The Pendle Print #10

Are those...fixed yields?

Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

Double Zircuit LRT Pool Launch 💚

EtherFi eETH (Zircuit) | 27 June 2024 Maturity

Zircuit LRT is expanding and this week we welcomed another 2 additions to the Pendle lineup, the first one being the largest LRT in the market - EtherFi eETH.

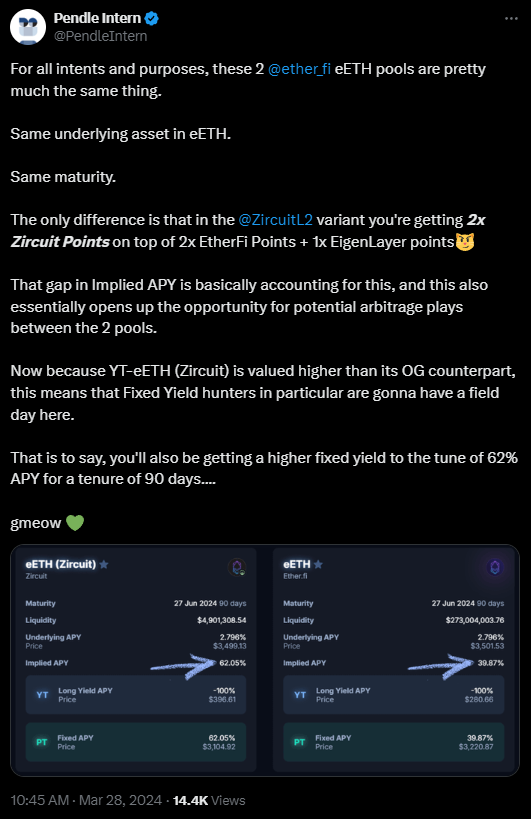

This Zircuit variant essentially offers the same yield + points as vanilla eETH, BUT with the addition of 2x Zircuit Points.

With Season 2 of ETHFI Airdrop having been confirmed to last until June 30, the maturity of this Zircuit pool aligns just nicely for those on the hunt for more points or ahem ETHFI, not to mention some good opportunities for Fixed Yield too:

KelpDAO rsETH (Zircuit) | 27 June 2024 Maturity

Similar to its eETH cousin, rsETH (Zircuit) will also be sporting 2x Zircuit Points on top of the usual yields + points offered by the base counterpart.

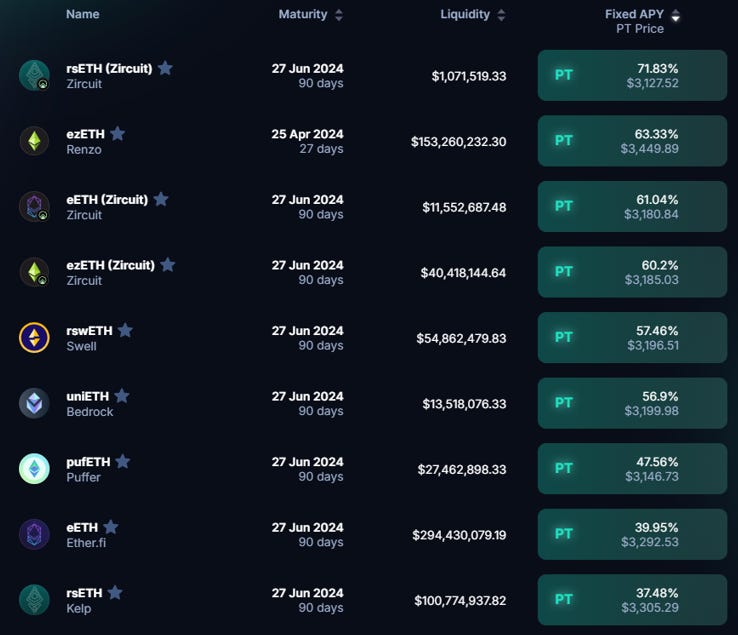

As of now, Pendle offers 3 pools for those seeking exposure to Zircuit Points:

50% 70% Fixed APY for ETH 👀

Speaking of Zircuit, check out these Fixed APYs for ETH:

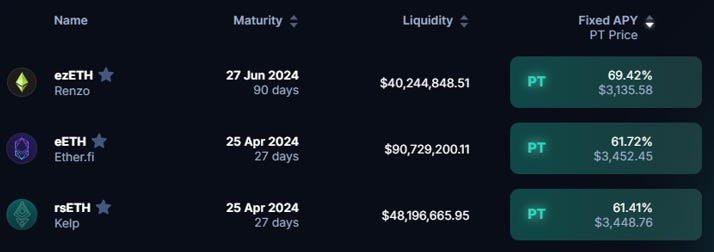

Demand for YT/points has been so rampant (especially after the success of ETHFI for Pendle users) that certain pools have been driven out of range:

But hey, good news for Fixed Yieldooors but only while stocks last 😉

Hot tip: use limit order to get around trading in out-of-range pools

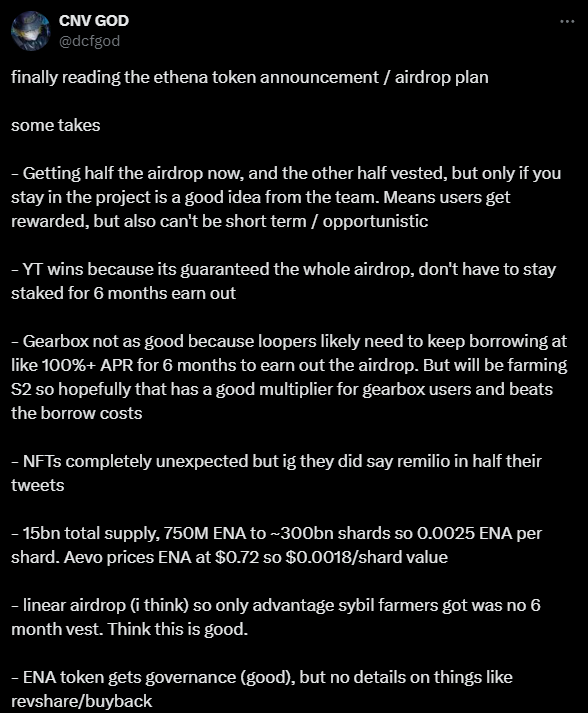

Ethena

We finally have a date for the end of Ethena’s Shard Campaign and similar to ETHFI, the conditions seem to be pretty favorable for YT holders, particularly so when you project with OTC prices on Whales Market:

With April 1st being marked as the end of Shard Campaign (and no, it’s not an early April Fool’s joke), YT-USDe holders were able to extract pretty much the full value of Shards from their YTs which are slated to on April 4th - just 3 days of overhang “waste”.

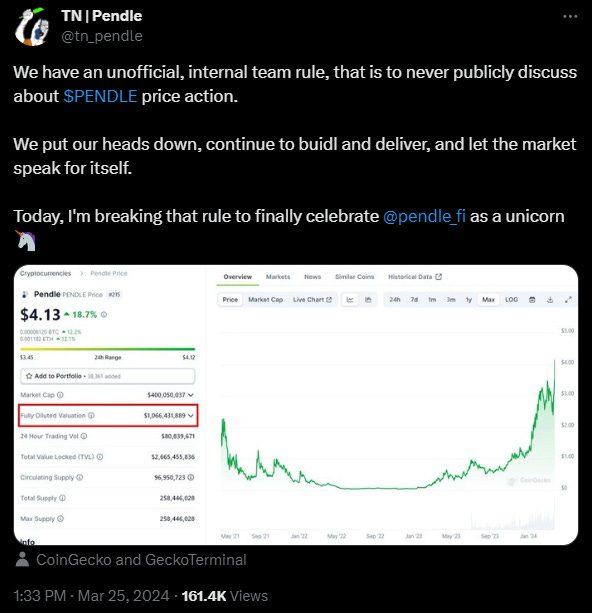

A Week of Milestones 🦄

Bit of taboo to talk about this but we’re breaking the rule just this once…

PENDLE IS NOW A UNICORN! 🥂

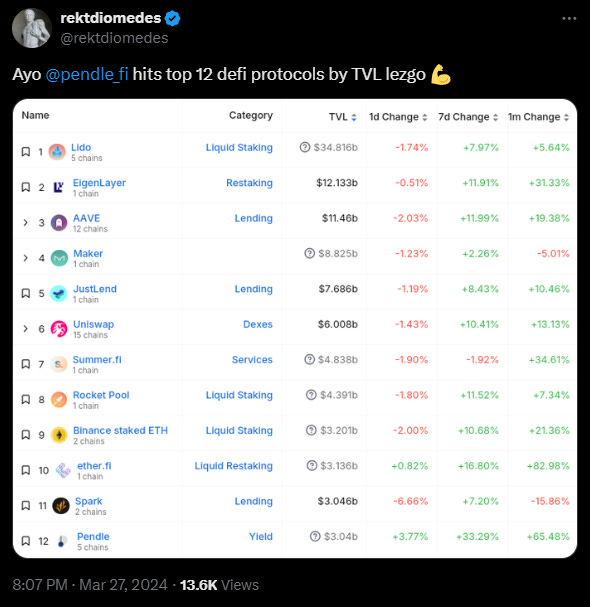

Just yesterday, we also hit $3 billion in TVL as LRT and Points Mania continue to dominate.

With this, Pendle officially becomes Top 12 (actually Top 10 now 😉) in TVL:

Trades continue to flow as Pendle also notched another all-time-high in daily trading volume.

One beautiful thing about this LRT + Points meta is how everyone wins on Pendle:

YT - the hopium in points is kept strong in YT’s hyper leveraged exposure

PT - abnormally high fixed yield (up to 65% now) for ETH, thanks to the aggressive bids for YT

LP - balanced exposure to both of the above

Which one’s the right play? That depends entirely on whom you asking:

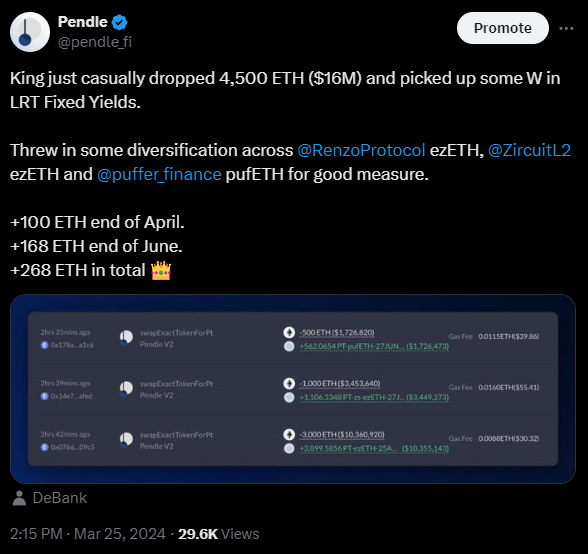

Trades of the Week 🔥

LP 1,500 uniETH ($8M) into uniETH Pool 27 Jun 2024 (Ethereum) @ >30% boosted APY

Swap 1,324 eETH ($5.3M) for 1,391 PT-eETH-27JUN2024 (Ethereum) @ 20% fixed APY

Swap 50 rsETH for 858 YT-rsETH-27JUN2024 (Ethereum) @ 17x points & yield exposure

Twitter Highlights

48% Voter’s APY for vePENDLE:

Estimating the value of YT-rswETH and $SWELL:

Pendle x StakeStone x HashKey LSTfi report:

Is YT really worth it?

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle