Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

⬆ Trade Opportunities on Pendle

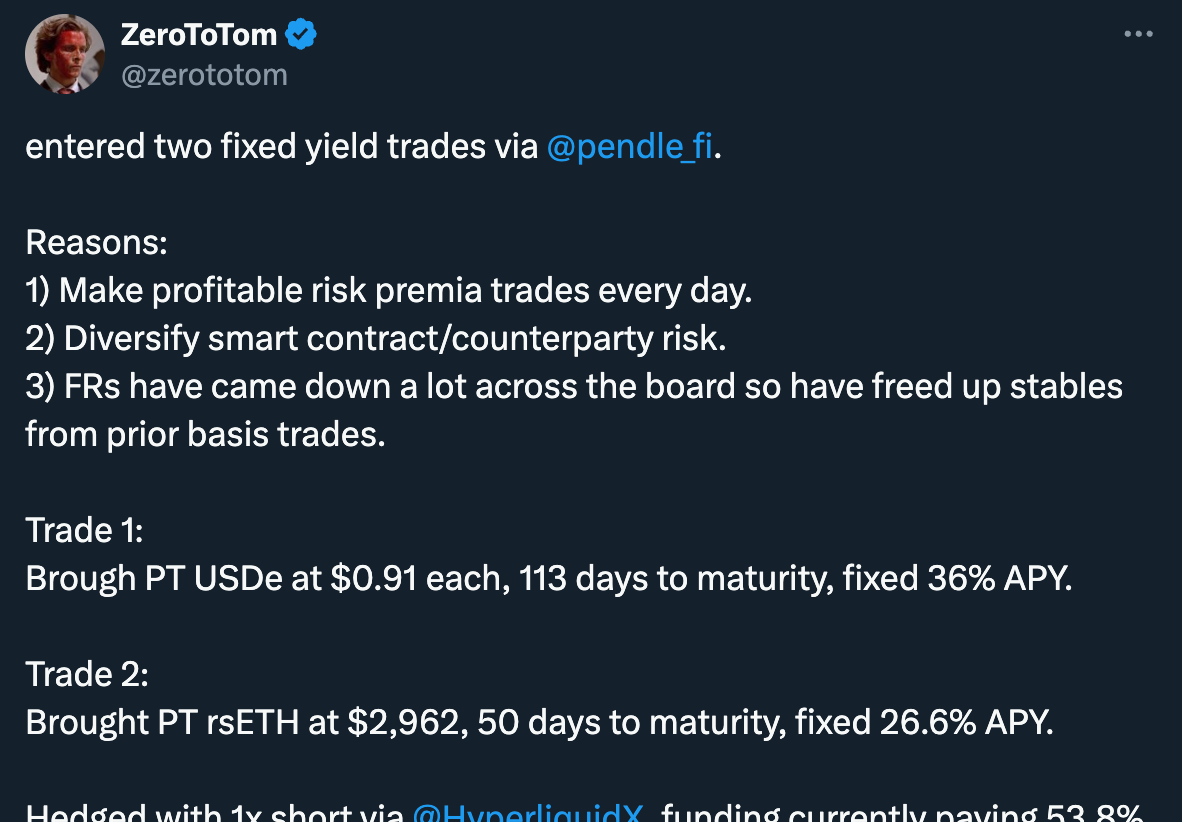

PTs are the new belle of the ball as users flock to the comfort of fixed yield in this choppy market.

Just to give you an idea, a 100 ETH buy for PT-eETH (Dec 2024) at the time of writing will yield ~8.8% in absolute profit in 229 days.

Particularly for whales blessed with an arsenal of ETH (or even stables), PT offers an attractive, predictable way to balance their portfolio + grow their stacks:

Remember, PTs (or any other positions on Pendle for that matter) are never locked. When demand for PT rises, and/or when ETH price appreciates, holders can still sell PT-eETH for instance anytime before maturity (just like spot ETH) for upfront profit:

Ethena assets have also been picking up in steam thanks to Bybit’s integration, a herald perhaps for more institutional adoption of USDe?

For those looking for more exposure to Ethena, Pendle yields are one of the highest across DeFi now:

And if you’re looking to build your ENA stack, both YT and PT actually allow you to do so:

Overall, we’re seeing more flows going into the Ethena markets, and just like LRT pools, whales are choosing to hunker down in PTs:

Pendle Integrations

Speaking of USDe, here’s a new way to juice up your PT-USDe yields:

Meanwhile, another long-time friend has also been giving some love to $PENDLE:

And for those wishing you could just auto-roll your matured PTs, you might want to pay attention to this:

Intern Insights

Since the post below, the influx of PT buys have pushed down ENA’s Implied APY to ~68%. Still decent as a fixed yield entry for Pendies on the hunt for an easy way to accumulate more ENA, but the low price of YTs in particular make this even more attractive.

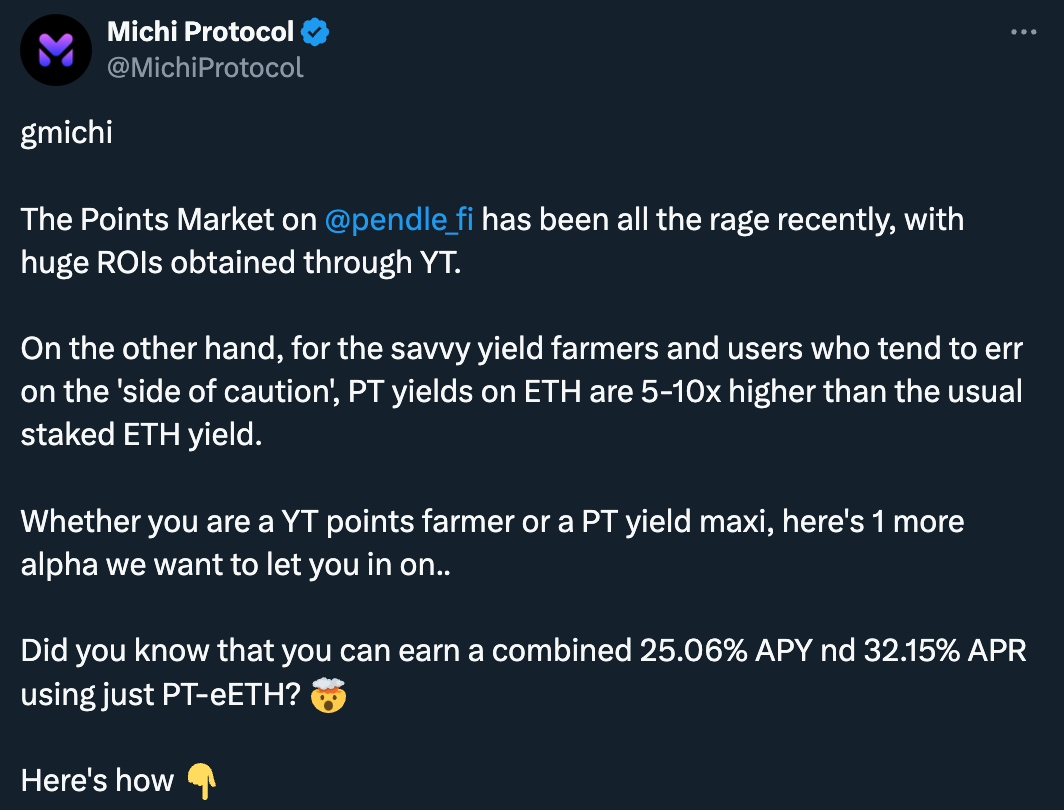

Wondering what else you could do to juice up your PTs? Our Intern’s got you covered:

Side note - what is up with stTAO Implied APY 🤔

Twitter Highlights

The Pendle-verse at a glance:

Pendle - The Golden DeFi Protocol of 2024:

A rising star in Silo Finance:

Go $NUTS with PT-USDe:

More PT strategies by Michi:

Min-maxxing the new Silo sETH-PT-eETH pool:

Last but certainly not least, the Eigen-verse is growing. Which means more restaking, more yield…more airdrops? 👀

That’s it for this issue.

Attention and capital are scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

Hi, I live in the US and would like to participate but when I go to Pendle’s website, it won’t even let me in because my location is recognized. Is there any way for US citizens to participate?

Pendle