Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

Ethena USDe pool launches

To kickstart $ENA Season 2, Pendle launched dual USDe pools on Mantle & Ethereum this week:

At point of writing, the $200M (Mantle) and $400M (Ethereum) pool caps are still up for grabs – but very quickly filling up!

As a quick recap, YT holders would be have a levered exposure to Ethena Sats (Season 2 points) AND EigenLayer points (only for Mantle pool), whereas PT holders would forego the points and secure high fixed USDe yields.

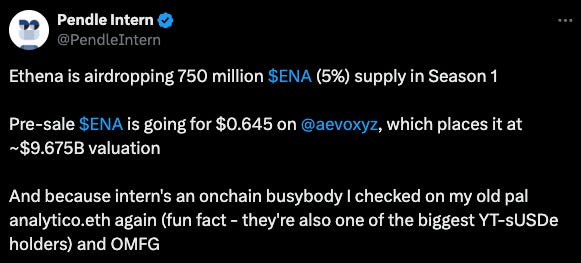

$ENA Season 1 Case Studies

One of the largest YT holders: analytico.eth

Biggest YT-USDe winner: 0x7121c

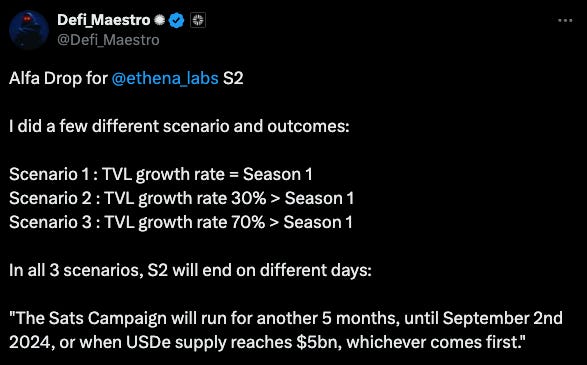

$ENA Season 2 Strategies on CT

To YT…

… or to PT?

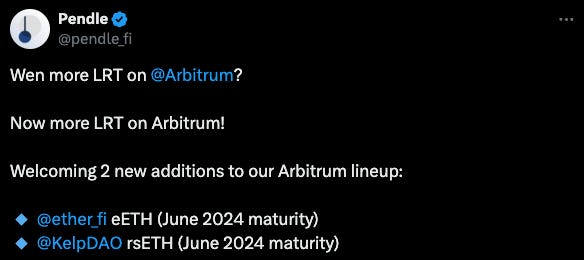

ETH LRT Pools

Double pool launches this week: rsETH Pool 27 Jun 2024 & eETH Pool 27 Jun 2024 on Arbitrum (to facilitate rollovers from the maturing 25 Apr 2024 pools):

Implied fixed yields on Pendle LRT pools are ranging as high as >60% APY (while stocks last).

Trades of the Week 🔥

Swap 2,600 eETH for 2,811.46 PT-eETH-27JUN2024 (Ethereum) @ 38% fixed APY – tx

Swap 1,799,655 USDT for 2,074,795 PT-USDe-25JUL2024 (Ethereum) @ 50% fixed APY – tx

Swap 382,294 USDe for 2,500,114 YT-USDe-25JUL2024 (Ethereum) @ 6.5x Sats exposure – tx

Twitter Highlights

Pendle hit three major milestones this week:

Twitter Spaces with Arthur Hayes, Ethena and Pendle:

Humbled 🙏, but job’s not done!

Pendle LRT dominance:

Pendle chain dominance: #1 by TVL on both Mantle (>60%) and Arbitrum (23%).

New DeFi integration: PT assets included in Index Coop’s hyETH index:

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.