The Pendle Print #14

REZ easy

Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Markets on Pendle

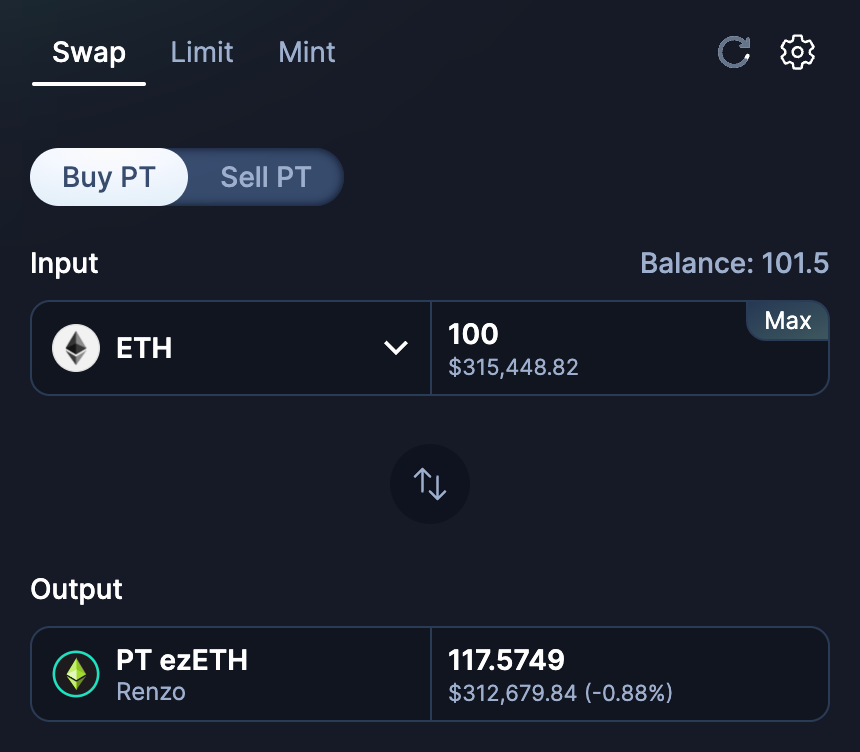

Kickstarted the week with some Renzo ezETH markets - a long-dated pool on Ethereum, and our first ever LRT venture on BNB Chain, right in time before the big 25 Apr maturity:

Ethena x Pendle also continued the weekly launch streak with sUSDe this week, which comes packing with some sweet Sats multiplier:

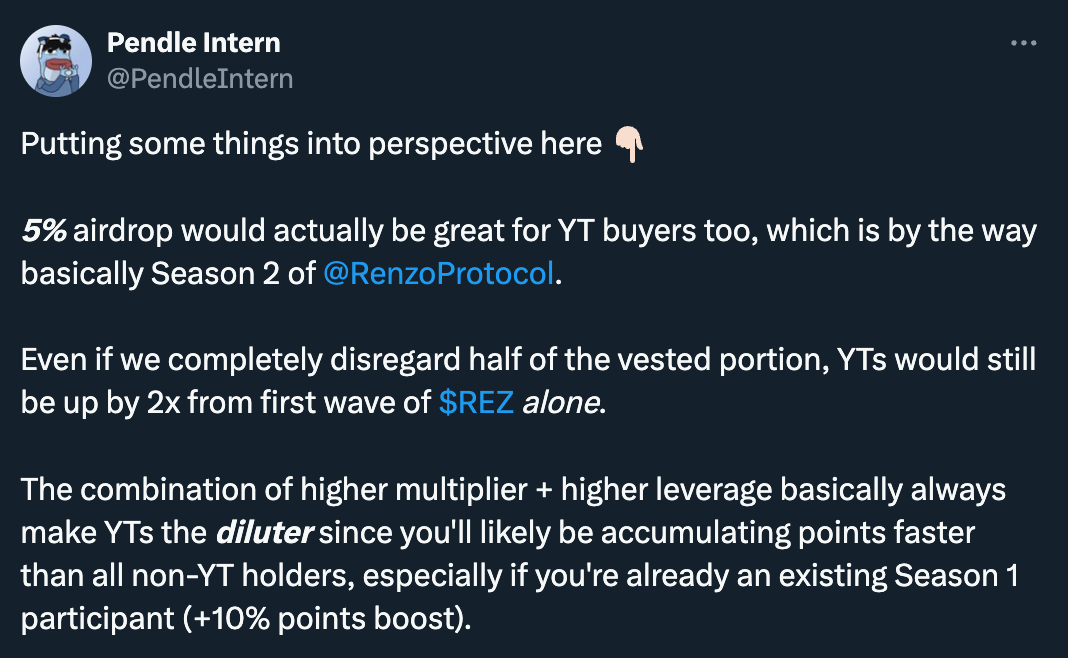

Surprisingly, the market failed to take notice of the mispricing that followed, but fortunately our Intern was kind enough to point this out:

⬆ Trade Opportunities on Pendle

With 5 pools having matured on 25 April, much money is on the hunt for opportunities to keep the yield ball rolling.

With Season 1/Season 2 of LRTs + EigenLayer points + future AVS rewards/airdrops still in play, the June/December LRT pools offer the chance may just be the answer here…

Now that the mystique of REZ and ETHFI have been lifted, all eyes turn to the next Binance LRT project - Puffer pufETH.

In fact, pufETH has been one of the most heavily traded pools on Pendle this week - something which LPs (and even PTs) can take advantage of…

Recent round of matured pools have also shown that the prowess of PT Fixed Yield:

Readers planning to emulate can perhaps consider long-dated options such as ezETH (Dec 2024) and eETH (Dec 2024), which are offering up to ~17% in absolute returns for fixed yield 👀

Big Movers of the Week 🔥

Swap 7,474 ETH for 7,951 PT-ezETH (25 Apr) - Link

LP 2,356 rsETH into rsETH (27 Jun) pool - Link

Swap 2,000 WETH for 2,130 Zircuit PT-ezETH (27 Jun) - Link

Swap 1,983 ez-ETH for 2,002 PT-ezETH (25 Apr) - Link

Swap ~3,004 ETH for 3,148 PT-eETH (27 Jun) - Link

Pendle Integrations

The trend of points + fixed yield for Pendle PT continues with 0xOlive…

…and Airpuff too:

Our old friend Dolomite continues to deliver as an avenue for recursive-fixed-yield-looping strategies:

While Hinkal makes privacy possible for PT and YT:

Intern Insights

A tale of two eETH:

Big Season 1 wins for YT-ezETH, including last minute doomsday buyers too:

And perhaps even for Season 2 too?

Twitter Highlights

Pendle reaches $5B in TVL!

(Guess what show TN has been watching)

And $15B in trading volume!

Deepdiving the mechanics of YT, and how can take advantage of it:

Alpha-filled podcast with DefiDad:

What could this mean?

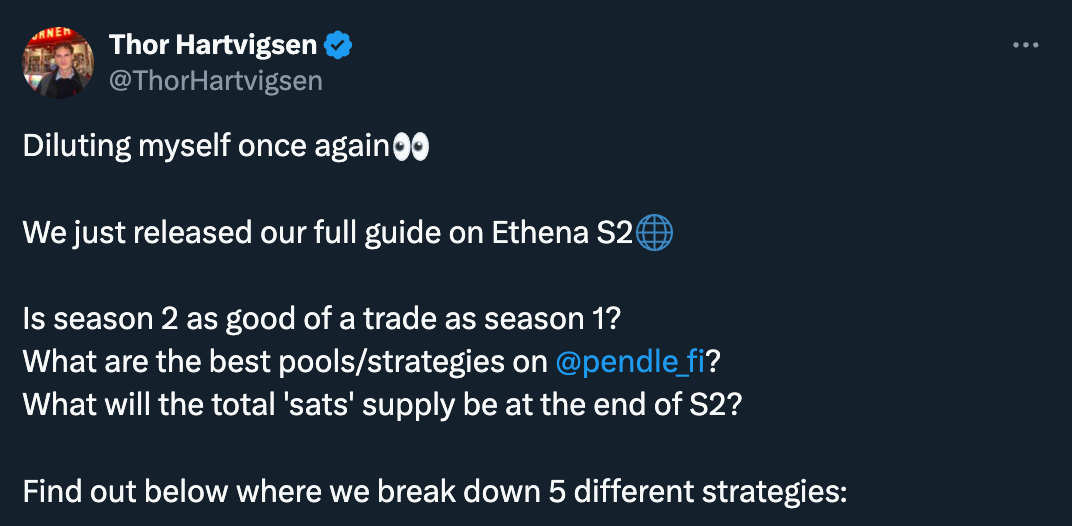

Ethena S2 outlook:

More Ethena x Pendle strategies:

Insight into Pendle market behaviour:

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

Pendle