The Pendle Print #17

Yield Galore

Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

💧 New Pools on Pendle

It was an LRT galore this week 🚂

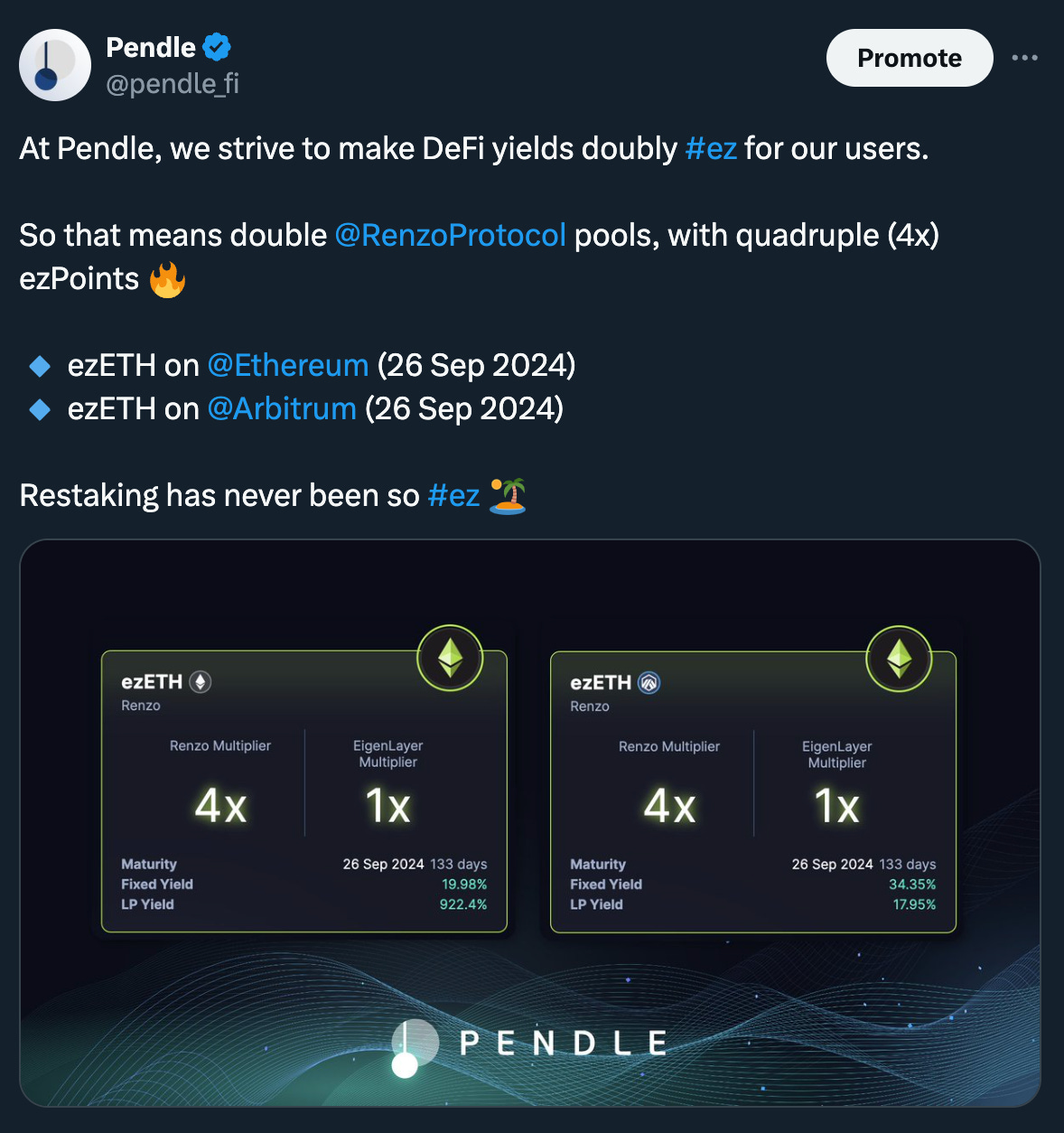

We kickstarted with a double launch for Renzo ezETH:

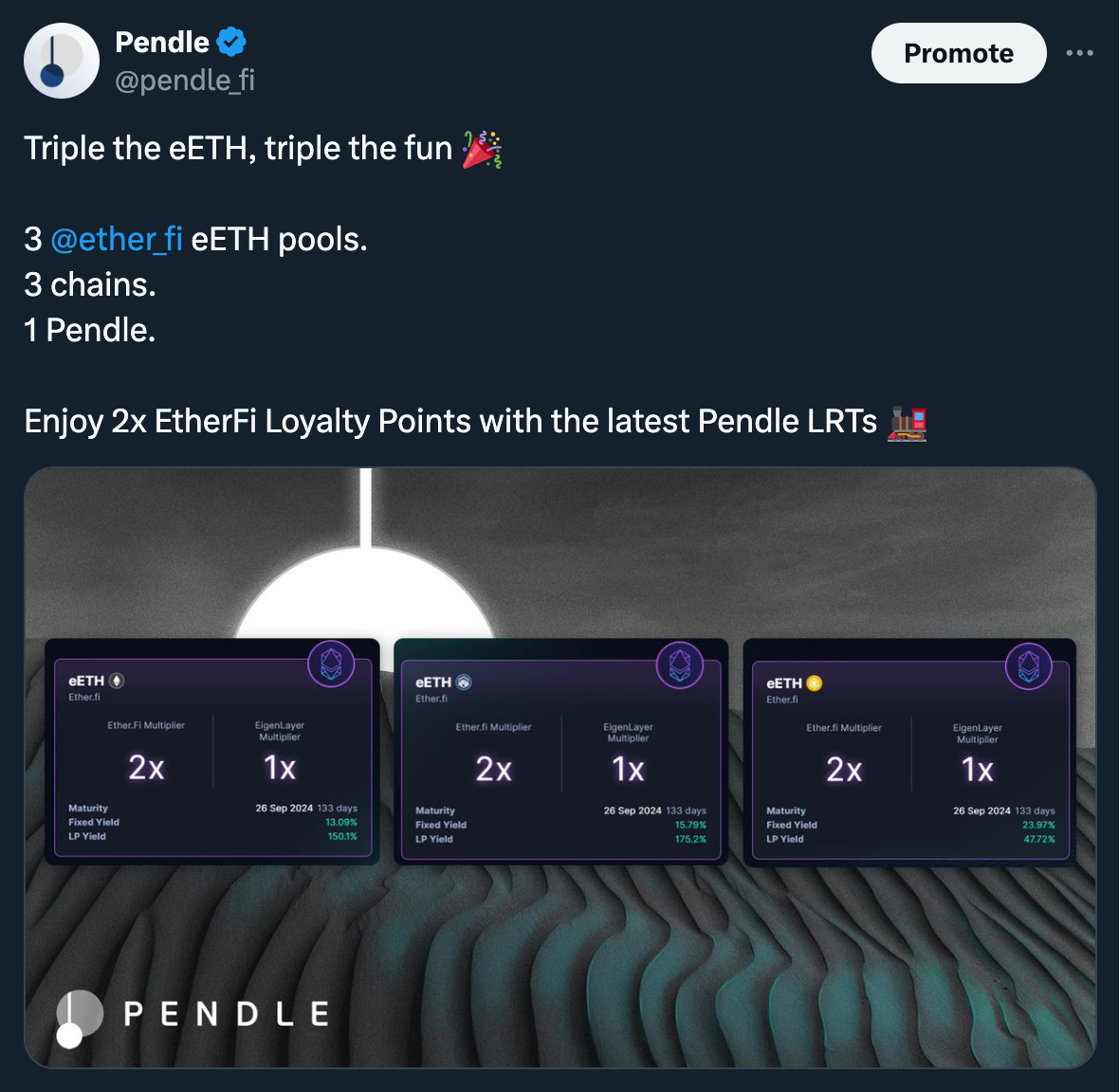

Followed by a triple launch for EtherFi eETH:

With all these Sep 2024 maturity pools, Pendies will have the chance to diversify your LRT exposure across more options.

Together with the June 2024 + December 2024 maturity pools, these essentially offer a cascading 3-month ETH term deposit for you to rollover your Fixed Yield/LP strategies when the time comes…or even ahead of time 😉

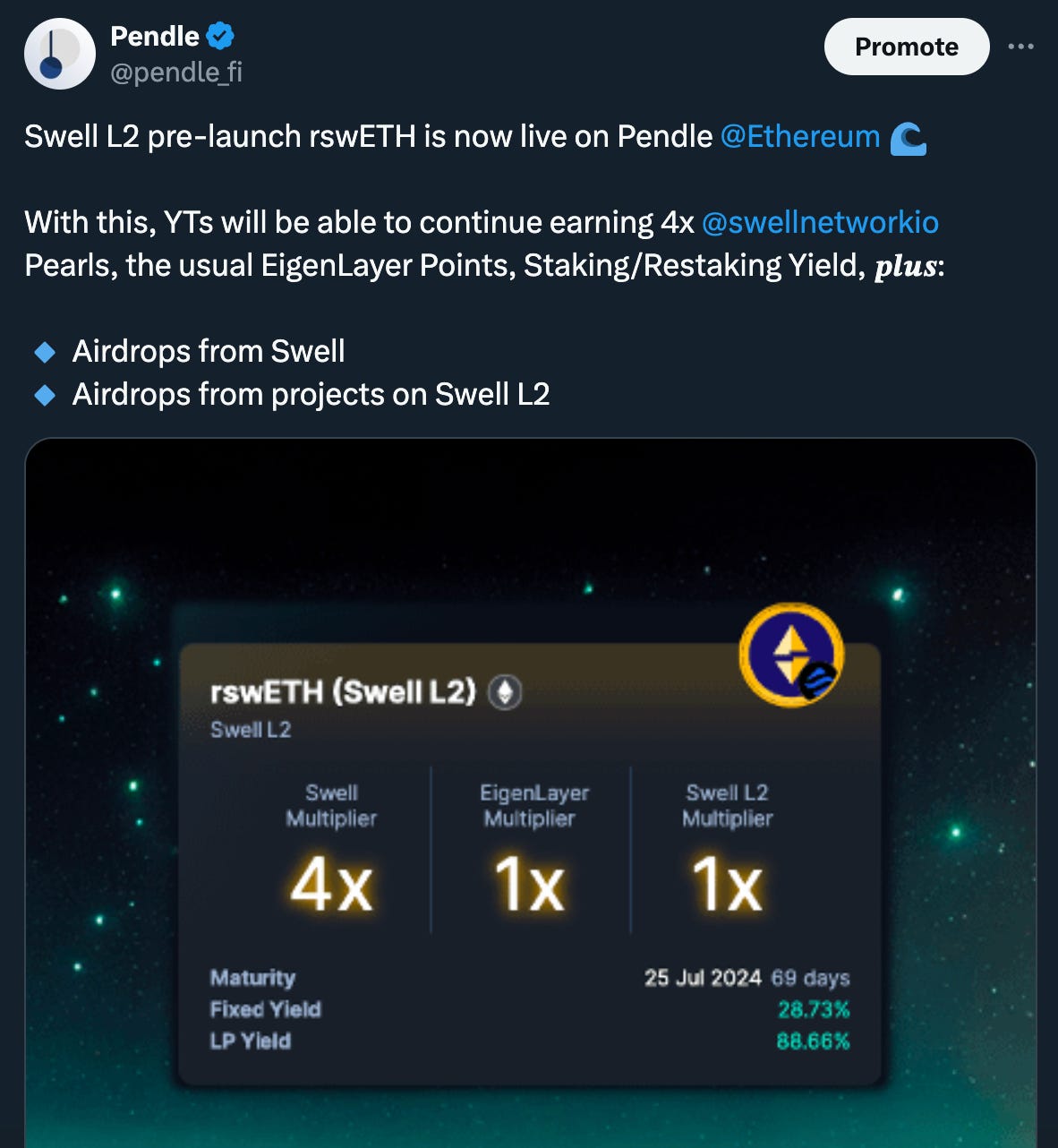

Meanwhile, rswETH (Swell L2) has also launched.

This version of rswETH is deposited in the pre-launch campaign of Swell L2 network, which gives you extra exposure to airdrops:

⬆ Trade Opportunities on Pendle

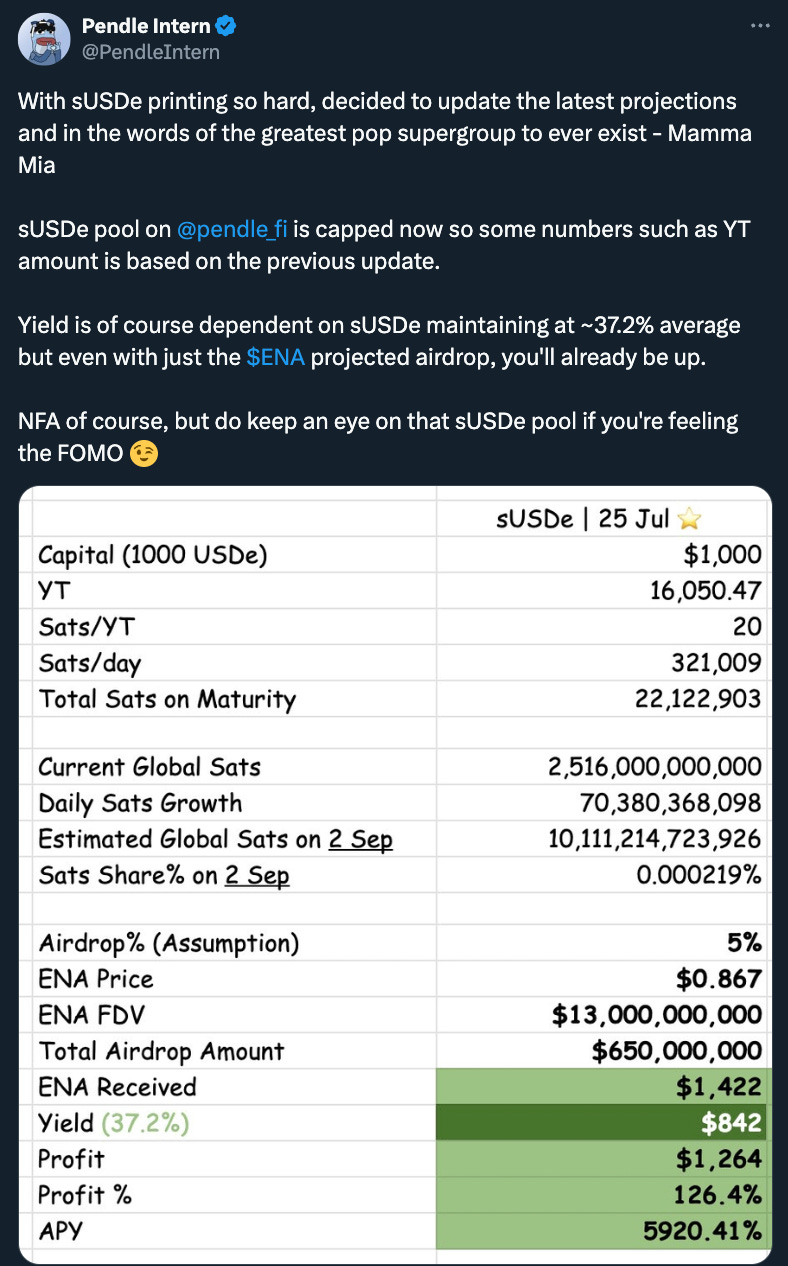

With the recent news of sUSDe yield having increased to 37.2% APY, Pendies flocked to YT-sUSDe in droves, driving up the Implied APY.

The 150M cap for the sUSDe pool on Pendle has been reached, so be sure to keep an eye out for future cap increases if you’re eyeing a piece of the action!

If you need more reasons, recent projections by our resident Intern have also shone a favourable light on YT-sUSDe:

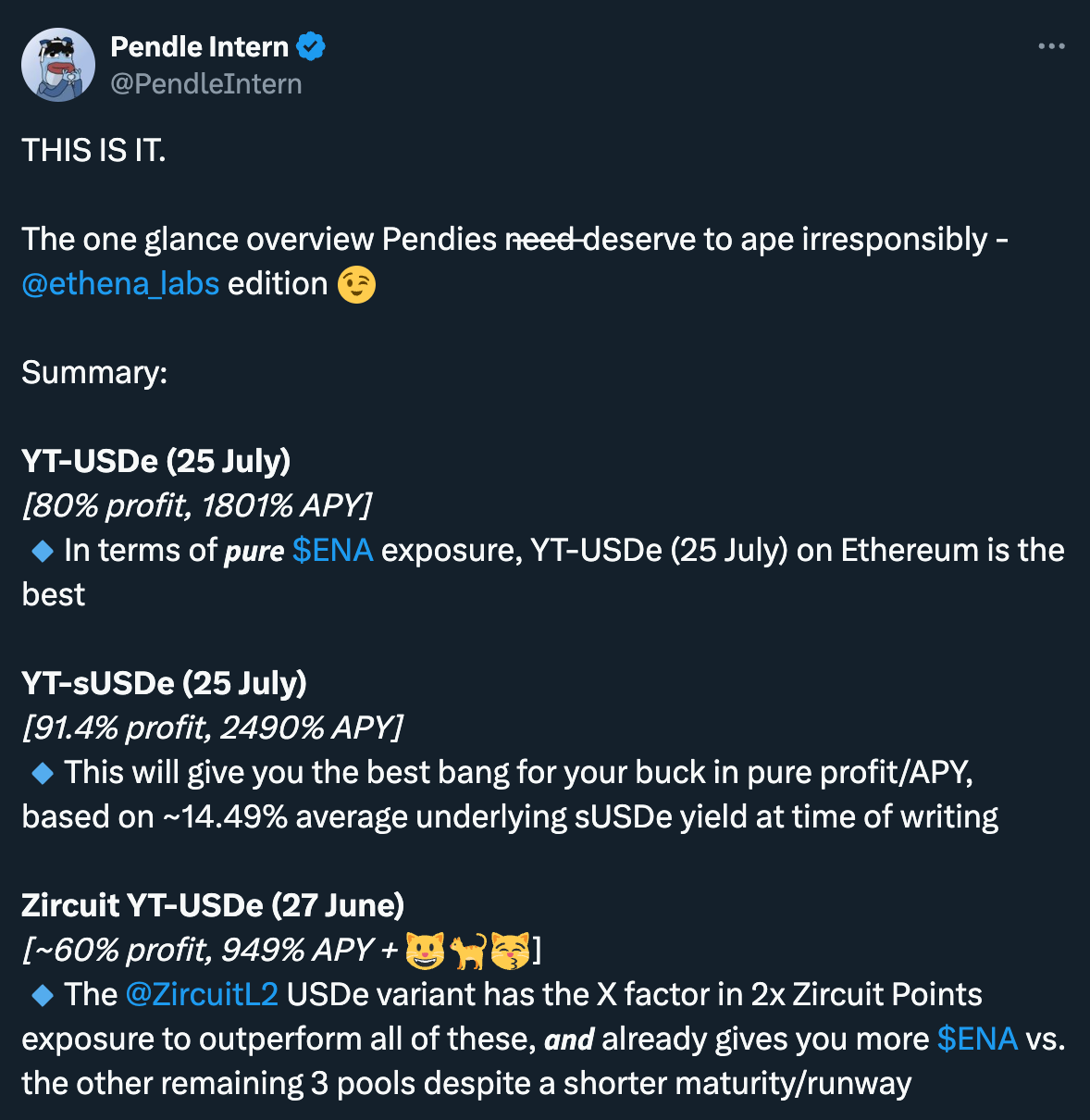

In fact, Ethena pools in general have garnered much attention from YT speculators, with good reasons:

Don’t have the appetite to stomach YT? The good news is there are other great ways to get point exposure too, all while retaining your full capital:

Even when you disregard the value of points (which are not factored in the APYs), Pendle LPs are providing decent returns at time of writing:

Pendle Integrations

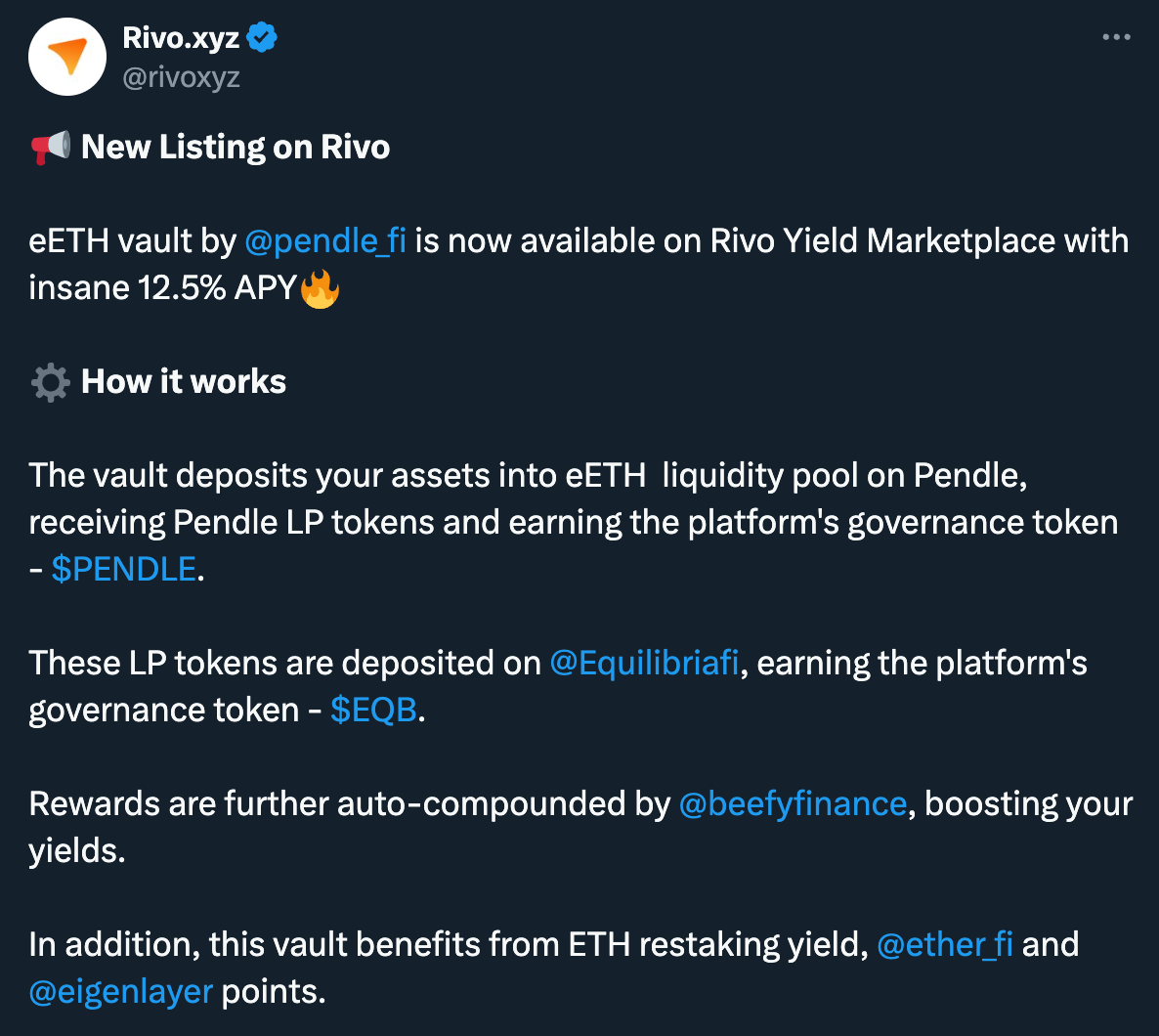

Auto-compound your boosted Pendle LP positions with Rivo’s eETH vault:

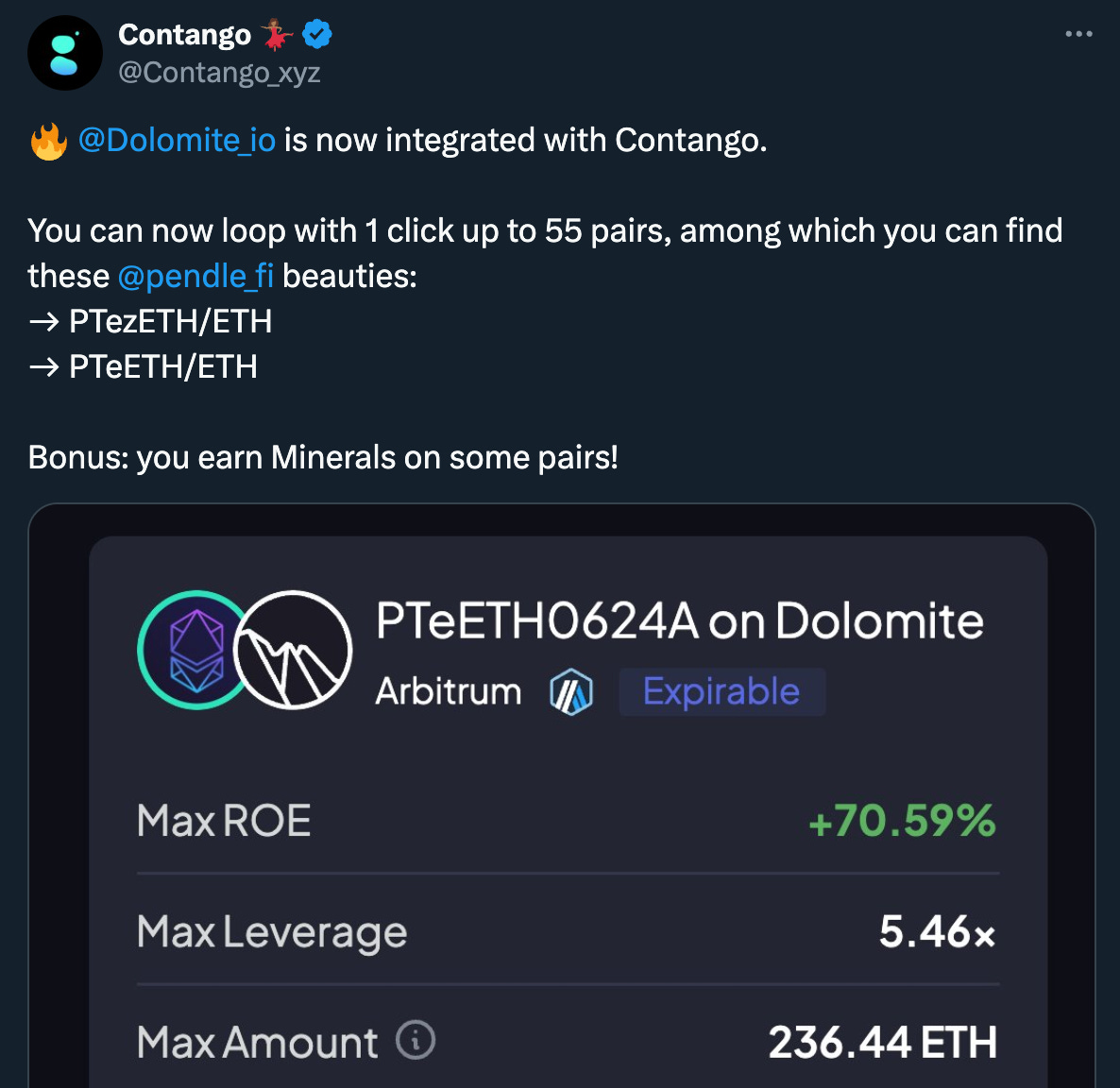

Contango and Dolomite link up for this 1-2 combo of Pendle PTs:

The Silo sETH pools get some bullish love from Beefy:

And if you’re looking for an angle on PT-USDe…

Intern Insights

All things in balance now for the circulating supply of PENDLE:

Who says PT holders have to resign to a life of no points (and no airdrops)?

More Thetanuts guides/strategies with PT-USDe:

Whale Trades of the Week 🐳

Swapped $5M USDT for 5.27M PT-sUSDe at 29.9% Fixed APY | Link

Swapped 1,100 weETH for 1,167 PT-weETH (Jun 2024) at 21.1% Fixed APY | Link

Swapped 5,865 eETH for 5,980 PT-weETH (Jun 2024) at 20.5-23.9% Fixed APY | Link

Swapped 2.375M USDe for 2.522M PT-sUSDe at 34.8% Fixed APY | Link

Swapped 743 ezETH for 765 PT-ezETH (Zircuit) at 17.7% Fixed APY | Link

Twitter Highlights

Too lazy to read and learn about Pendle? We gotchu:

Some crypto job opportunities out there:

Pendle Intern’s Notes - All you need to know about Pendle right at your fingertips:

In-depth analysis of the “new star in DeFi”:

More research piece(s) on Pendle:

Investment thesis on PENDLE:

Last but certainly not least, a quick ELI5 of Pendle PT:

That’s it for this issue.

Attention and capital are scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.