Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

💧 New Pools on Pendle

Salam 🍊

New restaking arc arrived on the Pendle shores this week with Karak assets, another ETH restaking infrastructure protocol (i.e. EigenLayer’s competitor) that has received much fanfare thanks to their eye-popping Series A lineup.

Some Pendle x Karak pools this week to kickstart this new dawn:

Ethena USDe (Karak)

EtherFi eETH (Karak)

Ethena sUSDe (Karak)

Consider that last one a special Pendle Print early preview 😉

Trade Highlights

New pools and new assets especially those heavy in points often bring much uncertainty.

“Are the points/airdrops worth burning my capital for YT?”

“What if the airdrops end up more than what I get from PT?”

Often times, PT Fixed Yield is the “safest” play but considering the loss of upside, LP is even “safer” since it offers a balanced exposure in both yield + points.

In most cases, LPs are simply just the same underlying asset/pool, but with more yield, and perhaps even more points on top.

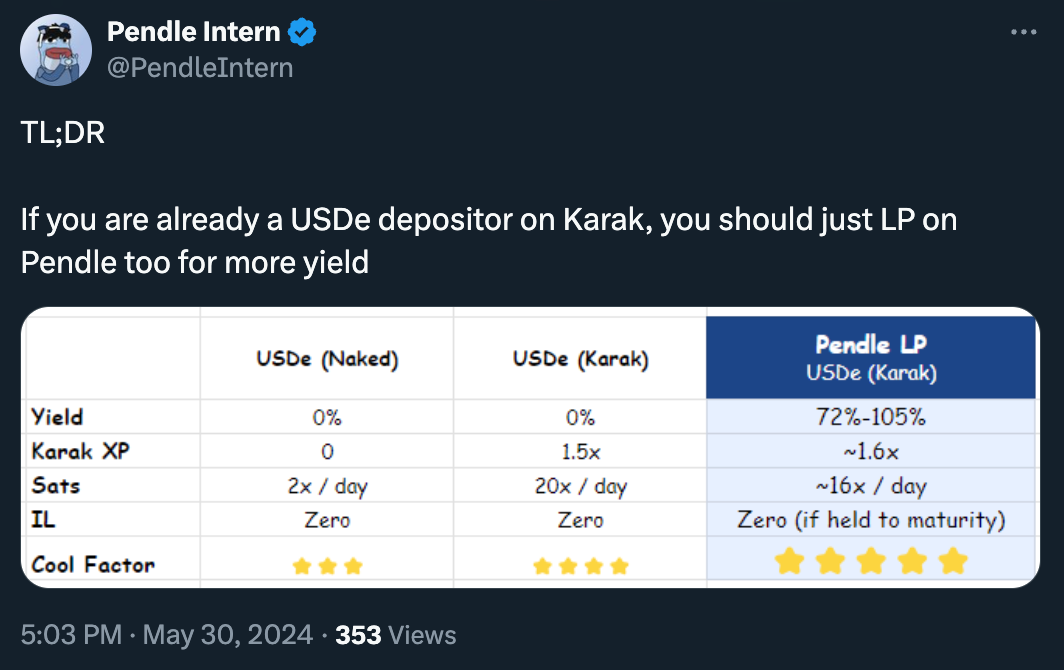

Consider the new USDe (Karak) pool:

LP APY (at time of writing) for reference:

Remember, Pendle LPs will have zero IL as long as the position is held to maturity.

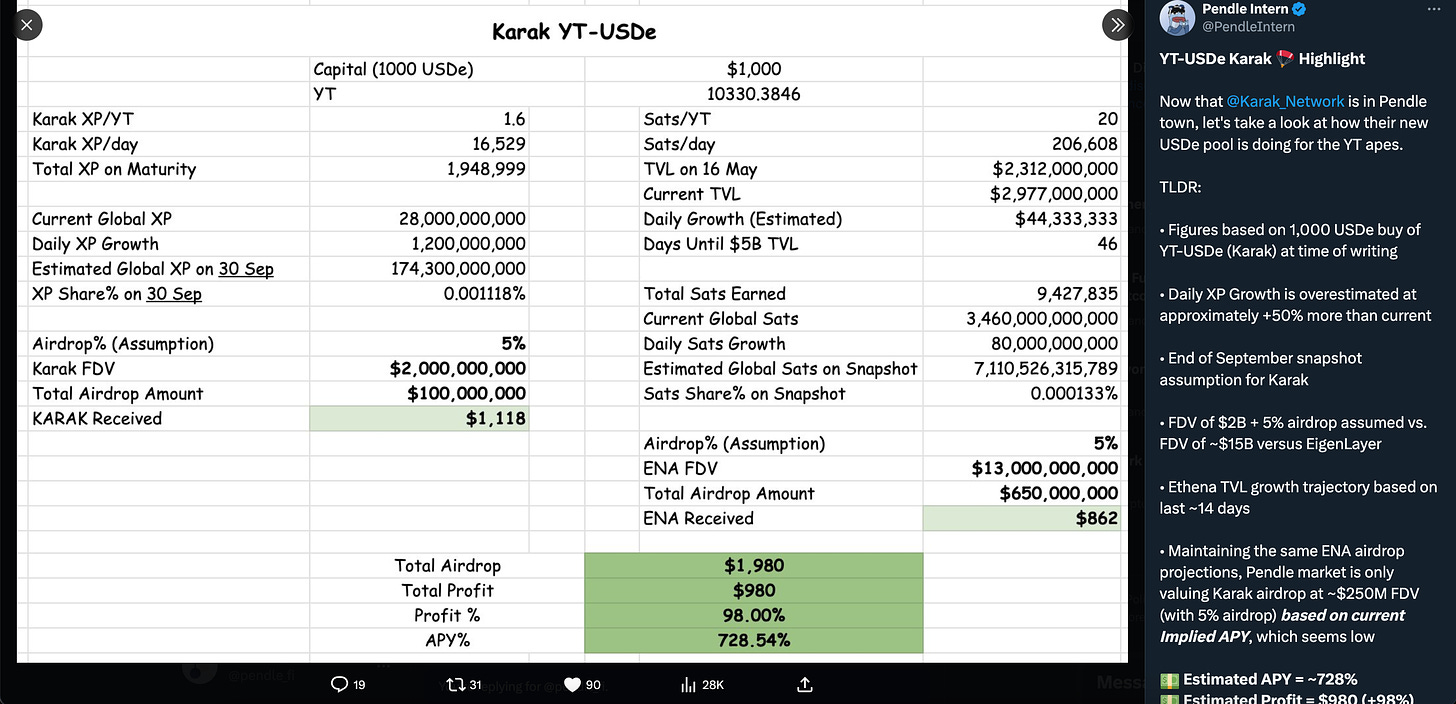

And if you’re more of a YT points ape, our intern has some good news for you too:

TL;DR

You never know where the pendulum might swing for these things and LP could be your best bet to play both sides. YTs are looking good based on current projections and PTs should also be pretty happy with their higher fixed APY.

Whale Trades of the Week 🐳

EtherFi eETH and sUSDe remain the most popular choices, including some very familiar faces addresses resuming their PT buying sprees.

Again, these “close-to-maturity, short-term fixed deposits for ETH” have proven to be an effective way for whales to ape and grow with size:

Provide ~$15.3M worth of ETH liquidity to eETH (26 Sep) | Link

Provide ~$15.3M ETH liquidity to eETH (26 Dec) | Link

Swap 10.5M USDe for 11.6M PT-sUSDe (26 Sep) | Link

Swap 2,675 eETH for 2,720 PT-eETH (27 Jun) | Link

Swap ~$21.4M worth of ETH for 4,068 PT-eETH (27 Jun) | Link

Pendle Integrations

More Pendle Domain Expansions this week from the usual suspect, Silo Finance:

Can’t decide where to yield? Just get the Pendle basket 🧺 instead:

Another W from GammaSwap with this new pool:

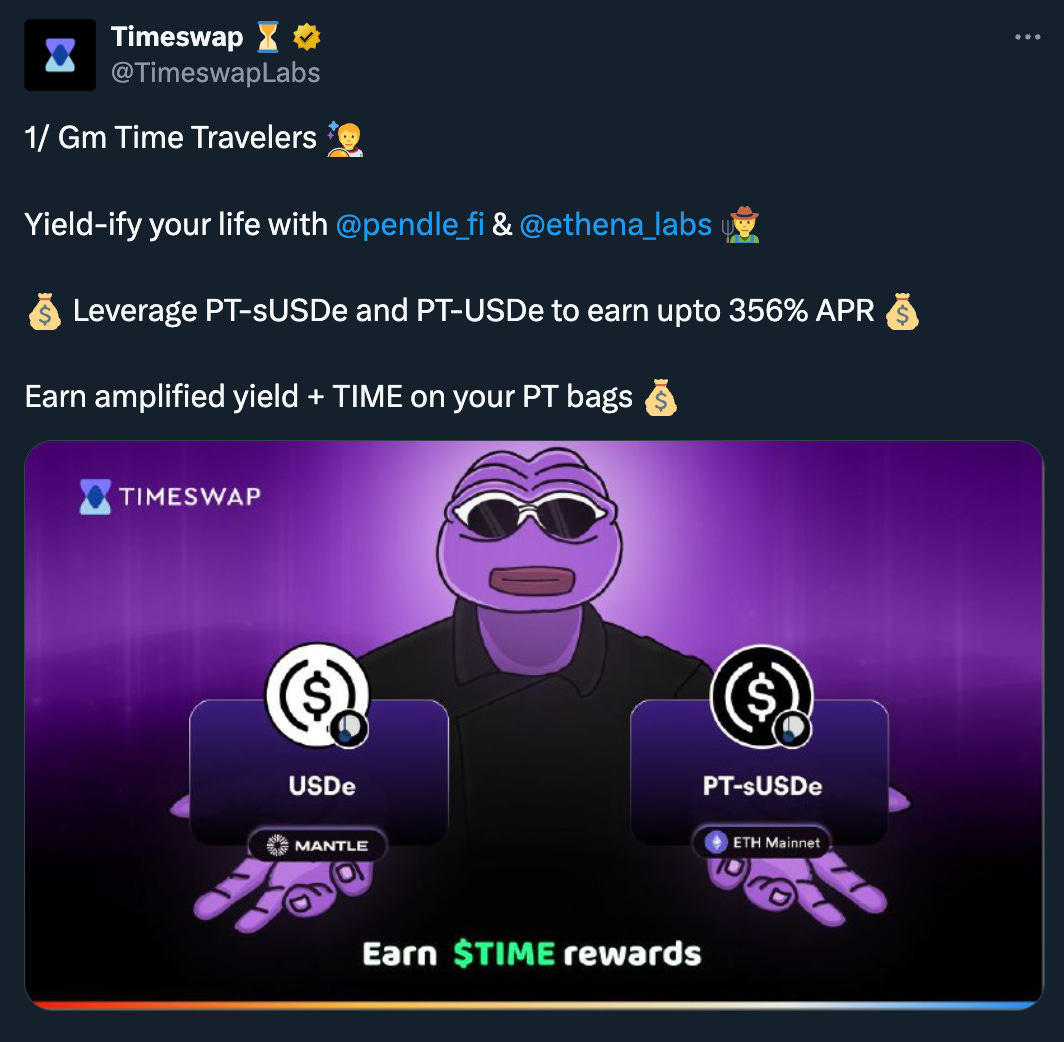

And if you ever thought what it would be like if Morpheus from The Matrix offered 2 red pills:

Intern Insights

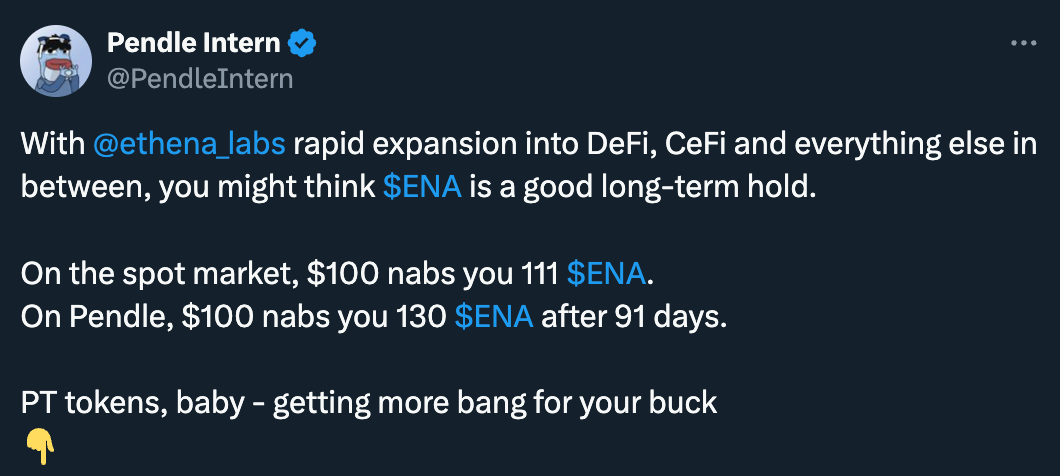

Think about it this way - if you’re planning to HODL ENA until 29 August at least, might as well buy PT-ENA instead of spot.

You get:

✅ More ENA by 29 August thanks to the PT-ENA fixed yield

✅ Downside cushion from the fixed yield

✅ Perhaps even chance to outperform spot in the short-medium term depending on how Implied APY swings

This of course applies the same to ETH, USDe, DAI and any other assets available on Pendle too.

Perhaps there’s a reason why whales love scooping up PTs after all…

Twitter Highlights

BOOM - more TVL milestones following up from last week:

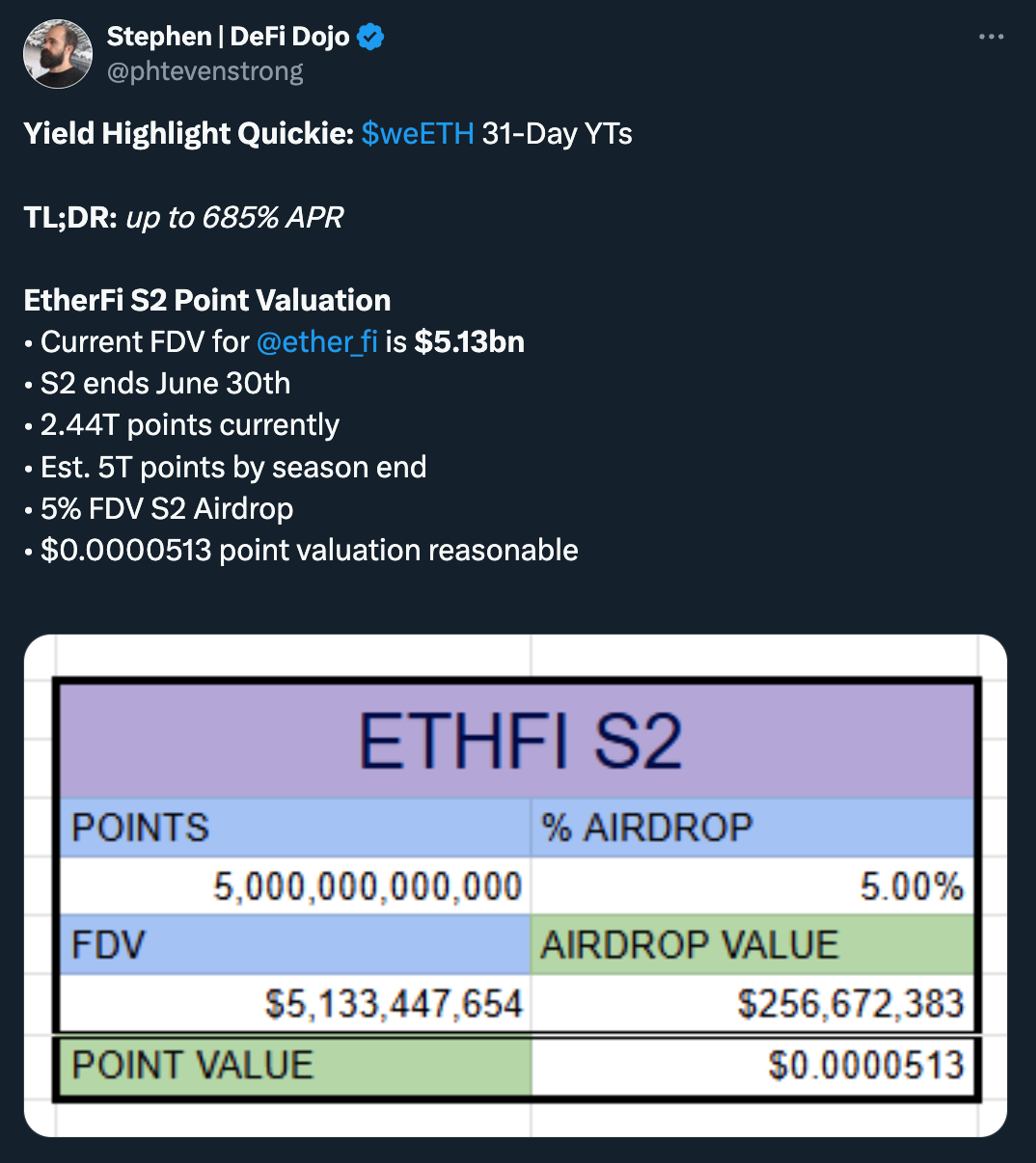

Some YT-eETH moonsheets from The Calculator Guy:

YT-USDe projections:

More Karak highlights:

Pendle dominates RWA sentiments + narrative:

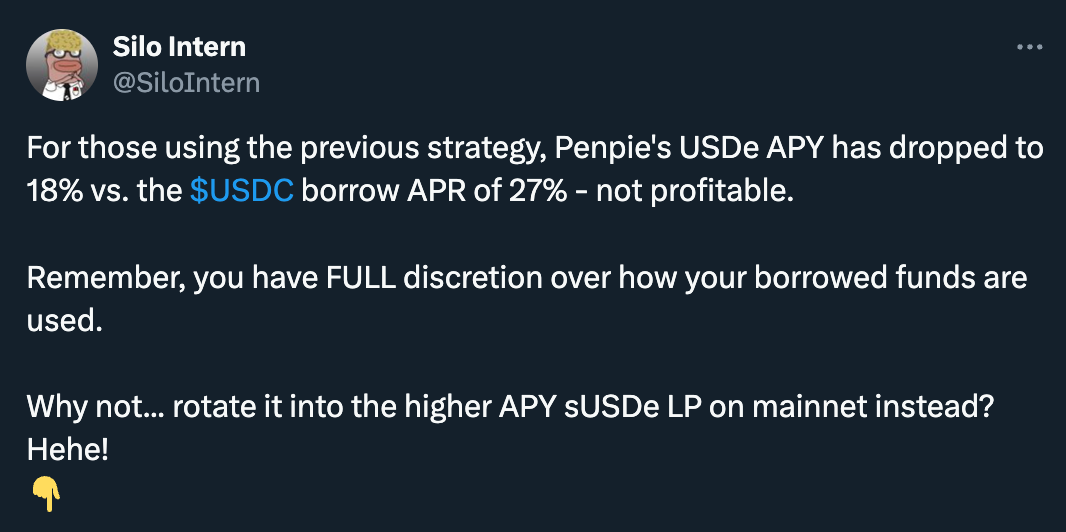

Multilayer strat to boost your sUSDe yields:

Interview with The Big Whale:

And last but certainly not least, we may have found El Dorado 👀

That’s it for this issue.

Attention and capital are scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle