Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

Update on the Squarespace Incident

Team was already actively monitoring the situation upon learning about the DNS attack on Squarespace.

Earlier today, we shut down the Pendle domain as a defensive measure but have since resecured our app/website 👇🏻

New Markets on Pendle

Salam 🍊

EtherFi’s King Karak LRT has finally graced Pendle with his arrival!

For the uninitiated, weETHk here is essentially the Karak-equivalent of their Super Symbiotic LRT, and also marks EtherFi’s official entry into the Karak restaking ecosystem.

It’s another points bonanza for weETHk on Pendle but for those who are happy to sacrifice some points for more yield, Intern has some ideas around this…

You can also learn more about weETHk from our Intern’s explainer thread:

Key Highlights 🔑

Pendle reached our largest maturity event on 26 June and had successfully passed the largest stress test on our mechanics (i.e. redemption) to-date, including eye-watering wins from some PT/LP owners:

In other news, we’re ~2 weeks out from the next major maturity on 25 July. Whales in particular have already started capitalizing on these ultra short-term, high APY fixed yield opportunities:

Also shoutout to Yearn for some pretty juicy APYs for their Auto PT rollover vaults too 👀

Intern Insights

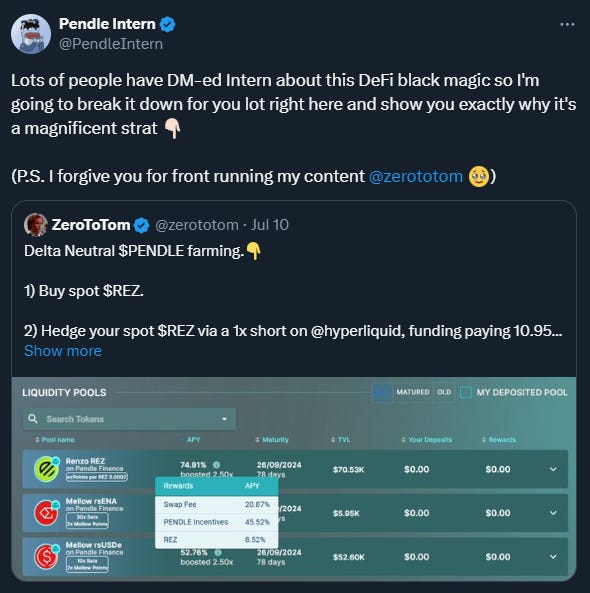

This delta-neutral strategy using Pendle has been making the rounds on X. Here, Intern breaks down the strategy step-by-step:

Essentially, the strategy involves LP-ing an asset on Pendle, and shorting the same amount on perps. Additional yield is even earned if funding is positive but be sure to monitor this closely!

For Pendies who like it vanilla, perhaps some PTs might interest you?

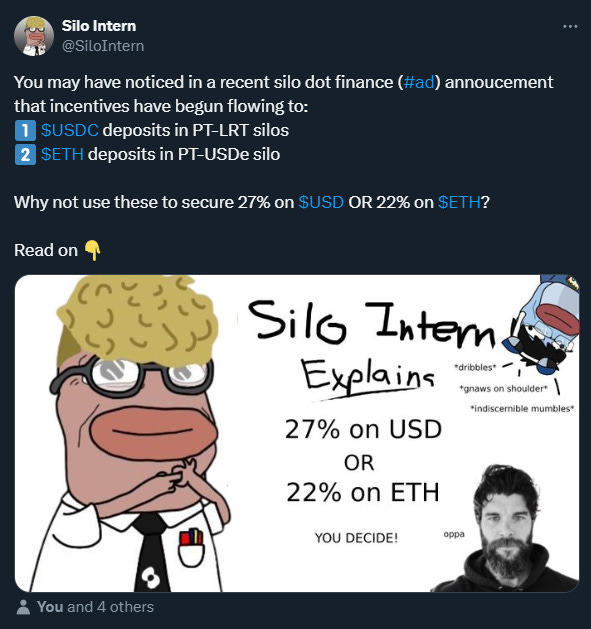

You take these fixed yield bad boys, slap them on a money market to loop and hey, you might just get way more than what you bargained for:

Trades of the Week 🔥

To no surprise, the 2-week July PTs have been the belle of the Pendle ball this week:

0xed0 accumulating 48.44M PT-sUSDe (25 Jul) since 27 June

0xb99 accumulating 54.86M PT-sUSDe (25 Jul) since 6 June

0xed0 swapped $3.25M for $3.37M PT-sUSDe (26 Sep)

0xf8a swapped $3.25M for $3.36M PT-sUSDe (26 Sep)

0x42c swapped 1,013 ETH for 1,018 Swell L2 PT-rswETH (25 Jul)

0x20c swapped 1,010 ETH for 1,015 Swell L2 PT-rswETH (25 Jul)

Shame that sUSDe (25 Jul) has already reached its max cap but there are a handful of other equally inviting fixed APY opportunities still up for grab:

🔹 Re7LRT - 23.18%

🔹 steakLRT - 20.67%

🔹 rstETH - 20.59%

🔹 USDe - 14.81%

🔹 rswETH (Swell L2) - 12.86%

Penconomy

P&L tracking unlocked for MetaMask Institutional 🔓

Spice up your YT yields with Cega’s YT Tiger Vault (i.e.Dual Currency Swap)!

Twitter Highlights

As it turns out, >20% APY for ETH still exists (with a little help from our little fren Silo):

Keno breaks down all the secrets of YT:

CT sentiments around Pendle V3:

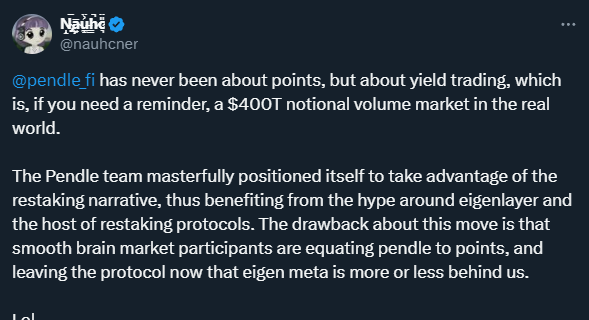

On Pendle being more than just points:

And last but certainly not least, sneak peek into how our BD superstar makes it rain:

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle