Pendle is the ultimate yield market in DeFi – fixed yields, floating yields, leveraged yield trading, “yield-neutral” liquidity provision.

The objective of The Pendle Print is to distill the developments in DeFi yield markets into a succinct and actionable format.

Get ready for the bera market, Pendies 🐻 (Read that again)

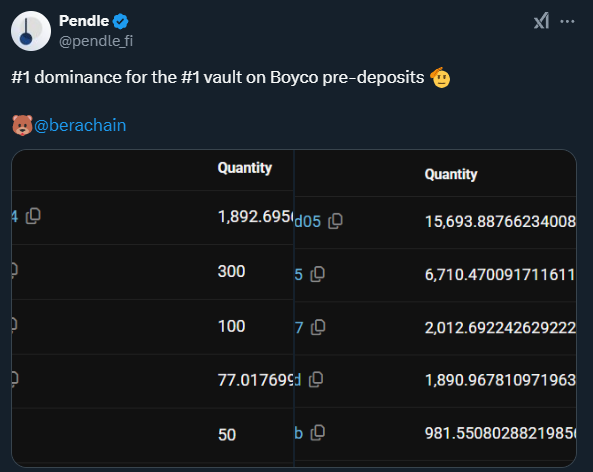

Last week, Pendle dove headfirst into the bera’s den in search of the best Berachain + Boyco vaults for you - with more to come soon in the following weeks!

New Markets on Pendle

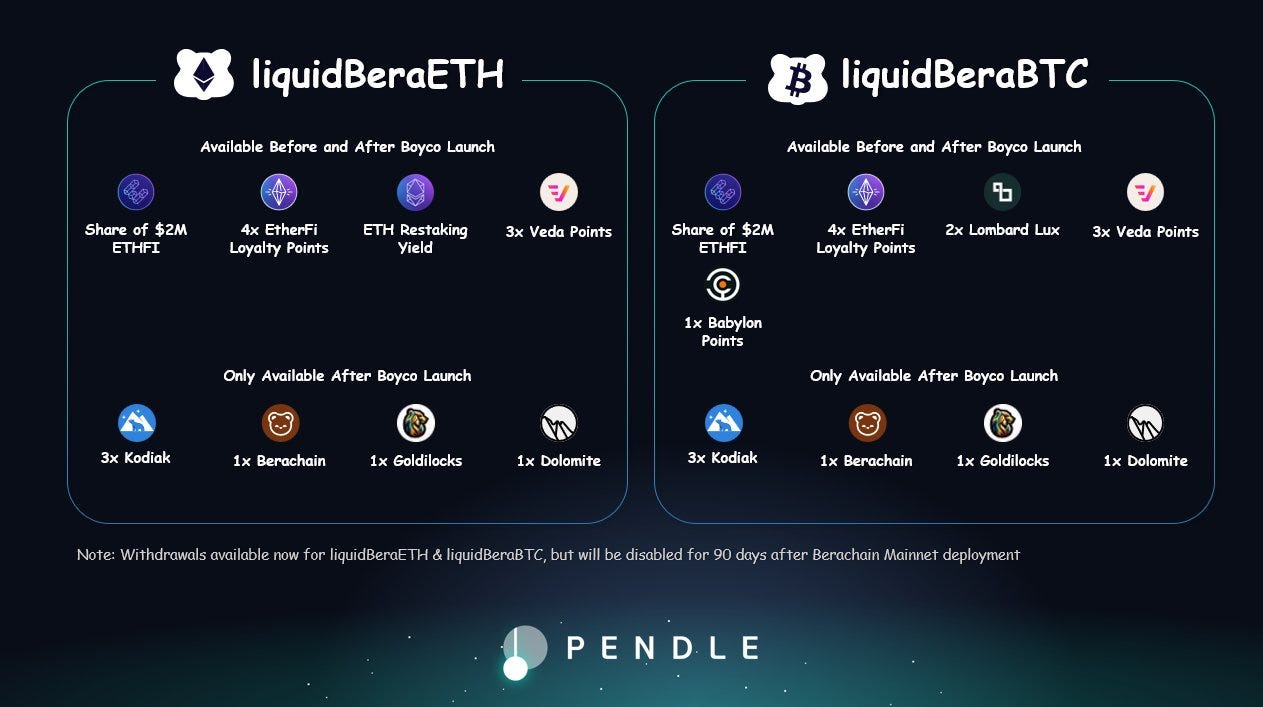

First up, EtherFi x BeraChain vaults.

For the uninitiated, you can think of this as a “pre-deposit” campaign for Berachain.

In EtherFi’s case, Pendies will be able to earn all the usual EtherFi rewards plus an assortment of Boyco rewards from the Berachain ecosystem (only available after Boyco launch):

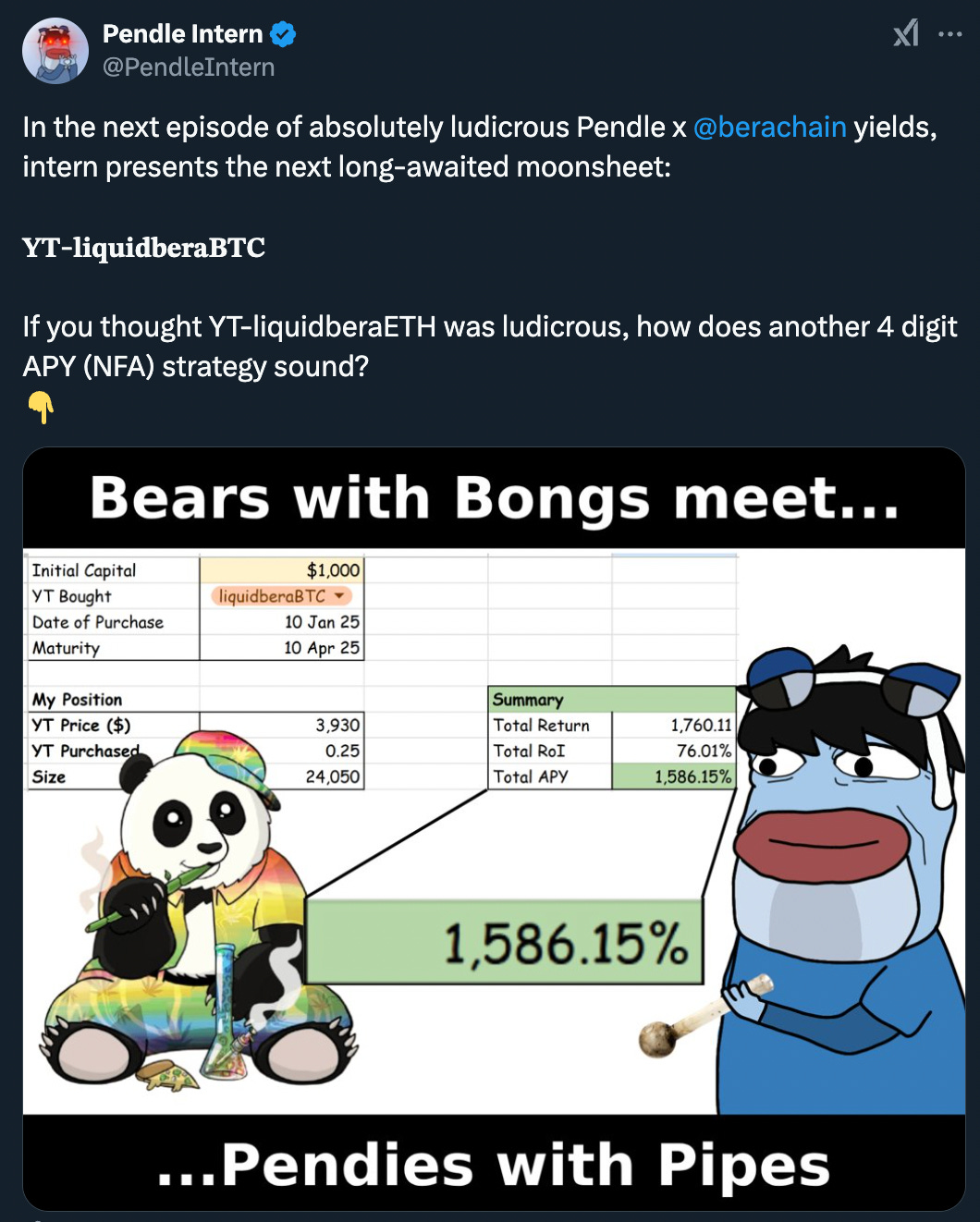

So how good are these rewards? That’s for you to decide. But if you need some (NFA) help…

That’s not all. We’ve also teamed up with our good pals from Ethena once more on their Berachain vaults:

Similar to the EtherFi vaults from before, these Ethena ones are essentially USDe/sUSDe + Berachain/Royco rewards:

More good news - Pendle ctUSDe will have NO vesting for Ethena S3 airdrop:

Since more points, more yields and more rewards are being abstracted away in these Berachain pools, their PT Fixed Yields are also higher than usual as a result vs. their native counterparts.

Fixed APY for stables up to 26.51%.

Fixed APY for ETH up to 13.94%.

Fixed APY for BTC up to 15.77%.

Speaking of BTC yields, there’s also a new, naked PumpBTC pool on the market!

vePENDLE Airdrop (Update) 🪂

vePENDLE airdrop has been distributed! Claim them from your vePENDLE Dashboard.

Usual USD0++

We are aware of the ongoing discussions and controversies surrounding USD0++. For those unfamiliar with the details, you can find their official blog here.

PT-USD0++ functionality remains unchanged and as intended - 1 PT USD0++ is equal to 1 USD0++ at maturity.

We will continue to advocate for Pendle users' interests and keep the community updated on further developments.

Intern Insights

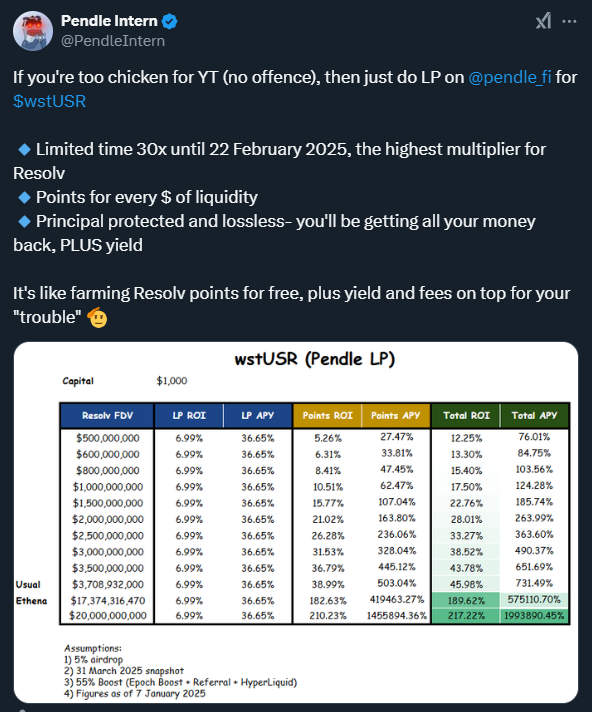

ICYMI, wstUSR on Pendle got an “upgrade” last week:

With this change, this is arguably the best LP play in Pendle’s history (again, NFA):

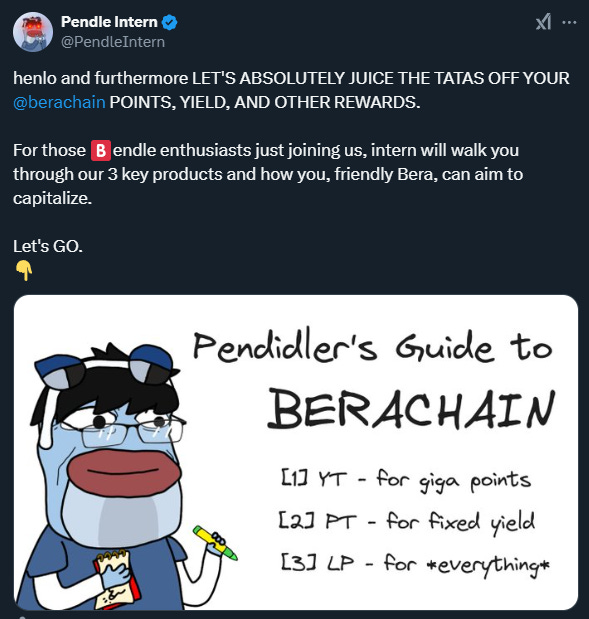

Still confused about Berachain pools? Don’t know how and where to get started?

Perhaps this might help:

Penconomy

PT-wstUSR looping unlocked on Euler - curated by Apostro ✅

Keep track of your Pendle positions with iYield:

Trades of the Week 🔥

0x93b bought $5.87M worth of PT-sUSDE 27FEB2025

0xed0 bought $5.62M worth of PT-sUSDE 27FEB2025

0xb99 bought $5.56M worth of PT-sUSDE 27MAR2025

0x111 added $5.34M worth of liquidity to Ethena USDe 27MAR2025

0x293 bought $4.94M worth of PT-sUSDE 27MAR2025

Twitter Highlights

HIGHEST BTC Fixed Yield in DeFi town:

What do Pendle and Santa’s Elves have in common?

Fastest TVL growth in history:

#1 TVL dominance:

pendle.finance | Twitter | Discord

Pendle is the largest rate swap protocol for fixed yields and yield trading in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, secure fixed yields and directionally trade yield on yield-bearing DeFi assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.

pendle