Welcome to the very first issue of The Pendle Print.

Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

With that out of the way, let us begin.

Liquid Restaking Tokens (“LRT”)

Restaking (and LRTs) is poised to be one of the largest and fastest growing DeFi segments, with the LRTfi ecosystem now slowly emerging to unlock its full potential.

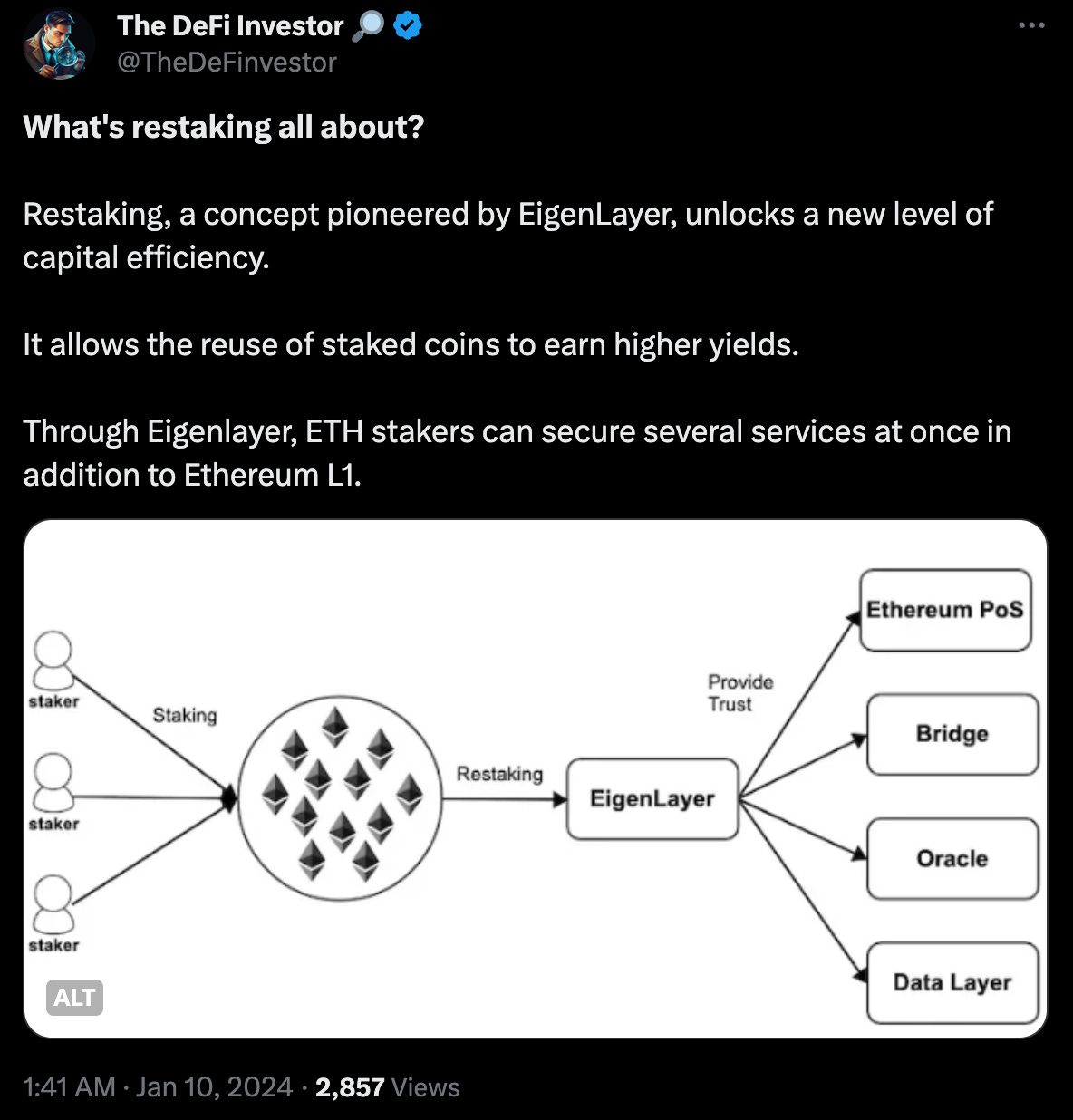

Before we dive in, here is a great overview thread on restaking and LRTs:

Restaking 101:

Restaking allows staked coins to be reused to secure multiple networks, and in return earn higher yields

ETH stakers can secure multiple networks at once in addition to the Ethereum mainnet via Eigenlayer

Liquid Restaking Tokens (“LRTs”) – similar to Liquid Staking Tokens (“LSTs”) – allow stakers to retain liquidity while earning higher yields

How big is the opportunity?

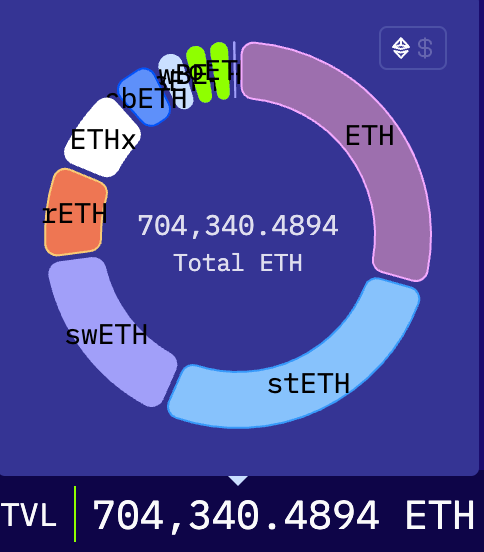

At the time of writing, Eigenlayer has over 704,340 ETH (>$1.7B) in TVL while steadily expanding its staking caps, with support for 9 different LSTs in addition to native ETH restaking.

LRTs already represent a sizable amount of TVL (especially for a product that is not yet live), but is still in early stages (>2% of all ETH staked / 10% of all LSTs).

Given the success of LSTs in 2023, and further supported by the shift in bullish sentiment towards ETH, it is our view that restaking and LRTs will be one of the biggest themes of the year.

“All aboard the Pendle LRT”

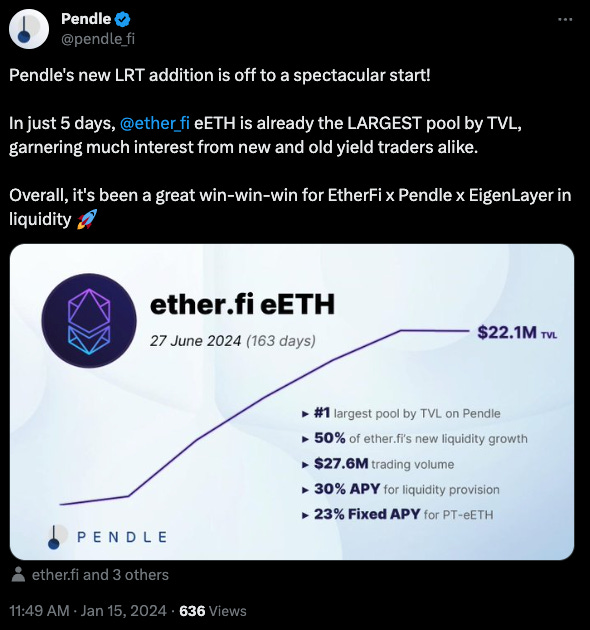

Pendle listed our first LRT pool on 10th Jan 2024 – eETH from ether.fi.

The eETH 27 Jun 2024 pool has since garnered >$45M in TVL, making it our largest pool in just over one week – overtaking both the stETH and GLP pools!

The opportunity with LRT pools on Pendle like eETH is interesting, especially given the points farming system.

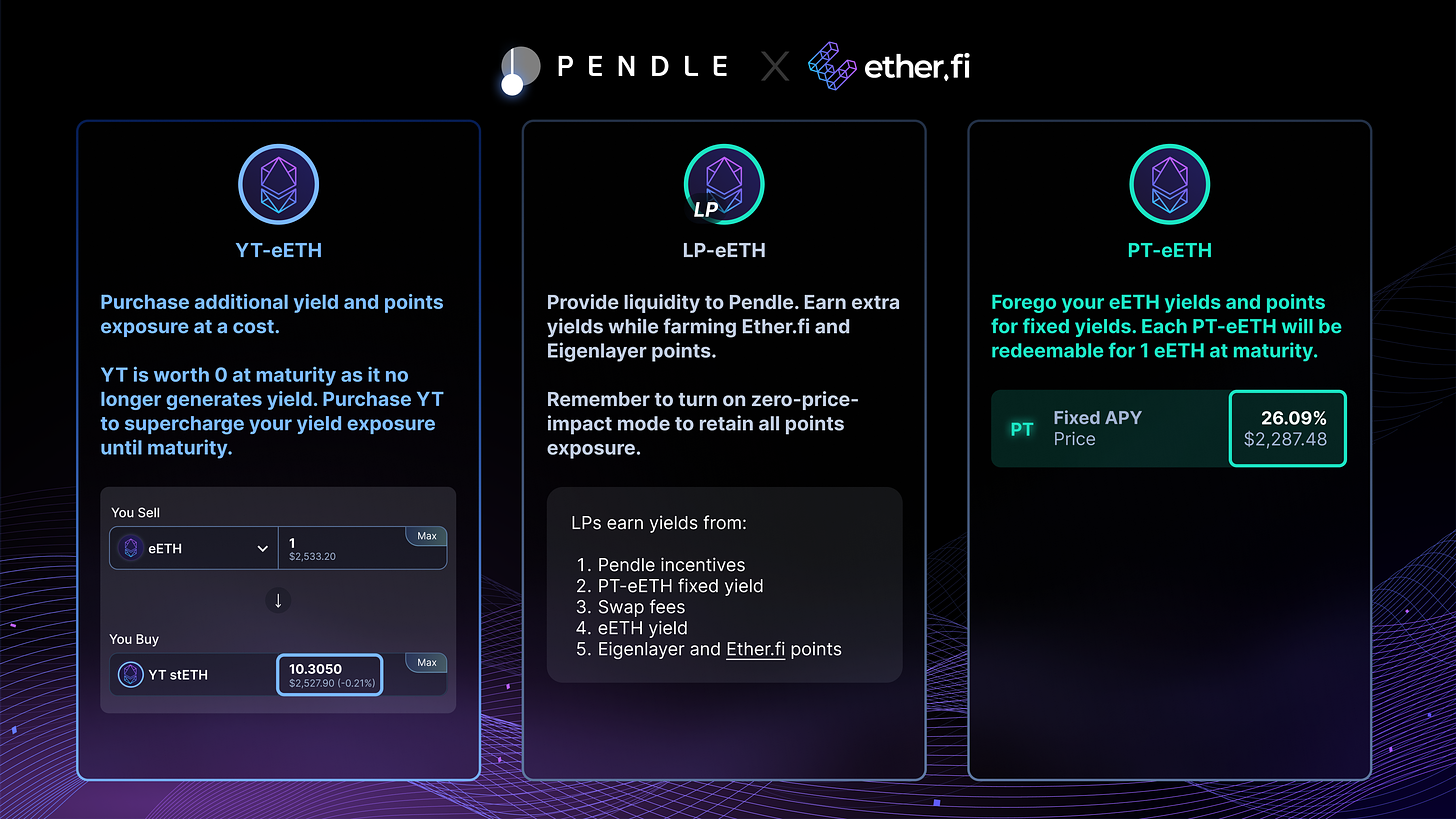

Pendle eETH Pool Mechanics

What makes this pool so interesting is the points farming aspect. Not only are participants entitled to both Ether.Fi and Eigenlayer points, but also points earned via Pendle will be doubled.

Thus, the eETH pool offers something for everyone (with different risk profiles):

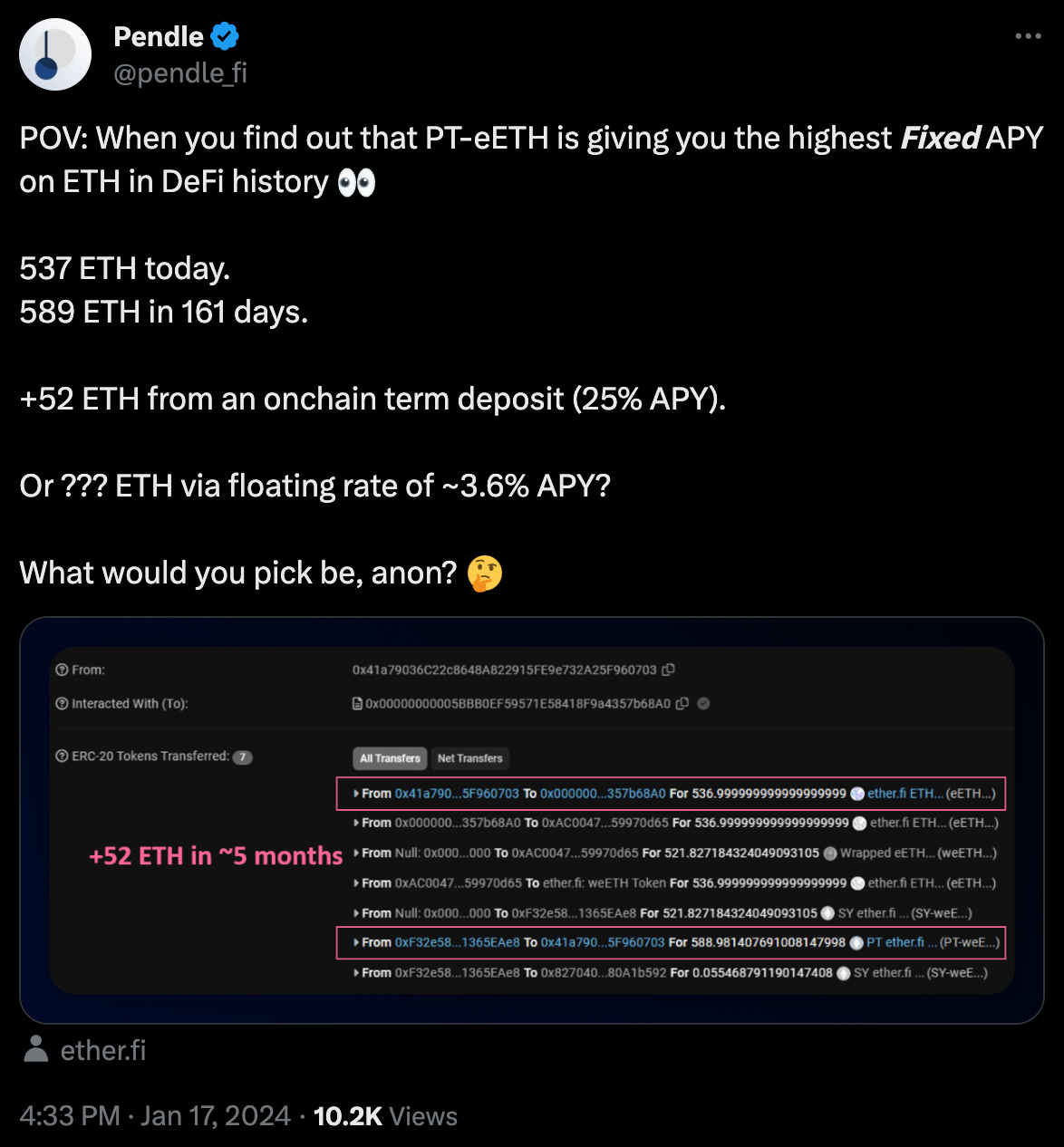

PT – fixed yield to earn more eETH (as high as 29% APY), but zero exposure to points (lowest risk)

LP – zero IL if held to maturity, single asset exposure farming strategy. eETH fixed yield + 1x points farming exposure + (balanced risk)

YT – levered points farming exposure (up to 15x), but zero exposure to eETH fixed yield (highest risk)

Our rockstar intern put out a thread explaining the pool mechanics in detail:

Another thread by Pink Brains:

Ecosystem Expansion

Our ecosystem partners are onboard the LRT train too.

Timeswap launched their PT-eETH pool, which enables borrowing WETH against PT-eETH as collateral, facilitating looping strategies with up to 166% APY.

Trade of the Week

Pendle Mentions

Shoutout to @0xomok from Nansen Research for the feature in his latest report on Restaking and LRTs.

Pendle is now live and available for Cobo’s institutional clients.

ICYMI

Pendle’s TVL > $300M

The much anticipated Limit Order feature was launched.

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest fixed yield and yield trading protocol in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure term yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

Pendleeeee