Pendle Print #89

From dolphins to whales

Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Pools

AID (29 Jan 2026)

sAID (29 Jan 2026)

syzUSD (29 Jan 26)

yzUSD (29 Jan 26)

tmvUSDT0 (15 Jan 2026)

nBASIS (26 Mar 2026)

ynRWAx (15 Oct 2025)

ynUSDx (30 Apr 2026)

USD (Midas mRe7BTC) (22 Jan 2026)

USD (Midas mRe7yield) (22 Jan 2026)

WBTC (18 Dec 2025)

Important Highlights ✨

Last Thursday, Pendle hosted our Discord Community Call, where the bossman TN Lee revealed all of his evil masterplans for Pendle.

Lucky for us, Intern has summarized some of the grand future plans in a post:

Pencosystem

Pendle strategies enhanced and made easier with INFINIT’s AI agent:

5 powerful new Pendle features that you may have missed:

Intern Insights

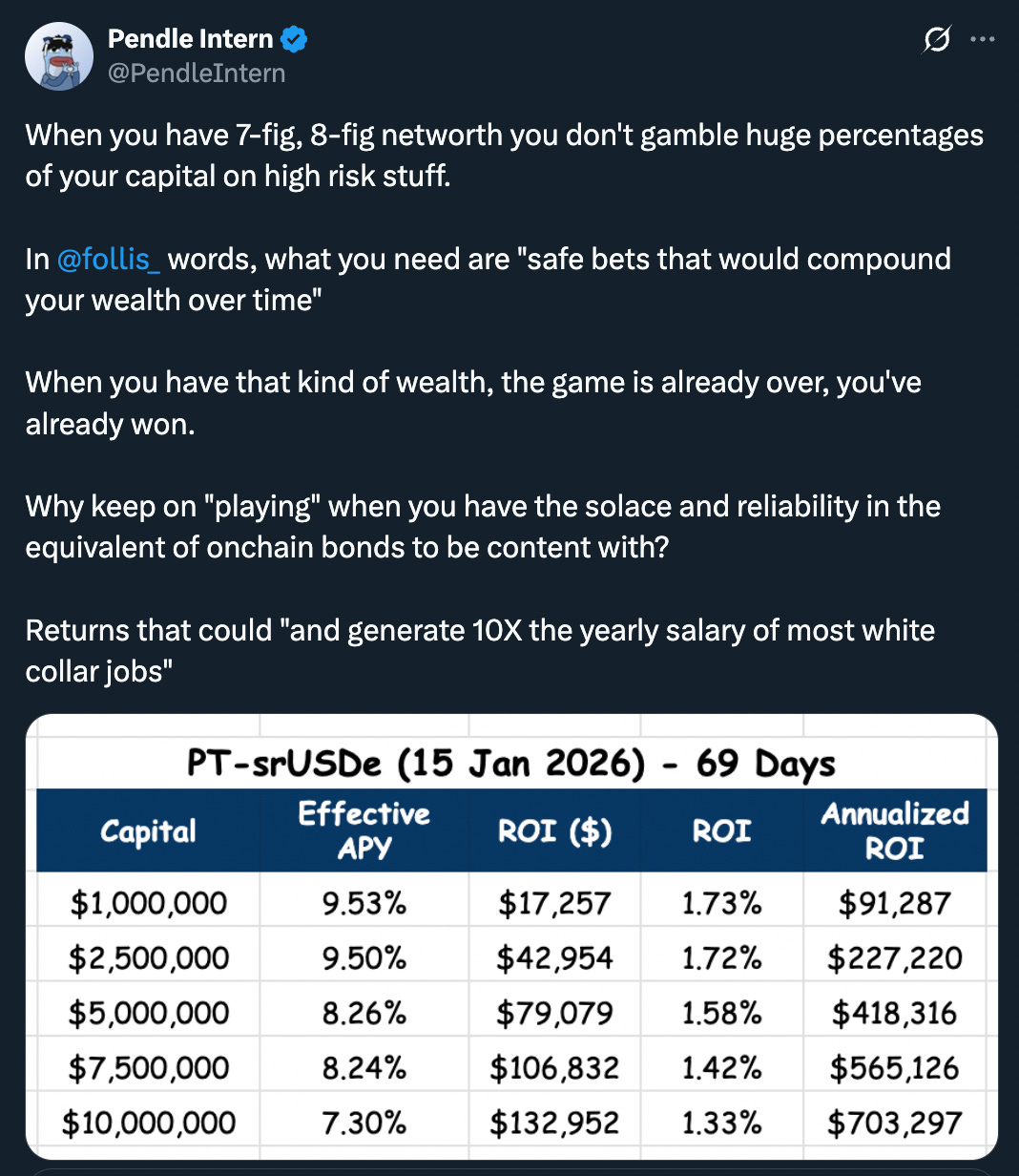

The gameplans to scale wealth for 7 figs, 8 figs….

The recent stablecoin blowup serves as a lesson for all, but yield farming (PT specifically) is still one of the most powerful ways to compound your wealth in a safe, responsible manner.

All it takes is some studying of the underlying protocols.

Case in point:

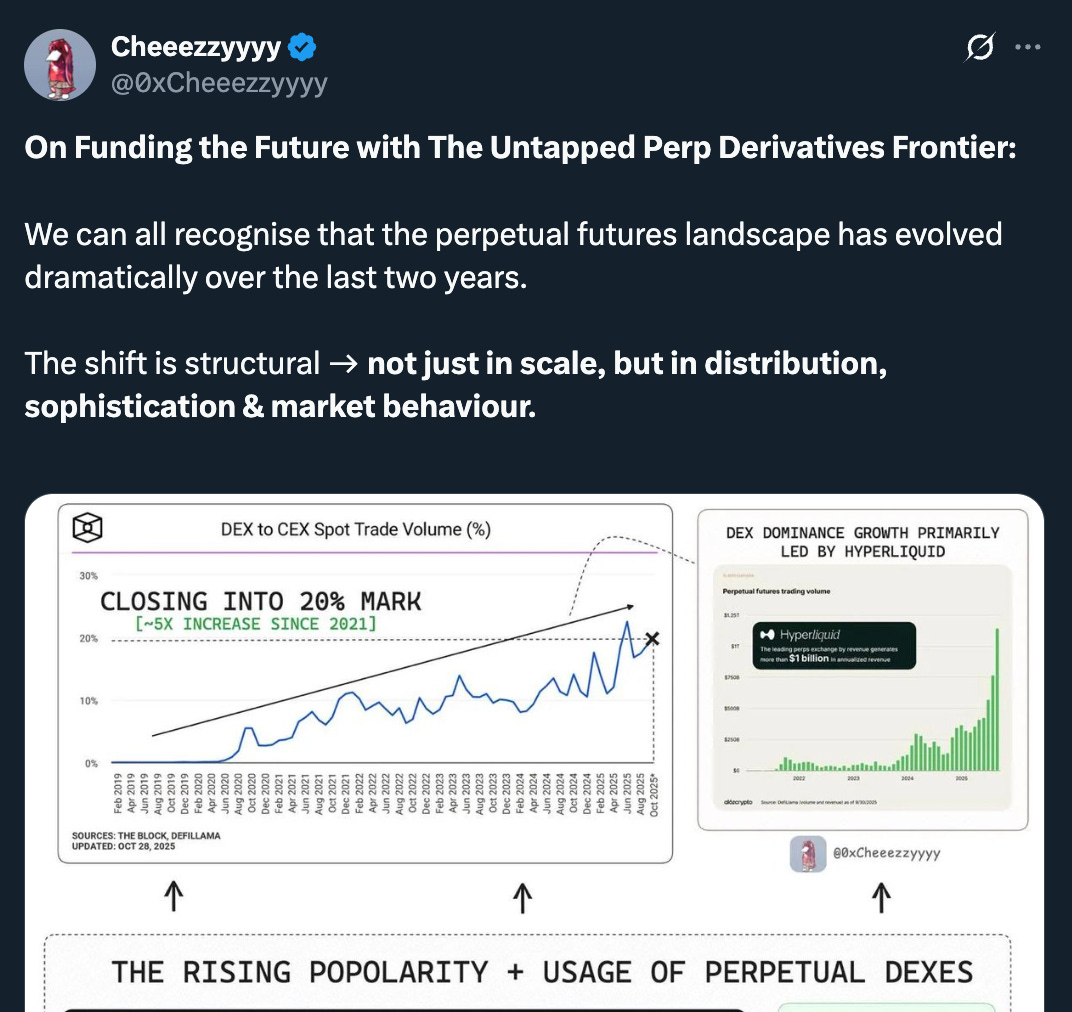

Boros

New BTCUSD-Hyperliquid markets on Boros!

Mission accomplished 🫡

Some cool features to level up your Boros game:

Levelling up perp trading with Boros:

X Highlights

Watch TN butter up Pendle for incumbent banks LIVE 😉

Getting front-run by a shitposter on major news:

Pendaavethena:

From 5-6 figs to 7 figs, from dolphins to whales:

sUSDe…but (even) safer?

And last but certainly not least… how to enhance your portfolio with Pendle:

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle