Pendle Print #98

NVIDIA x Pendle

Pendle is the ultimate yield market in DeFi – fixed yields, leveraged yield + points trading, and funding rate swaps (via Boros).

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Pools

mHyperBTC (30 Apr 2026)

mHyperETH (30 Apr 2026)

gUSDC (25 June 2026)

savUSD (14 May 2026)

Important Highlights ✨

The first equity perps funding rate market is now live on Boros, starting with the world’s largest company:

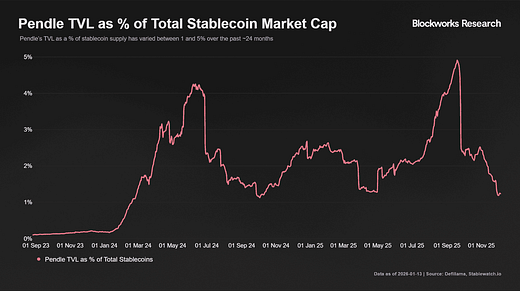

We’re entering a new phase for RWAs. 2026 marks the transition from crypto-native rotations to the large scale onchain migration of offchain securities.

Tokenization alone offers limited utility. The real value is unlocked through second-order yield financialization - stripping, pricing, and trading yield to form entirely new derivative markets that are impractical within today’s TradFi structures.

Pendle is purpose built as the yield infrastructure layer to support this shift:

ICYMI gentle reminder to handle your maturity affairs!

PENDLE on Grayscale’s list of “Assets Under Consideration”:

PSA: If you ever held YT/LP in the upBTC or other Mezo pools, please remember to register claim your $MEZO airdrop:

Pencosystem

Already 90% filled and counting so better hurry up!

And for the Strata PT-srUSDe fans, the Morpho markets already now up and running for Apr 2026 maturity:

Cap increased to $200M for sNUSD (5 Mar 2026):

Pendle swaps now integrated on OpenOcean:

Extra incentives for YU-mHyperBTC yummmmm 😋

Start using Scale Order to scale your well…orders:

Boros

New ETH maturities, expanding your list of selection for cross-venue funding rate arbitrage:

$206M OI and counting, with plenty more exciting markets on the way soon!

Even scaling to just 1% of the TAM means a 10x growth for Boros at this point so yes, DeFi Dad may have a point here…

IVEN with the funding slam dunk:

DarkLord revealing her Boros secrets:

Bullish for Q1? Here’s how to position with Boros:

Intern Insights

The 2nd largest protocol on the leading neobank chain:

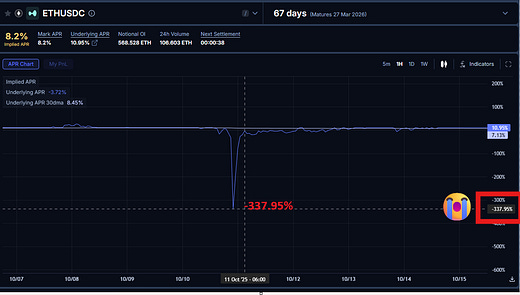

Volatility is not a bug here. It’s a feature.

X Highlights

From 4.6% to 20% APR:

Why you should really start looking into Scale Order on Pendle:

Pendle is positioned to be the main fixed-yield infra for crypto neobanks:

You can’t be bullish for perps without being bullish for Boros too:

14% profit AND you get to walk away with some points (i.e. Strata airdrops) in April too:

ATH locked supply for vePENDLE and I have a feeling this might get even higher soon…

And last but certainly not least…

Tomorrow.

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

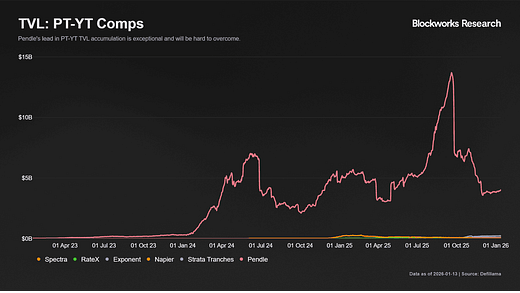

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle