The Pendle Print #32

New dawn on ₿endle

Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Markets on Pendle

New, never-before-seen markets on Pendle! Including some fresh verticals that Pendle is tapping into:

BTCfi with eBTC (26 Dec)

The first of many BTC markets to come.

Memecoins with Sophon PEPE (26 Sep)

Pendle to the Mantle with Mantle Network MNT (3 Oct)

With the new eBTC pool, Pendle unlocks access to a new layer of DeFi yield strategies for BTC HODLers. We look to replicate the same success we have had with ETH staking/restaking in the BTC ecosystem.

More to come soon 😉

Key Highlights

As we approach the final ~2 weeks of Arbitrum Season, here’s your last chance to snag up some juicy ARB rewards from the Pencosystem.

For the full list of our partners, you can can check out Arbitrum dashboard or the thread linked below:

Trades of the Week 🔥

0xc5c provided ~$12.9M of liquidity (ZPI) to agETH (26 Dec)

0xf0b provided additional ~$12.6M of liquidity to weETHs (26 Dec)

0x2fe provided additional ~$7.4M of liquidity (ZPI) to weETHs (26 Dec)

0x3e8 provided ~$5.5M of liquidity (ZPI) to agETH (26 Dec)

0x17f provided ~$4.8M of liquidity (ZPI) to agETH (26 Dec)

Whales and institutions seem to be gravitating towards LP this week, in particular weETHs and agETH.

It’s also worth nothing that MNT has experienced a massive 4x jump in Implied APY since yesterday, and although pool liquidity is relatively thing, Pendies interested in scooping up some 41% Fixed APY can do so via Limit Order.

Intern Insights

Intern’s been going on a tear in the Sheets this week, with a new format that showcases the projected value of various points, applicable beyond just Pendle users 👇🏻

MNT Power:

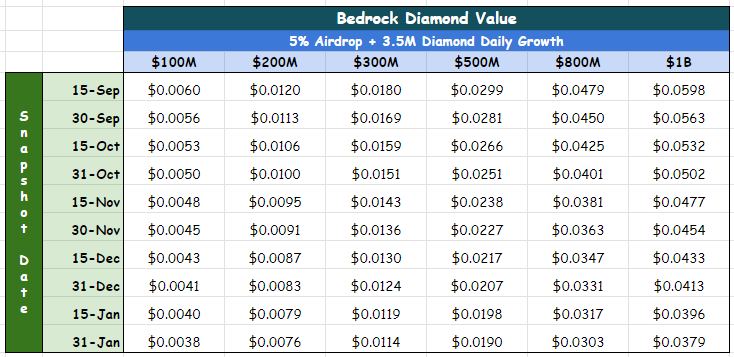

Bedrock Diamonds:

Usual Pills:

For Pendies who prefer to keep it simple and vanilla (no judgments here!), there are some opportunities to be found in Lido stETH too:

Same goes for sDAI too, especially when PT-sDAI is offering a higher Fixed APY than the current “Fixed APY” of sDAI now:

As for the more adventurous Pendies, there’s also the new PT-sfPEPE to consider:

Penconomy

Pendle PT depositors on Sumer, gentle reminder that you may need to adjust your collaterals:

New Ethena assets now supported as deposit on Swell’s L2 pre-deposit campaign:

Twitter Highlights

MNT staking ELI5 by Mantle Intern:

Aylo’s take on YT-MNT (feat. Pendle Intern’s table):

Not one…

Not two…

But three podcasts!

And last but not least, it’s not cheating if it’s mutually beneficial, right?

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle