Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

Boros

Pendle kickstarted last week by unveiling Boros (previously known as Pendle V3), our new yield trading platform with margin.

Boros will offer a separate Base that operates alongside the current V2 platform, and is designed to help expand Pendle’s capabilities to support all manners of yield, including off-chain rates such as perp funding rates.

In another note, there’ll also be an airdrop from points that the protocol has collected for vePENDLE holders. A snapshot of vePENDLE holdings will be taken on 31st Dec 2024 at 23:59 UTC and the tokens will be distributed pro-rata.

You can read more about Boros here.

New Markets on Pendle

sUSDe 29 MAY 2025

With yield spiking up to 29% APY for the week, sUSDe remains one of the hottest commodities on Pendle in these few weeks - for both YT and PT.

In light of this, Ethena x Pendle has released another sUSDe pool with a long-dated maturity on 29 May 2025 to cater to this demand.

More maturities. More choices.

ZeroLend eBTC 27 MAR 2025

Meanwhile, ZeroLend finally takes its Pendle stage with eBTC 27 MAR 2025.

This is essentially the same offering as vanilla EtherFi eBTC, but with the addition of Lending APY and ZeroLend points from the money market.

eBTC, but more.

26 June 2025 LRT Pools

And last but not least, some of your favourite LRT pools have gotten a maturity "“upgrade”!

Pendle WBTC Vault on Morpho 🏦

Morpho’s Pendle WBTC vault, curated by MEV Capital, is now live.

PT looping has been one of the most popular strategies, as evident in borrowing APYs skyrocketing to 18-20% in Morpho’s PT-sUSDe markets.

This vault essentially lets users capitalize on this trend by servicing the liquidity demand for these markets, while at the same time earning diversified Lending APYs + MORPHO + PENDLE rewards (limited time only) at the same time.

At the moment, the vault will be allocating liquidity to these 2 new BTCfi PT markets (see above), with potentially more to be added in the future.

For BTCfi PT loopers, Enzyme launched a new PT-BTC Looping Vault, providing easy one-click, leveraged exposure to loop these Fixed Yield opportunities via Morpho.

Trades of the Week 🔥

0x69d added $15M of liquidity (ZPI) to Ethena sUSDE 27MAR2025

0x69d added $10.9M of liquidity (ZPI) to Ethena sUSDE 29MAY2025

0x7df bought $10M worth of PT-sUSDe 26DEC2024 at 19.18% Fixed APY

0x790 added $10M worth of liquidity to USD0++ 27MAR2025

0xfe0 added 100 BTC of liquidity to pumpBTC 27MAR2025

Intern Insights

Great news for Usual USD0++ fans - Binance announced their launchpool and listing plans for USUAL token last week.

As a result, Implied/Fixed APY for USD0++ 27 MAR 2025 shot up to >21% APY as YT apes piled in for last minute Pills shopping.

For those eyeing the upcoming USUAL launchpool on Binance, YT-vBNB offers an avenue for you to counter those pesky spikes in BNB borrowing costs on Venus 👇🏻

In other news, the BTCfi pie continues to grow, and Pendle’s slice continues to grow even faster - shooting up from ~33% last month to ~41% at the moment.

With BTC price action catching all the attention lately, updated projections for BTCfi YTs have also been looking up (goes without saying, NFA):

And if you’re bullish BTC anyway, perhaps you might want to consider selling puts on it? 🤔

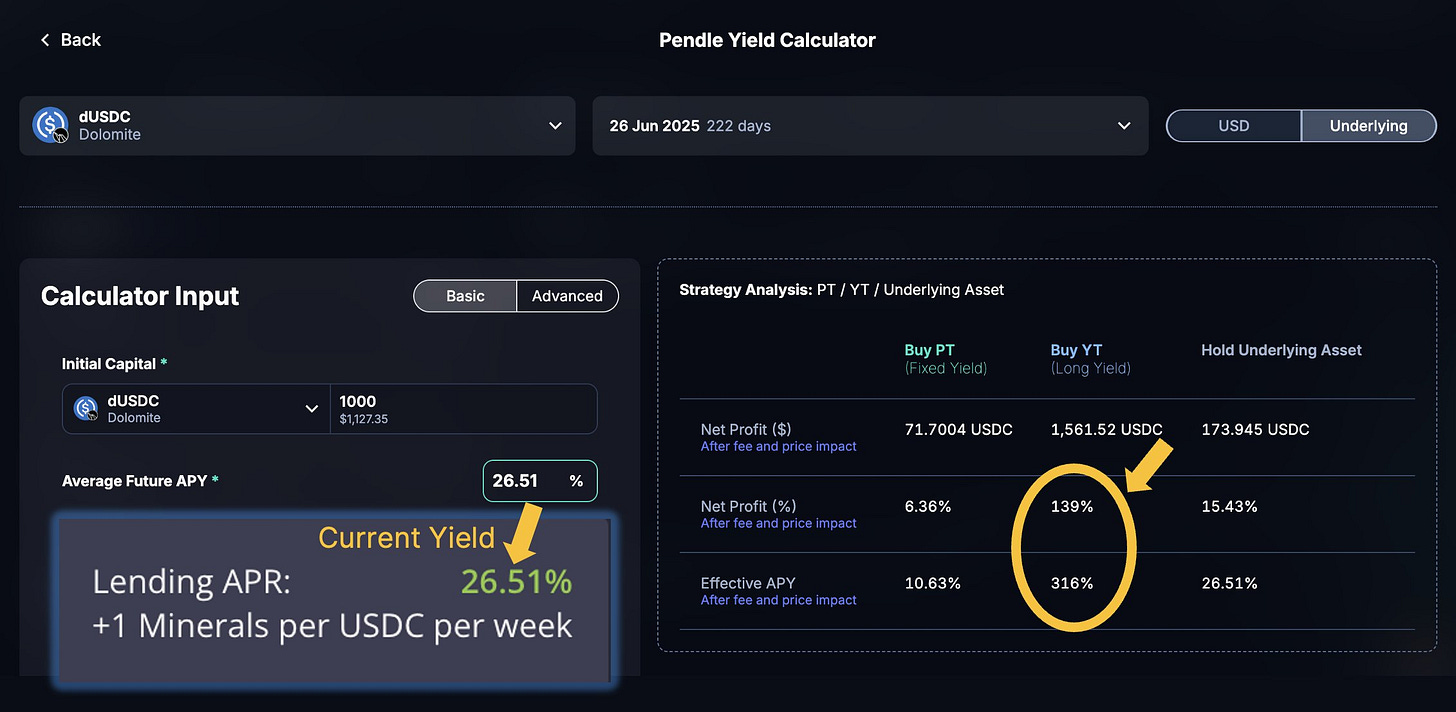

Meanwhile in the land of Arbitrum, new opportunities have also cropped up for Dolomite YTs, thanks again to the surge in borrowing demand:

Twitter Highlights

Pendle tops the DEX volume charts:

Buying ETH on discount via spSILO:

Don’t forget about stables in this bull market!

Sneak peek of Boros, courtesy of our very own Dan x DeFi Dad:

Boros, snack version:

And last but certainly not least…real men do this 👇🏻😤

That’s it for this issue.

Attention and capital is scarce in this market – and for that we thank you for your continuous support.

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle

boros