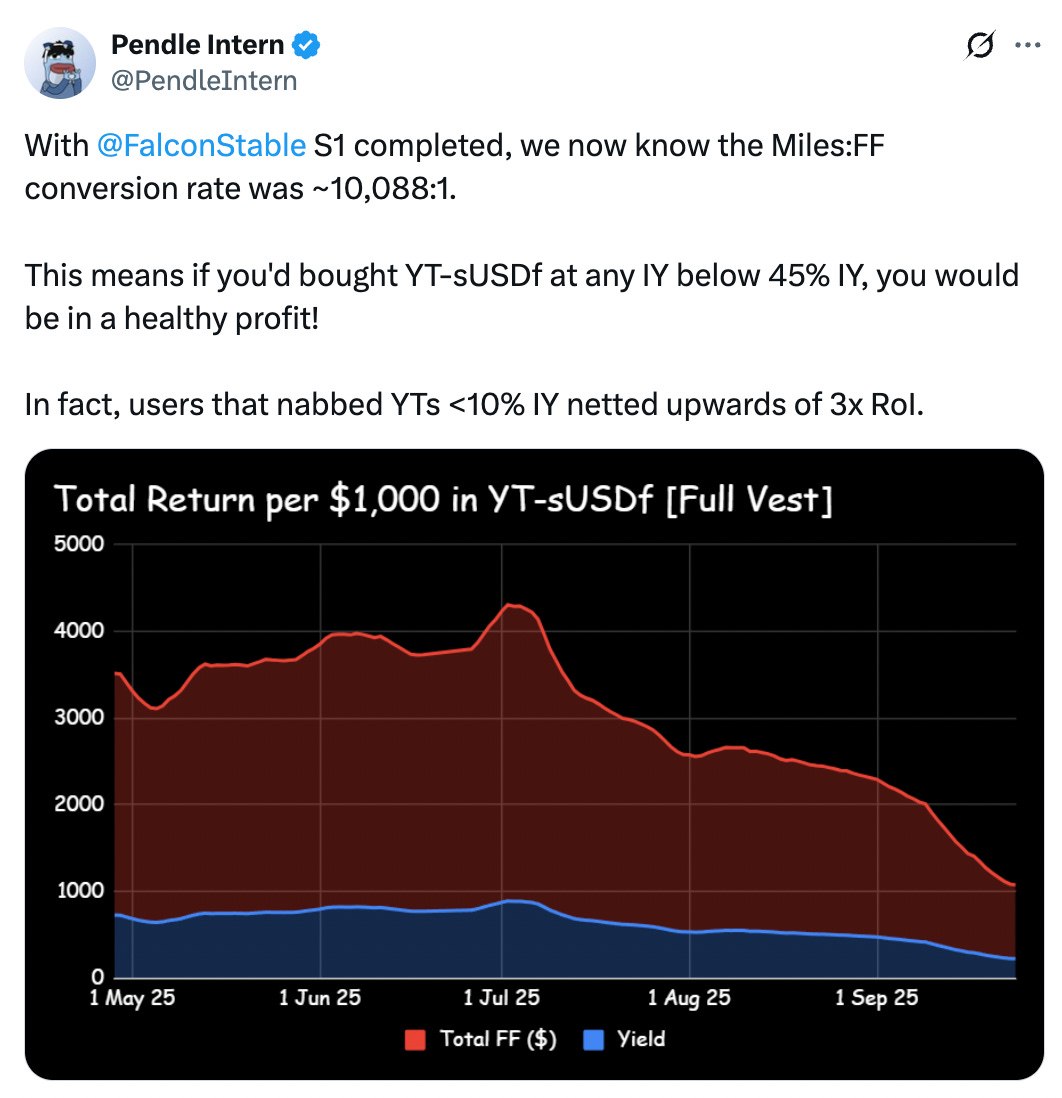

Are YTs actually profitable? Based on Intern’s projections, pretty much yes.

Very yes:

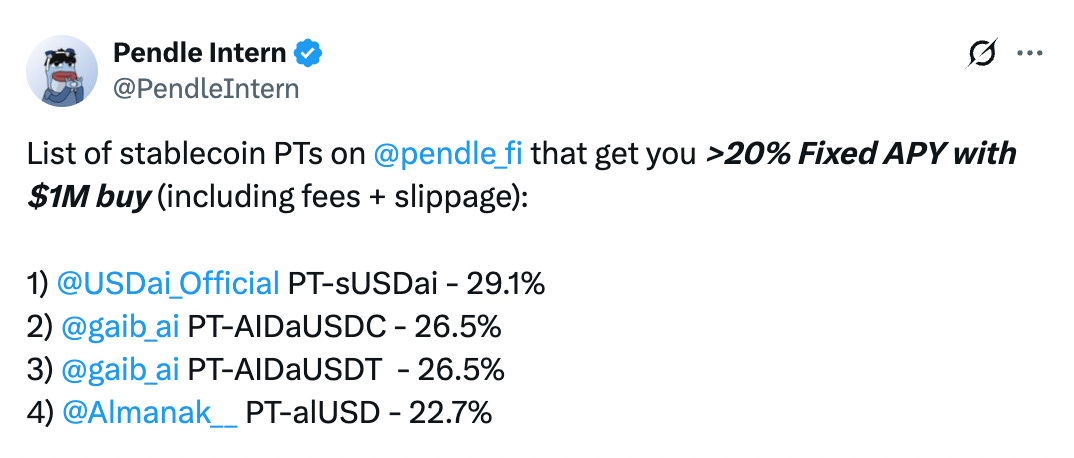

For those on the hunt for the best possible stablecoin fixed yields:

Boros

USDT collateral is now live on Boros!

And with this, the same seamless experience you enjoy on perp exchanges:

Some major milestones from the Sep 2025 maturity last week:

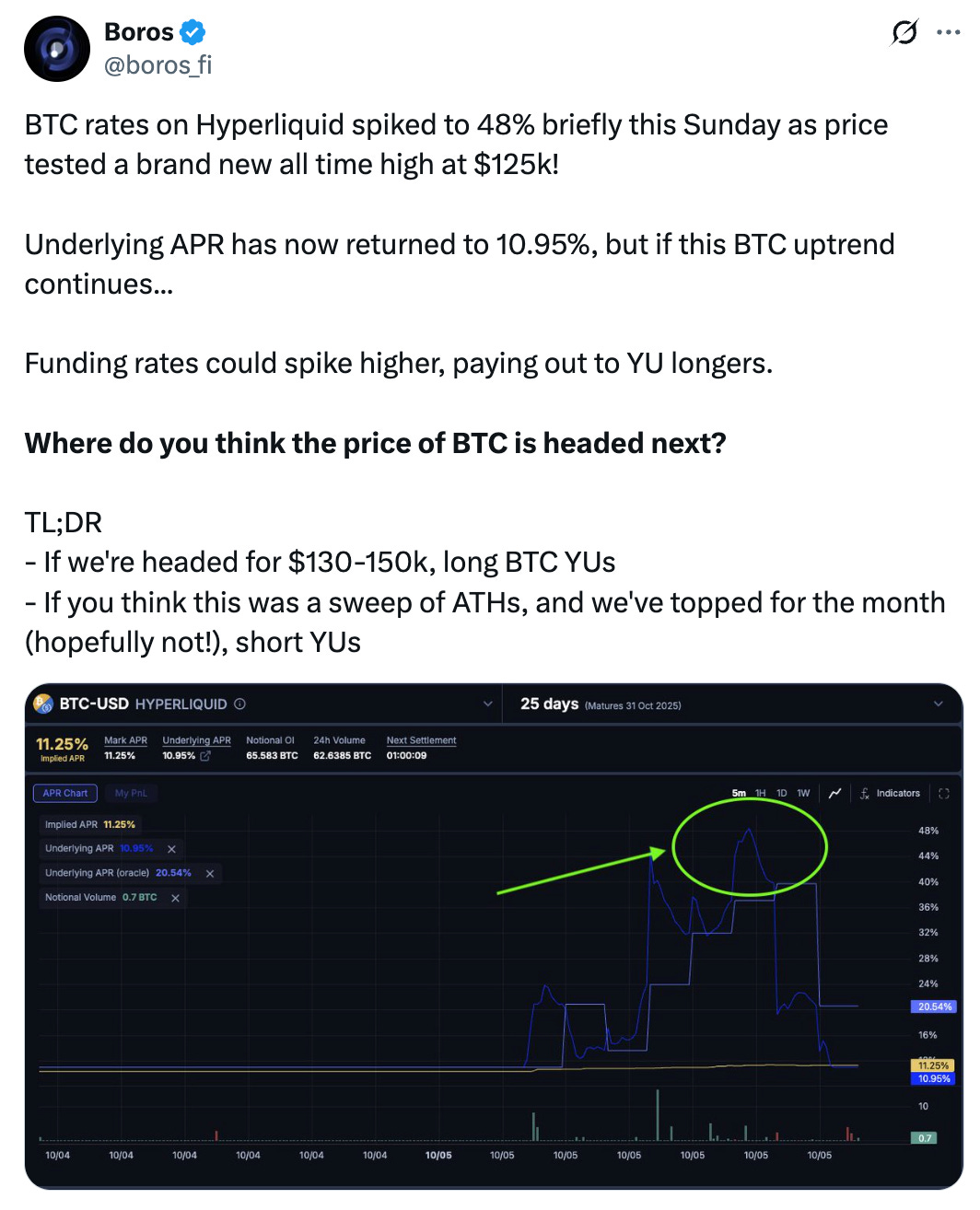

With BTC hitting new ATH, here’s how you could trade on Boros:

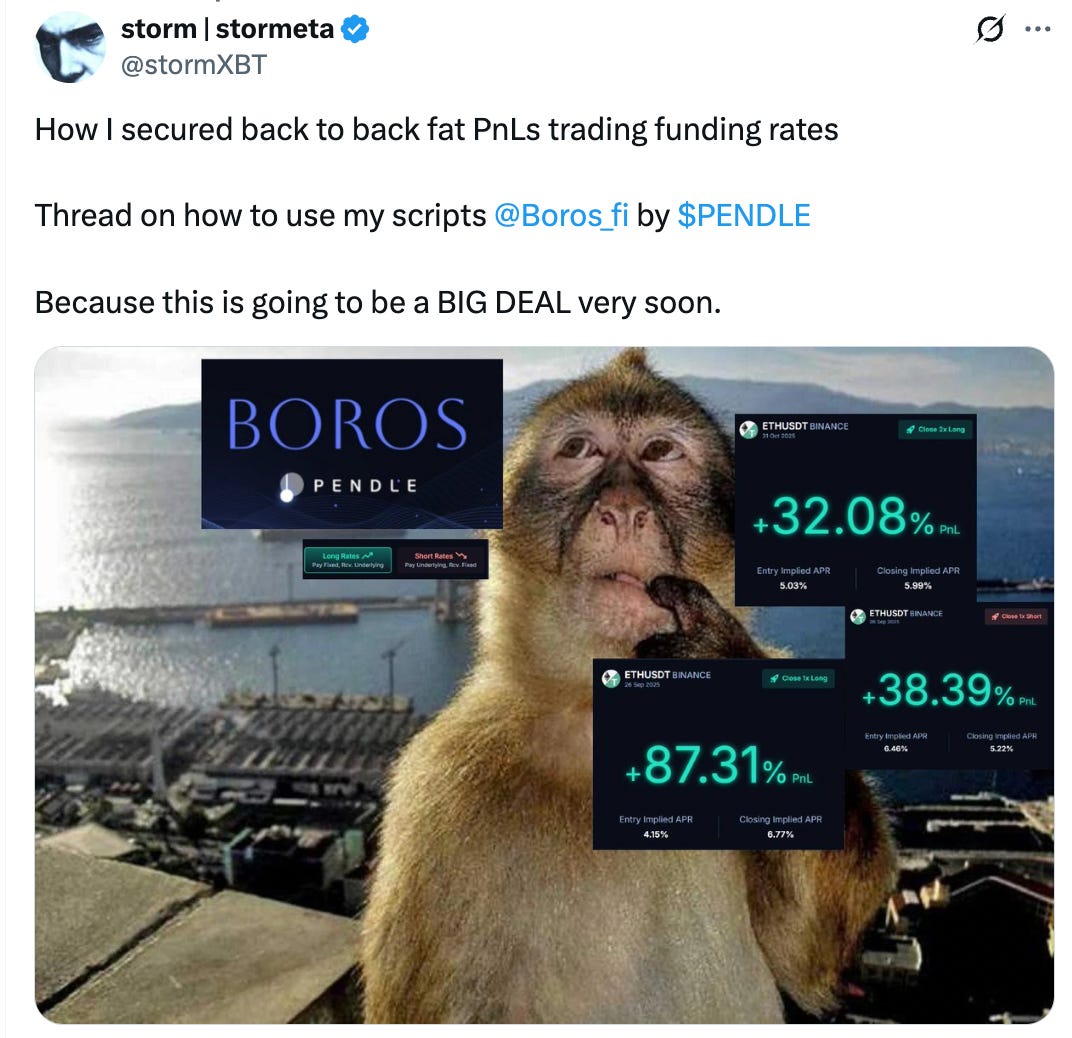

Big numbers and big profits for Borosians.

So why aren’t you one yet, anon?

Boros leaderboards are now live! Which means you now start stalking and copying your favourite trader:

X Highlights

Are USDai PTs worth it at 34%?

And are they still worth it not that they’re 50%?

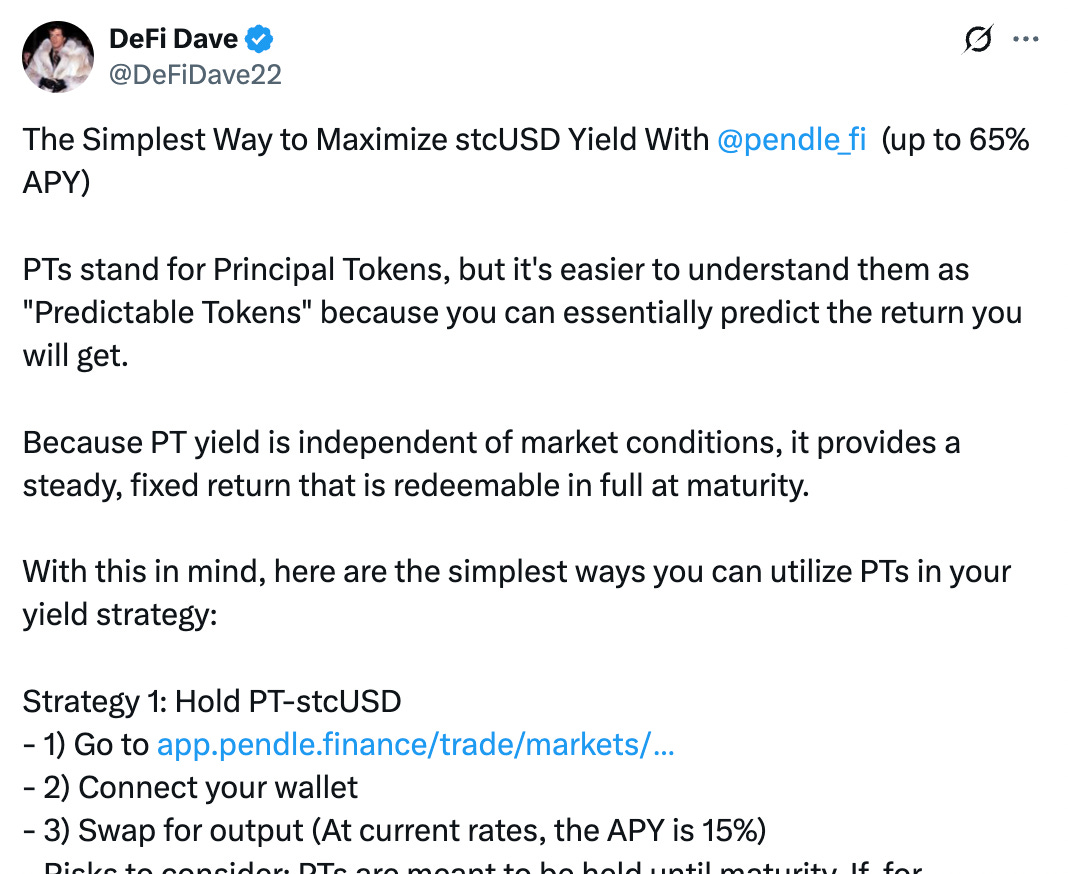

Alpha on stcUSD yield:

Also not forgetting Boros, which is also operating on Arbitrum:

How a Japanese Pendie earned 4x from Falcon YTs:

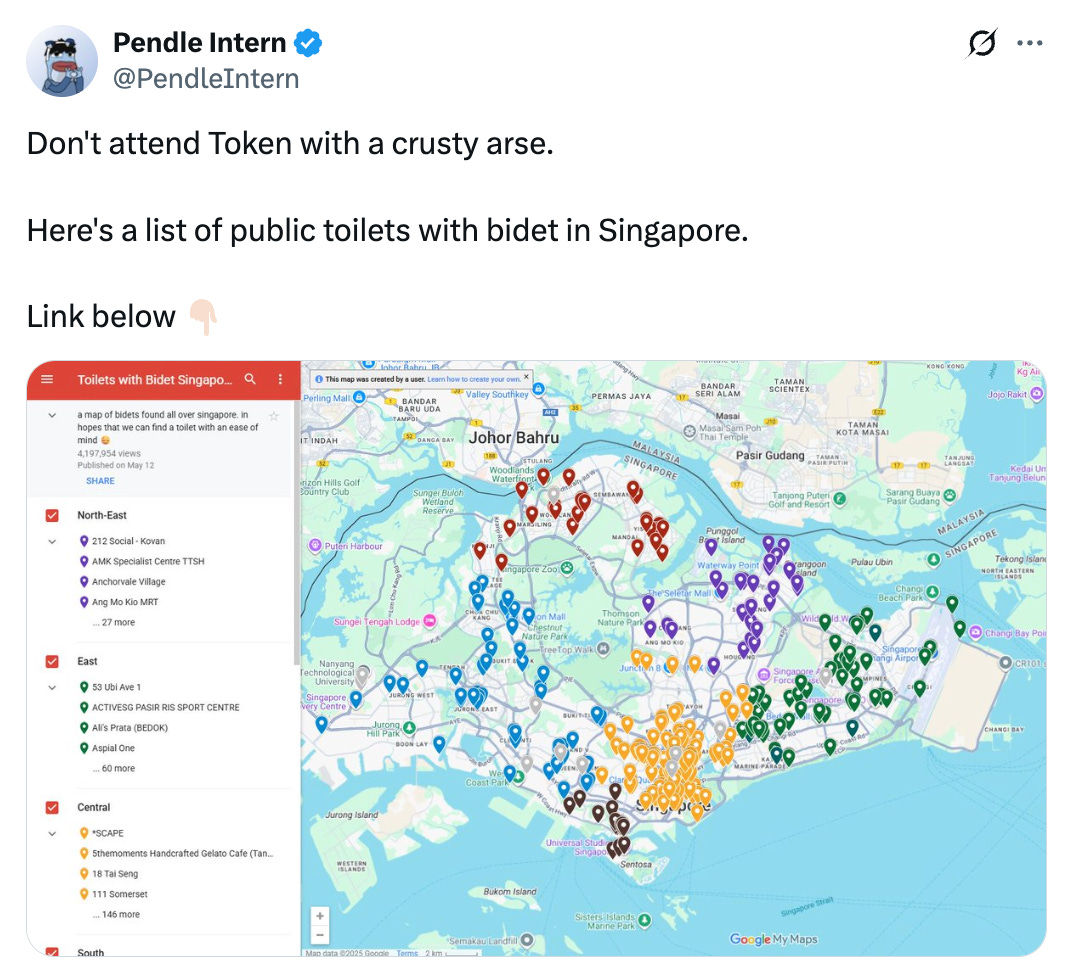

And last but certainly not least… for those visiting/living in the Lion City:

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle