Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Markets on Pendle

1) sETH (PT-ezETH/PT-eETH/PT-rsETH) 26SEP24 by SiloFinance

Opportunity for existing PT-ezETH/PT-eETH/PT-rsETH holders to loop their PT positions: deposit PTs on Silo to borrow ETH, deposit borrowed ETH into sETH-26SEP24 for higher PT yields. Implied APY as high as ~15%.

2) crvUSD-26SEP24 by Curve

New maturity for existing LP/PT holders to rollover from 27JUN24 pool. Implied APY as high as ~20%.

Alfa play for crvUSD borrowers: since YT holders are entitled to crvUSD yields, YT-crvUSD-26SEP24 could be used to hedge borrowing costs, resulting in a fixed borrow position via Pendle.

3) dUSDC-26SEP24

Announcement later today → sum alfa for Pendle Print readers 😉

PSA to PT/LP holders of JUN-24 pools

All eyes are on the 27-JUN-24 maturity coming up in two weeks. While whale wallets continue to remain opportunistic with short-dated PT buys (see Trades of the Week below), do also consider the following as we approach the June maturity:

On maturity date, 1-click transfer LP / rollover PT to any other pools. There are SEP-24 and DEC-24 pools for consideration

Note that for Karak pools, there is a 7-day queueing period for withdrawals. Do plan accordingly

Trades of the Week 🔥

Whales continue to capitalize on short-dated pools for short duration, high yield ETH LRT plays:

0x7a9 buys 9,988 PT-eETH-JUN24 (+88 ETH for a 20 day hold)

0x435 buys 4,033 PT-pufETH-JUN24 (+33 ETH for a 18 day hold)

0x2fe buys 2,202 PT-eETH-JUN24 (+18 weETH for a 19 day hold)

DeFi Integrations

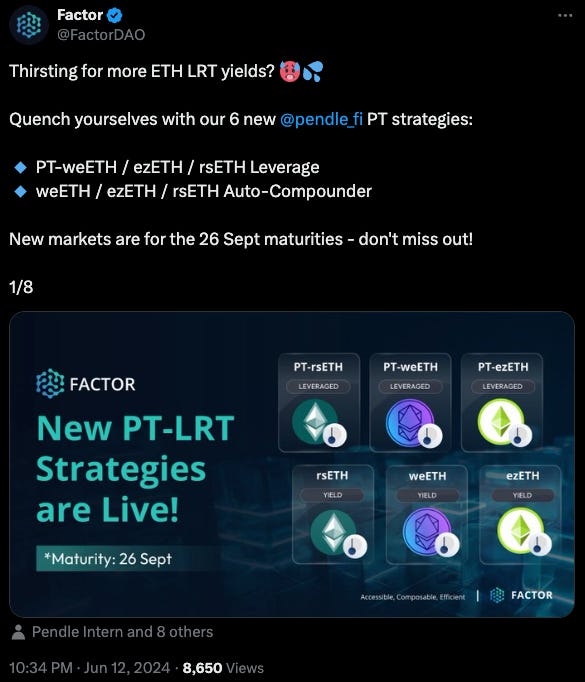

PT strategies on Factor

PT strategies on Covenant

New PT-LRT pools on Silo

Intern Insights

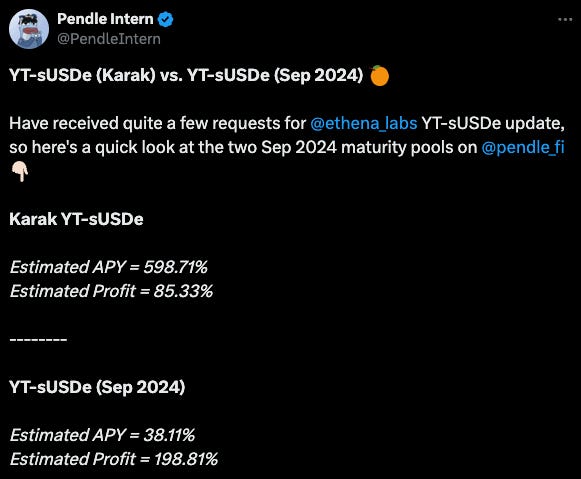

Karak YT-sUSDe analysis

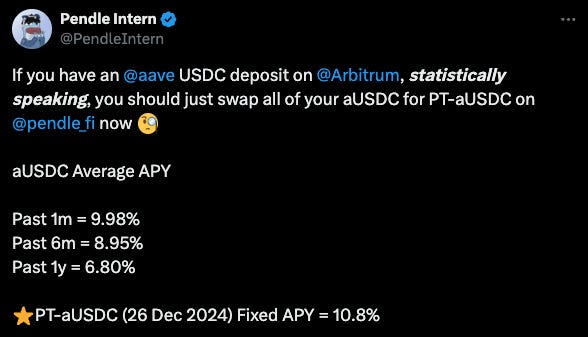

PT-aUSDC

Twitter Highlights

Understanding Pendle YT tokens

vePENDLE plays

Top 5 on DefiLlama

Pendle hits $20B in cumulative trading volumes – JOB’S NOT DONE

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

Wen 100b volume?