Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Markets on Pendle

Thanks to the high fixed yield opportunities offered by Pendle LRTs, PT looping has been one of the most popular strategies, driving up the demand for ETH liquidity.

Buy PT on Pendle > Deposit PT on Silo > Borrow ETH from Silo > Rinse & Repeat

With these new pools, you’ll now get to roleplay as a highly-sought-after ETH lender, earning some juicy APYs (and even LRT points 👀) for your trouble:

Couple this with fixed rate borrowing on Silo and users could start getting really creative with both sides of the trade:

⬆ Trade Opportunities on Pendle

Most eyes are on the June-July maturity pools these days but the long-dated EtherFi (26 Dec 2024) pools has quietly become one of the best places to LP:

For fixed yield lovers, sUSDe (25 July 2024) is also offering ~7.2% in absolute, fixed returns with a ~2.5 months term:

As for the 1 ETH = 1 ETH crowd, raw APY numbers may no longer be what it was, but at 18-20% fixed APY, the long-dated LRT pools are still some of the most reliable places to grow your ETH stack across DeFi.

ezETH (Dec 2024) for instance is offering ~13.7% in absolute return for a decent size:

While not exactly a trade per se, it might interest some of you to know that there’s a more than decent way to earn ETH as a vePENDLE voter, with some users earning over 100 ETH and 300% APY:

Note on Pendle RouterV4 🖥️

We deployed our RouterV4 yesterday at 0x888888888889758F76e7103c6CbF23ABbF58F946.

This router is fully backward compatible with RouterV3, meaning only a change in address is needed for migration. The purpose of this Router is to:

Enhance the reliability of limit order matching in high-traffic environments

Lay the groundwork for upcoming features like Auto Roll-over for mature markets, smart exit all (automatically pairing YT with PT for lower price impact), and more

Enable us to optimize the router without requiring you to change the address or interface in the future

Router V2 & V3 will continue functioning normally, but upgrading to V4 is recommended to enjoy the latest optimisations!

Please do reach out and let us know if you have any questions.

Big Movers of the Week 🔥

Swap 571,173 USDe for 612,585 PT-USDe (25 Jul) on Mantle - Link

Swap 1,957,082 USDe for 2,103,377 PT-USDe (25 Jul) on Mantle - Link

Swap 784,893 USDe for 849,196 PT-USDe (25 Jul) on Mantle - Link

Provide ~206 ETH of liquidity to wBETH (26 Dec) on BNB Chain - Link

Pendle Integrations

Unlock USDA liquidity all while retaining your fixed yield exposure from PT-weETH with Angle:

Swell L2 expands support for the long-dated Pendle LRTs:

Intern Insights

Now that the EIGEN cat is out of the bag, what’s next for Pendle?

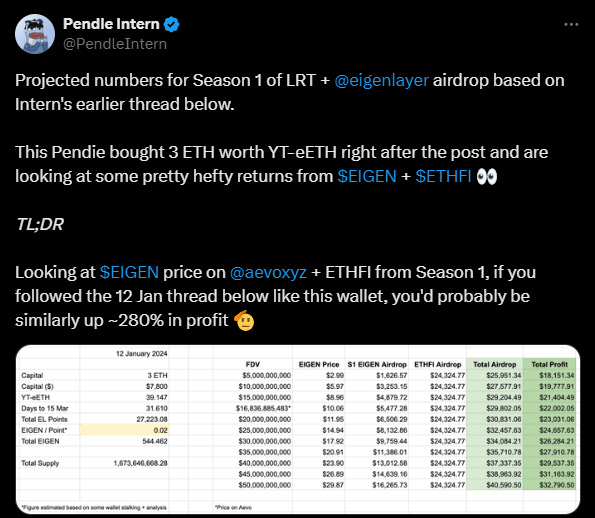

Thus far, YTs have been a profitable venture for airdrop hunters:

And now that YTs are not as crowded a play (with Implied APY dipping across), subsequent Seasons and long-dated YTs may just surprise you:

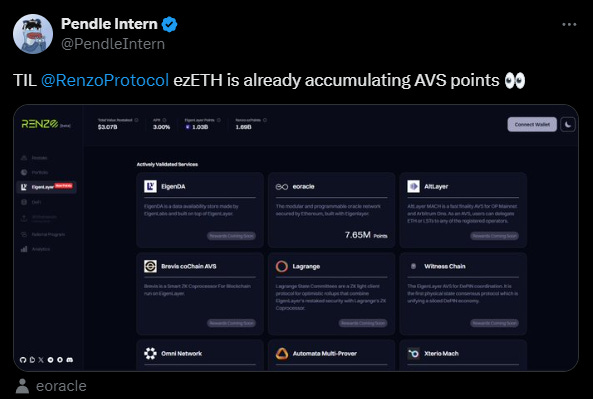

The long-dated YT-ezETH for instance offers a very efficient way to rack up points in the long-run:

In fact, unbeknownst to many, the Eigen Infinite Sum gears are already spinning, and YTs may just print more than you think…

In other words, there are better things to do than just leaving your ETH naked:

Last but not least, fun fact from our resident intern - Pendle has apparently been a key liquidity driver for many LRTs:

Twitter Highlights

Sentiment analytics regarding Pendle:

Some moonsheets for the Ethena and ENA fans:

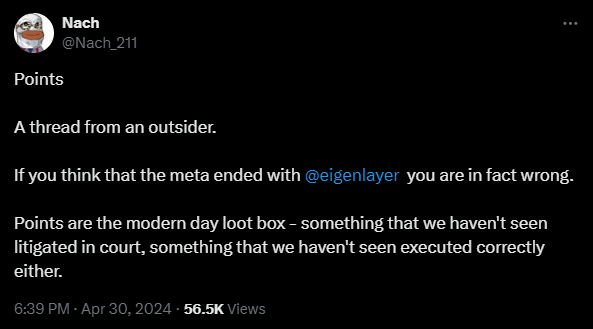

Pendle beyond the Eigen + Points meta:

Decent haul for vePENDLE holders in the month of April 👀:

Exhibit A:

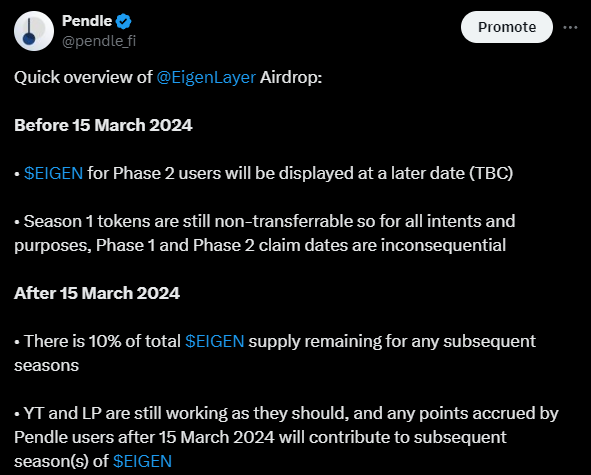

Further clarifications on EIGEN airdrop:

Points points points with PT on Olive:

That’s it for this issue.

Attention and capital are scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle