Pendle Print #87

The Future of Yield

Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

Did you miss me? The Pendle team is finally back from our short offsite (we’ve been back from quite some time actually) and oh boy do I have lots to share with you.

But first… let’s take a look at some of the new additions to our market lineup:

New Pools

mHYPER (29 Jan 2026)

wstUSR (26 Feb 2026)

RLP (26 Feb 2026)

srUSDe (15 Jan 2026)

jrUSDe (15 Jan 2026)

splUSD (29 Jan 2026)

fxSAVE (30 Apr 2026)

wstOBOL (22 Jan 2026)

rUSD (25 Feb 2026)

wsrUSD (25 Feb 2026)

mevBTC (25 Dec 2025)

mMEV (29 Jan 2026)

Important Highlights ✨

Pendle ETP (APEN) by 21Shares is now live on SIX Swiss Exchange!

TN Lee’s inspirational speech immortalized in writing! A peek behind-the-scenes for Pendle’s offsite:

ATH revenue month for Pendle:

Pendle - The Future of Yield:

Boros might just be the greatest DeFi innovation in the entire history of DeFi:

Pencosystem

BOOM! PTs on AAVE have gone online on Plasma:

UltraYield for ultra leverage on PTs:

Pendle on Stable soon 🤝

Leverage up your PT yield using Aave! Except now it’s fully automated for hyper-efficiency:

Speaking of efficiency, how about doing the same for your vePENDLE votes too?

Agentic DeFi, but Pendle:

Intern Insights

Ever heard of ambiguity aversion? Pendle PTs are built to annihilate this. And that’s the #1 reason why Pendle will be the gateway for institutional access to crypto yields:

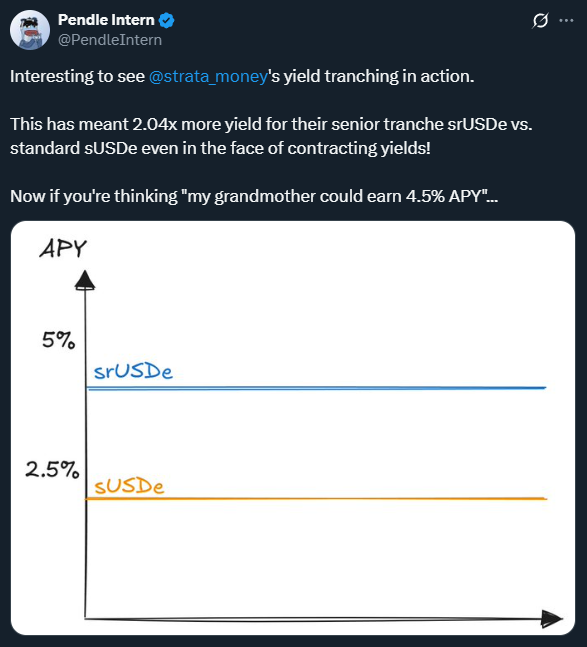

You should definitely start paying attention to Strata:

Boros

The options market might be onto something…

3 days. 40% APR.

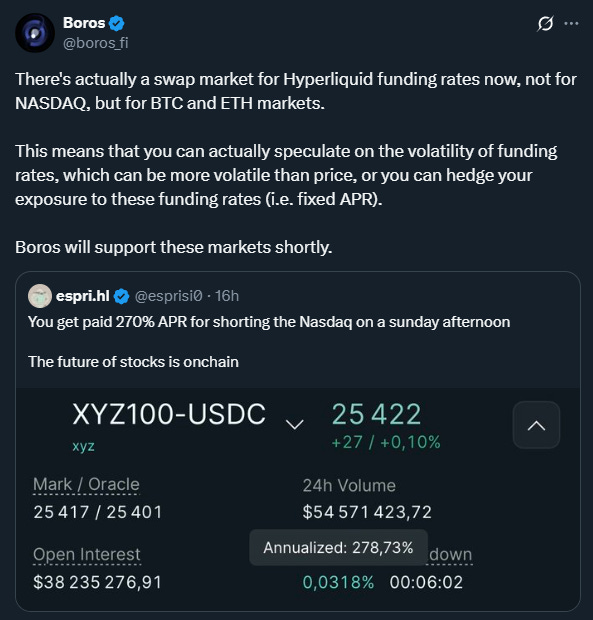

Imagine funding rate trading on Boros for NASDAQ:

Boros after 3 months:

X Highlights

Okay Linn, okay.

ATH in revenue, ATH in volume too:

It’s not just hype:

The beginning of the beginning:

Guess who’s on Artemis’ protocol highlight! 😳

And last but certainly not least…RIP all of your magic internet gloves and knives 🙏🏻

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle