Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

New Markets on Pendle

BOOO 👻 Some scary good (and new) markets on Pendle this week to cap off Spooktober, starting with Aave’s very own stablecoin:

stkGHO 25 APR 2025

stkGHO generates yield on 2 fronts:

More GHO earned through Aave’s Merit Program

AAVE rewards allocated via governance (pending renewal soon)

Thanks to this, stkGHO has consistently been one of the highest yielding stablecoins in DeFi (APY = pink line) and now that it’s on Pendle, more yield strategies are made possible

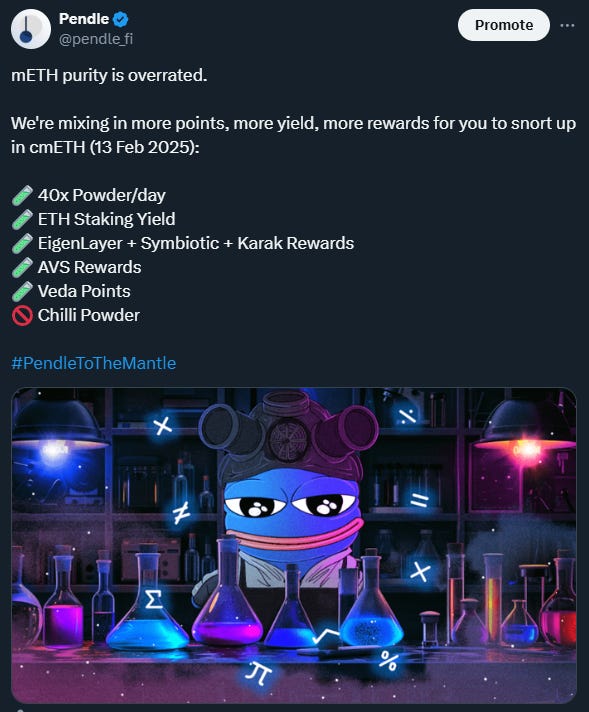

cmETH 13 FEB 2025

With COOK’s TGE and Metamorphosis Season 1 coming to an end, all eyes now turn to cmETH and Season 2.

cmETH (i.e. LRT) is essentially the restaked version of mETH (i.e. LST) and as a result, provides more yield, more points, including exposure to all the major restaking layers.

For participants of Season 1, you can check and claim your COOK rewards here.

Dolomite dUSDC & dWBTC 26 JUNE 2025

One of Arbitrum’s most popular pool, Dolomite dUSDC, returns alongside a new buddy in dWBTC 🏔️

dUSDC in particular has a long history of spiking above 20% APY and should make an interesting asset for Pendies to yield trade / hedge.

New USDe Multipliers

Not new markets per se but these USDe pools have gotten a major upgrade over the week, with Sats multipliers getting bumped up from 30x → 50x

Following the announcement, Fixed Yield for both pools surged from previous levels and are now sitting at 15.3-15.9% APY.

USD0++ Maturity

Reminder that the 31 OCT maturity for USD0++ had just passed.

For those with positions in the matured pool, here’s all you need to know on how to redeem / transfer to the 27 MAR 2025 pool.

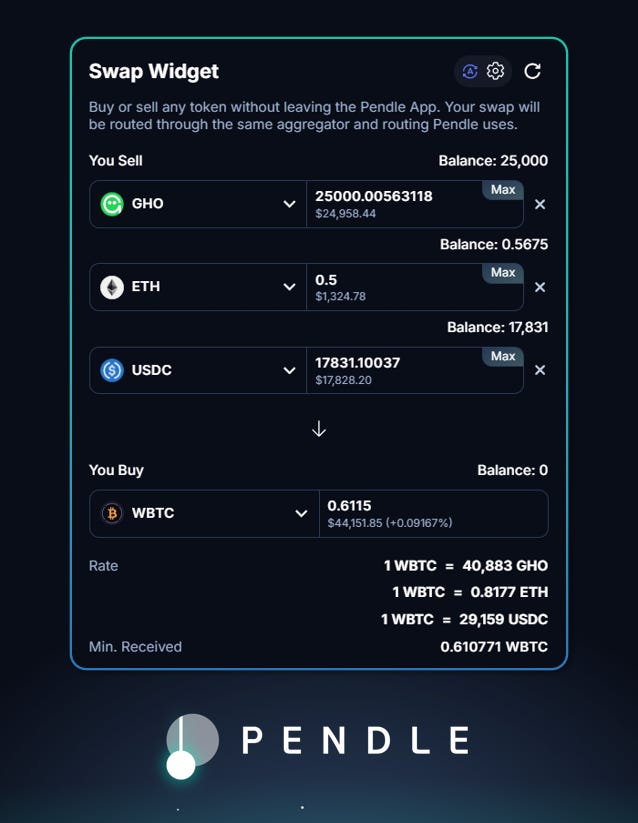

New Feature – Swap Widget

Pendle’s newly upgraded Swap Widget (powered by KyberSwap) lets you swap up to 3 tokens into any token of your choice at the best possible rate - a feature not available in aggregators themselves 😉

Also, no more pesky manual unwrapping! All SY tokens are now auto-unwrapped when claiming rewards.

Trades of the Week 🔥

0x994 added 350 BTC of liquidity to Corn uniBTC 26 DEC 2024

0x6be added 100 BTC of liquidity to SolvBTC.BBN 27 MAR 2025 on BNB Chain

0x7e3 added 100 BTC of liquidity to Corn SolvBTC.BBN 26 DEC 2024 on BNB Chain

0xc46 added $7M of liquidity to USD0++ 27 MAR 2025

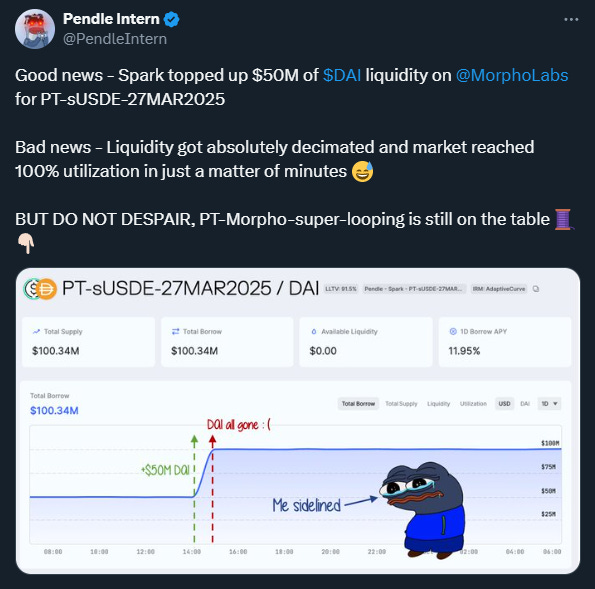

0xbfb bought ~$27.4M of PT-sUSDe 27 MAR 2025 (for PT looping on Morpho)

Intern Insights

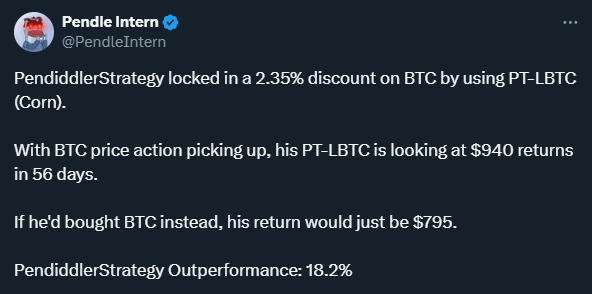

Missed the pump? Lucky for you (and me), you can always buy the dip on Pendle:

Some of the best YT plays that you should keep an eye out for:

And if YTs aren’t your cup of tea, perhaps some PT looping x leveraged fixed yield might interest you instead:

But be quick about it - liquidity seems to get gobbled up really quickly in these markets 🧐

DeFi magic that’s possible with vBNB now that it’s on Pendle:

(Not) delta neutral strategy featuring our newest stablecoin addition:

Penconomy

Despite the name, there’s nothing “baby” about an extra 69,420 Babylon Points 🌽

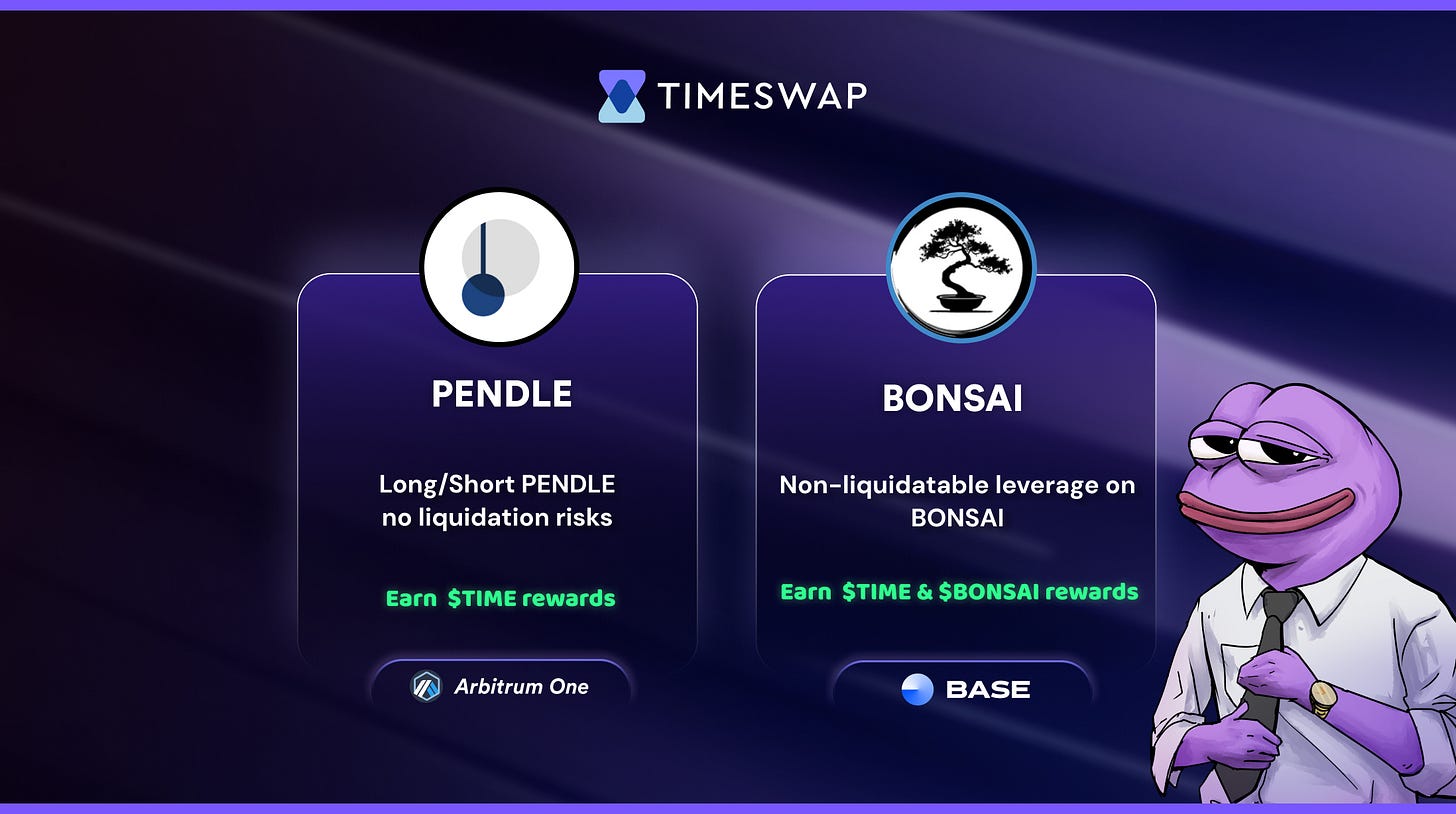

PENDLE pool returns on TimeSwap

Attention all PT owners - the Maple Direct team is prepared to discuss the gamut of opportunities and considerations for borrowing USDC/USDT against your PT positions (note: institutional borrowers only) 🥞

Yield opportunities for rsETH on both Ethereum and Arbitrum:

Twitter Highlights

PENDLE making waves on DEXes:

Some of the best DeFi yields up for grab this week, feat. Pendle:

That shirt 😚

And last but certainly not least…happy belated Halloween, Pendies 🎃

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle