Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Markets on Pendle

Tis’ another big BTCfi week on Pendle, with 2 new pools to grace our lineup:"

SolvBTC.BBN on BNB Chain

Thanks to this, Pendle is now able to tap into the big reserves of BTC liquidity on BNB Chain, unlocking DeFi integration potentials with incumbent protocols - money markets.

For those looking to level up your BTC yields on BNB, stay tuned—there’s more to come!

Naked LBTC

It’s the biggest BTC LRT, stripped down to its purest form. We understand that not everyone is comfortable layering up and stacking the DeFi legos, and LBTC will let Pendle cater to a wider set of audience.

With Babylon’s second cap raise on the way, the expectation is that Lombard will finally secure a commanding dominance on Babylon (as of now, LBTC is earning 0 Babylon Points).

The Babylon Derby 🏇🏻

One of the key events next week is Babylon’s 2nd cap raise, scheduled to open on 9 October.

From block 864790 to 864799, LRT protocols (and any other aspiring stakers really) can battle it out for BTC stakes on Babylon.

Since only a set number of Babylon Points (3125 after Cap 1, 10000 after Cap 2) in each block, the dominance of your stake will determine how many points you receive.

Which LRT horse will come up on top? Can uniBTC maintain their 30% dominance? Will Lombard’s stake finally match or even outperform their impressive market share in BTCfi?

Place your bet with Pendle YT:

Bedrock uniBTC Exploit [Update]

uniBTC contracts have been resumed and all operations have returned to normal on Pendle:

Bedrock has also released a post-mortem + final audit report and you can read more about this here.

Trades of the Week 🔥

0x603 adds $23M liquidity (LP) to Corn uniBTC 26 DEC 2024

0x8f9 adds $22.2M liquidity (LP) to sUSDe 24 OCT 2024

0x6e2 adds $12M liquidity (LP) to pufETH 26 DEC 2024

0xb2e adds $7.63M liquidity (LP) to Corn SolvBTC.BBN 26 DEC 2024

0xeae adds $7.33M liquidity (LP) to SolvBTC.BBN 26 DEC 2024 (BNB Chain)

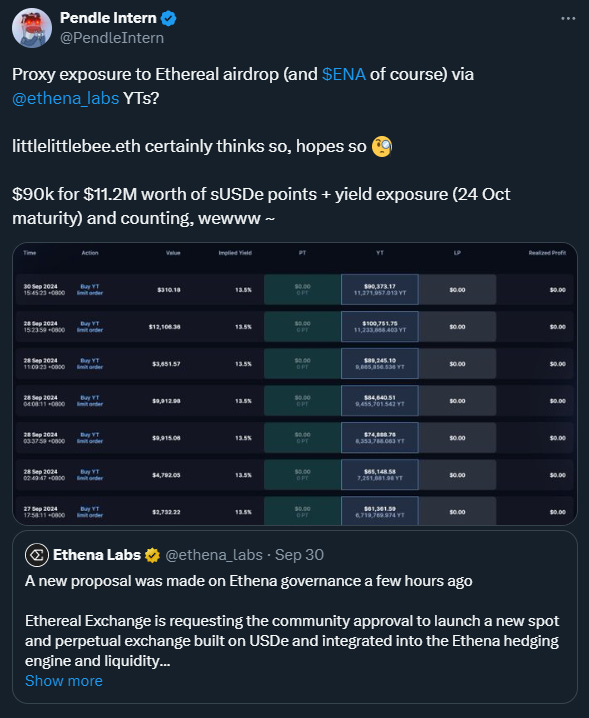

YT buys continue to outpace PT buys for the 4th straight week. Most of these activities are from sUSDe pools (same as last week) and Usual USD0++.

sUSDe has become a crowd favorite, with the Underlying APY climbing to 10.7%. For comparison, the Implied APY is currently between 12.5% and 13.5%. Combine that with growing optimism around ENA + Ethena, and it’s clear why the momentum is building

With chatter around RWA picking up on CT, USD0++ has also been receiving its fair share of attention, especially with its attractive Fixed APY + decent YT ROI projections.

A little Pendle Print special - keep those eyes peeled for more RWA pools soon on the horizon 😉

Intern Insights

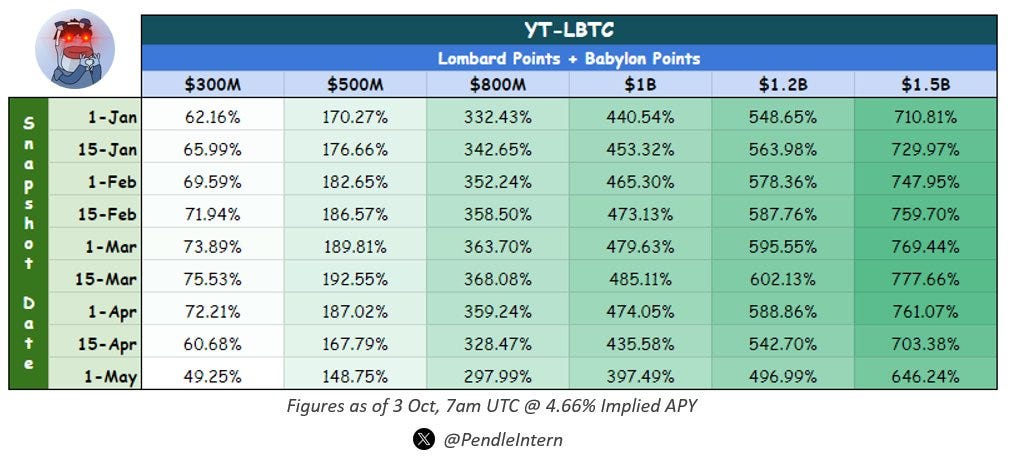

What would LBTC look like with Babylon Points?

As it turns out, even with just a 10% stake share, YT-LBTC is already looking pretty good (NFA):

YT not quite your tempo? Then how about PT on steroids?

In other news, the Ethena bulls continue to swarm the USDe/sUSDe pools, contributing >62% of our trading volume in the past week.

The mini tug-o-war between YTs and PTs continue to rage on:

For those looking to accumulate more ENA, here’s a delta-neutral farming strategy for you.

Note: Slight mistake in the post. Positive funding rate means you earn from shorting ENA.

Also, ever wondered how things would have been of Laszlo just Pendled?

Penconomy

Pendle gets inducted into SwissBorg’s DeFi Thematic basket:

PT looping unlocked for the stablecoin with the highest fixed yield:

VaultCraft deploys Pendle strategies for LBTC vault:

Stake Pendle assets on Form Network to earn points:

How to Pendiddle with Dolomite:

Twitter Highlights

When 2 DeFi daddies get together:

Pendle week in review by Linn:

Pendle 101:

Our dear leader on blockmates Orange:

Are you ready for Bombard?

Betting on the LBTC horse:

And last but certainly not least, would you rather…

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle